Invitae: Exponential Growth In Genetic Testing

I think the biggest innovations of the 21st century will be the intersection of biology and technology. A new era is beginning. - Steve Jobs

Invitae (NVTA) is a market leader in genetic testing, the company is growing at full speed and it has enormous room for further growth in the years ahead. Investments in R&D and marketing are significantly hurting profitability, and this is a major risk factor for investors in Invitae. That being acknowledged, the stock could offer massive returns from current levels if management executes well in the years ahead.

Exponential Growth Opportunities

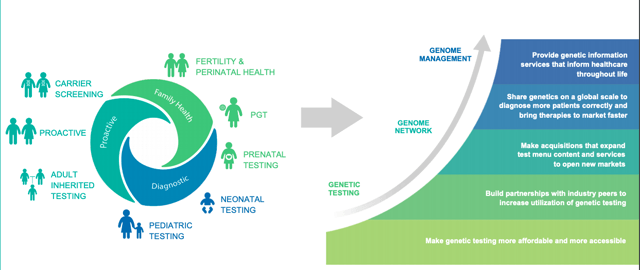

Invitae delivers affordable genetic testing solutions with a focus on areas such as cancer, heart disease, fertility, and pregnancy, among others. Genetic testing is a relatively new area in medicine, but it has already proven to have enormous benefits, and we are only seeing the tip of the iceberg in terms of the possibilities that this technology has to offer.

It is not unreasonable to say that over the long term declining testing costs should allow for a large share of the global population to access the benefits of genetic testing, and Invitae should be both one of the major driving forces in this revolution and a leading beneficiary from it.

From the company's annual report:

Combining genetic testing services that support patient care throughout life's journey - from inherited disease diagnosis, to family planning, to proactive health screening - with a unique, rapidly expanding network of patients, healthcare providers, biopharma and advocacy partners, Invitae is capturing the broad potential of genetics and helping to expand its use across the healthcare continuum. Through the custom design and application of automation, robotics and bioinformatics software solutions tailored to the complexity of sample processing and complex variant interpretation, Invitae can apply its world-class clinical expertise to medical interpretation at scale, simplifying the process of obtaining and utilizing affordable, high-quality genetic information to inform critical healthcare decisions while making genetic testing available for billions of people. By pioneering new ways of sharing and understanding genetic information, Invitae is transforming the field of genetics from one-dimensional testing to complex information management.

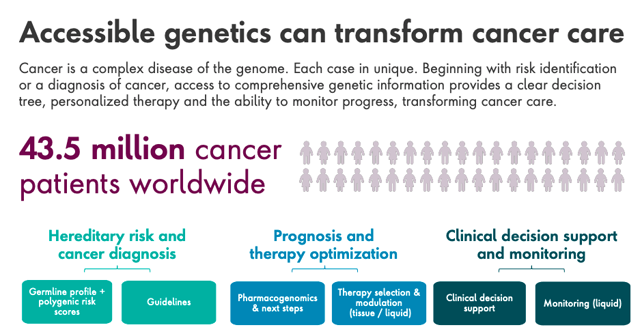

The market opportunity for genetic testing is downright enormous, and Invitae has recently made a smart move by acquiring ArcherDX for $1.4 billion. The move is risky and expensive, but it consolidates the company's position in the much important market of genetic testing for cancer.

(Click on image to enlarge)

Source: Invitae

When the market opportunity is large enough, and in this case, it certainly is, positioning the business to capitalize on those growth opportunities is of paramount importance. Deals such as the recent ArcherDX acquisition need to be analyzed with a long-term view, considering not only the short-term financial implications but also, and more importantly, the long-term strategic impact of the acquisition.

(Click on image to enlarge)

Source: Invitae

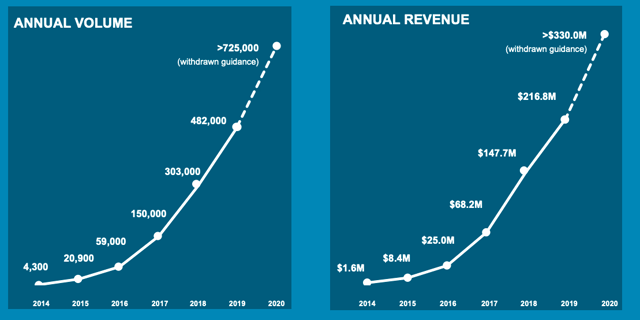

Invitae is producing spectacular growth rates in terms of both volume and revenue. Nowadays, many patients are postponing their testing due to the pandemic, so the outlook is uncertain in the short term, but the long-term opportunity is clearly exceptional.

