IPO Frenzy

IPOs are in the news with gains of 100% from offering prices generating universal awe. The SP500 is making new highs as some tout a ‘new era’ amid warnings by others of market over-pricing. Just as no two investors are alike, no two issues are priced alike. While some are vastly over-valued, others remain deeply undervalued. Markets include many self-styled theme-based price-trend followers and just as many self-styled value-based fundamental investors. There is homogeneity only in the fact that everyone is different. In addition, there are Institutional investors with one set of rules and tools intermingled with Retail investors with a different set of rules and tools. Two charts seek to capture some of what is driving the markets currently.

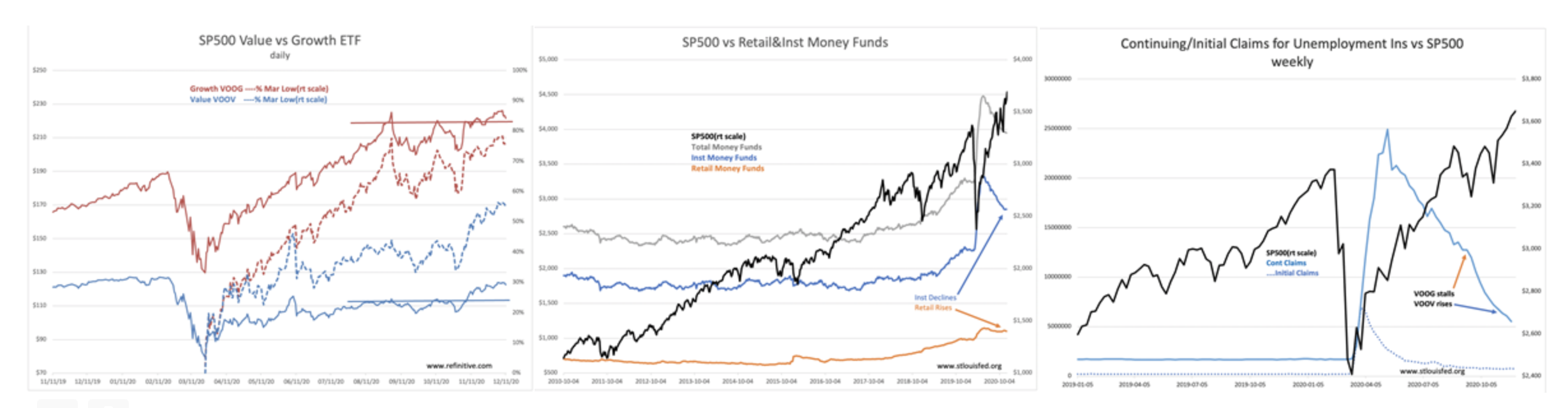

The first chart shows daily VOOV(Value stocks) vs VOOG)Growth stocks) performance using SP500 ETFs. The growth issues were highly favored during the COVID-19 lockdown as people could not go to work and had to remain mostly at home. As the unemployed level fell from 25mil to ~12mil, VOOG outperformed. It began to stall in late August. Between Aug and Nov, VOOG and VOOV both traded flat. Then the 1stweek of Nov VOOV began to outperform VOOG as the promise of a vaccine against COVID-19 became reality. The Nov rise in VOOV coincided with a fall in unemployed below `6mil.

The second chart shows the weekly changes in the levels of Institutional vs Retail Money Funds, a good proxy for investor psychology. The sharp rise in March reflected the fear of the COVID-19 impact. The peaks in Money Funds occurred on May 9th. Both Retail and Institutional investors began to shift back to equities. As growth issues began to stall or as a result of stalling, Retail Money funds stopped declining suggesting Retail investors turning more cautious. Institutional investors have kept shifting cash to equities as the SP500 continued its rise and are likely responsible for the rise in VOOV.

(Click on image to enlarge)

This week several IPOs have doubled performance expectations. Individual and Institutional investors have doubled the prices of issues already excessive by any valuation metric. This is highly speculative and reflects investors with little valuation experience. Nonetheless, even with this frenetic behavior, there remain many undervalued issues with exceptional opportunities for returns using fundamental valuation. Just because some issues trade at ‘crazy prices’ relative to any business metric, it does not mean there are not still whales to be had using normal valuation techniques.

Good values exist in many sectors.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more