IPO Lockup Expiration Could Rock ShockWave

The 180-day IPO lockup period for ShockWave Medical Inc. (SWAV) will end on September 3, 2019.

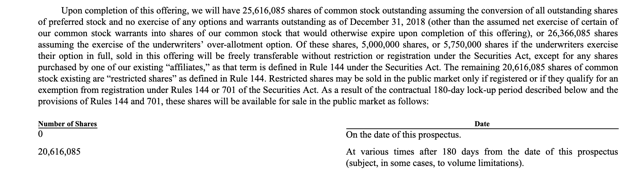

When the lockup period ends for ShockWave Medical, its pre-IPO shareholders and company insiders will be able to sell their 20 million currently-restricted shares. This will be a huge increase over the 5.7 million shares offered in the IPO. The potential for a sudden increase in stock traded on the secondary could cause a sharp, short-term downturn in SWAV's share price.

(Source: SWAV S-1/A)

Currently, SWAV trades in the $39-40 range, a return from IPO of more than 132%.

Business Overview: Medical Device Company in California

ShockWave Medical is working on developing and marketing devices used to treat calcified cardiovascular disease. The company offers proprietary medical tools that deliver sonic pressure waves that break-up calcified plaque that accumulates due to atherosclerotic cardiovascular disease. The company calls this procedure intravascular lithotripsy (IVL), and its IVL system is based upon ShockWave Medical's IVL technology. In its SEC filings, ShockWave Medical notes that their system is easy-to-use, minimally invasive, and a safe method that greatly improves patient outcomes.

(Source: SWAV Website)

The U.S. Food and Drug Administration gave the ShockWave M5 IVL catheter a ce-mark in April 2018. The FDA cleared the M5 catheter for use in the company's system in July 2018 for treating peripheral artery disease.

ShockWave Medical currently markets its ShockWave C2 IVL catheter in Europe. It was ce-marked in June 2018. The company is conducting clinical programs for several of its products for a variety of indications. If the trials are successful, ShockWave Medical will expand its sales and marketing efforts into new areas and for treating additional health conditions. In particular, ShockWave Medical expects to expand across the U.S. and into Japan if their clinical trials result in supporting data for its FDA and Shonin applications. ShockWave Medical expects to launch the C2 catheter in the first six months of 2021 in the U.S. and in the second half of 2021 in Japan.

The company is headquartered in Santa Clara, California and has approximately 160 employees.

Company information was sourced from the firm's S-1/A and company website.

Financial Highlights

ShockWave Medical reported the following financial highlights for the second quarter ended June 30:

- Revenue was $10.0 million, which represents a stunning increase of 339% versus the second quarter of 2018. The company attributed the growth to increasing sales of the M5 catheter in the United States and C2 catheter in other countries.

- Gross profit was $5.9 million versus $1.1 million for the same period the prior year. This represents an increase to 59% versus 48% the previous year. The company attributed the improved gross margins to better efficiency and increased production volume.

- Operating expenses were $17.1 million versus $11.3 million the prior year for an increase of 52%.

- Net loss was $10.6 million versus $10.1 million the previous year.

- Cash and cash equivalents totaled $125.1 million at the end of the second quarter.

Financial Highlights were sourced from the company's website.

Management

President and CEO Douglas Godshall has served the company since May 2017. His previous experience comes from senior positions at HeartWare International and Boston Scientific Corporation. He serves on the board of EyePoint Pharmaceuticals. He earned a B.A from Lafayette College, and he earned an MBA from Northeastern University.

CFO Dan Puckett has served in his position since November 2018. Prior to joining ShockWave, he held senior financial positions at Counsyl, Ariosa Diagnostics, Forest Laboratories, and Affymetrix. He earned an MBA from the University of San Francisco.

Biographical Information was sourced from the company's website.

Competition: Cardiovascular Systems, Boston Scientific, and Others

ShockWave Medical competes in a saturated marketplace against many manufacturers and marketers of cardiovascular medical devices. These companies include Philips N.V. (NYSE: PHG), Medtronic plc (MDT), Cardiovascular Systems (CSII), and Boston Scientific Corporation (BSX).

Early Market Performance

The underwriters priced the IPO at $17 per share, above the company's expected price range of $14-16. The stock has had a remarkable performance in the secondary market. It closed its first day at $30.50 for a return of 79.4% from IPO. The stock spiked to $38.10 on March 18, then dropped to $29.98 on April 17. After a lull, shares spiked again to reach a high of $66.02 on June 10. Shares now trade in the $39-40 price range.

Conclusion: IPO Lockup a Short Opportunity

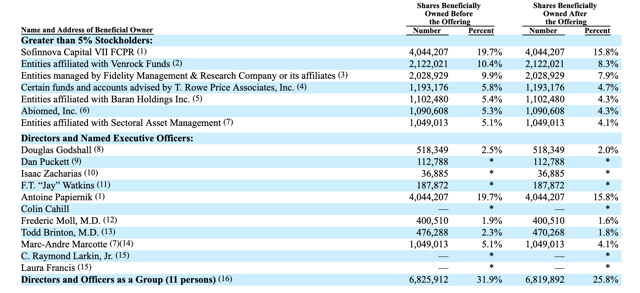

When the SWAV IPO lockup expires, pre-IPO shareholders and company insiders will be able to sell 20 million currently-restricted shares. This number dwarfs the 5.7 million shares offered in the IPO. This group of pre-IPO shareholders and company insiders includes numerous directors, officers, and corporate entities.

(Click on image to enlarge)

(Source: SWAV S-1/A)

Any large sales of currently-restricted stock could flood the secondary market and cause a sharp, short-term downturn in SWAV's share price. We believe that company insiders and pre-IPO shareholders may be especially keen to cash in with shares of SWAV having return from IPO of more than 132%.

Aggressive, risk-tolerant shareholders should consider shorting shares of SWAV ahead of the September 3rd IPO expiration. Interested investors should cover short positions over the course of the September 4th and September 5th trading sessions.

Disclosure: I am/we are short SWAV.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more