(Click on image to enlarge)

Source: Invitae

Picking the right management team is very important in these kinds of growth stocks, and Invitae is run by CEO Sean George, who has a lot of experience in this area. Dr. George has a Ph.D. in Molecular Genetics and he was a co-founder and CEO of Locus Development, an early stage genetic analysis startup that later merged with Invitae.

The Main Risk

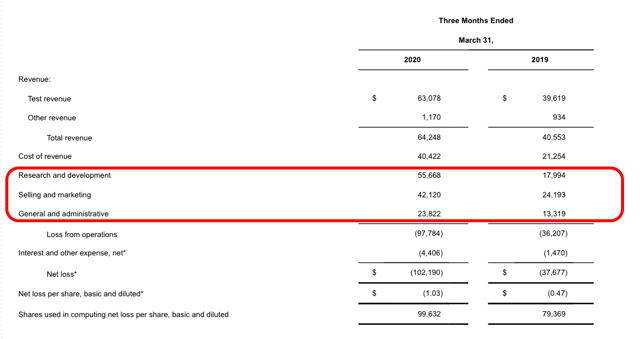

Genomic testing will offer enormous room for growth in the years ahead, but opportunities attract the competition, and Invitae will most certainly face growing competitive pressure over time. For this reason, Invitae needs to aggressively invest in R&D and marketing to protect its competitive advantage and sustain growth over time.

This brings us to perhaps the most important risk factor to consider when assessing Invitae, which is the fact that the company is not shy at all when it comes to investing for growth. These investments are costly, and they are significantly affecting shareholder profitability.

Expenses in areas such as R&D and selling and marketing are quite large in comparison to gross profit, and this puts downward pressure on the income statement.

(Click on image to enlarge)

Source: SEC Filings

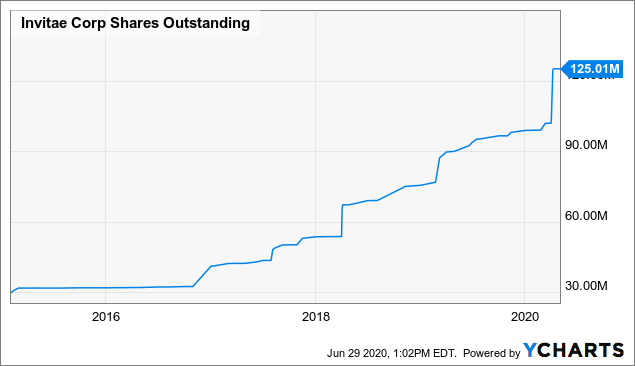

Since the company consistently spends more money than it makes, it has issued large amounts of shares over the years. This is obviously a major negative for investors in Invitae because it dilutes the value of shareholder capital over time.

(Click on image to enlarge)

Data by YCharts

Management has announced some cost reduction initiatives to reduce cash burn this year, but the degree to which Invitae can improve profitability in the middle term still remains to be seen.

Timing And Valuation

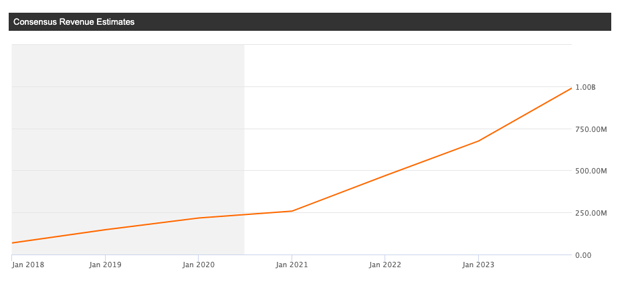

The chart shows forward revenue estimates for Invitae over the years ahead. As you can see, the numbers are very promising.

Sales estimates always carry a large margin of error, and especially now that Invitae is going through the ArcherDX acquisition and the COVID-19 pandemic is creating additional uncertainty on the revenue front. Nevertheless, and even admitting that these estimates are subject to large errors and revisions, it makes a lot of sense to expect vigorous revenue growth from Invitae.

(Click on image to enlarge)

Source: Seeking Alpha

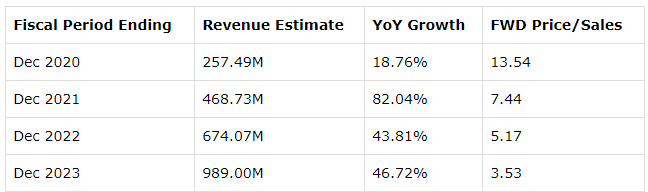

The table shows the actual revenue estimates and the implied price to sales ratio based on those estimates. The stock is very reasonably valued when considering those growth forecasts.

The key point is assessing if Invitae can meet or ideally exceed those growth expectations in the future. There are no guarantees, but the company clearly has the potential to do so if management plays its cards well.

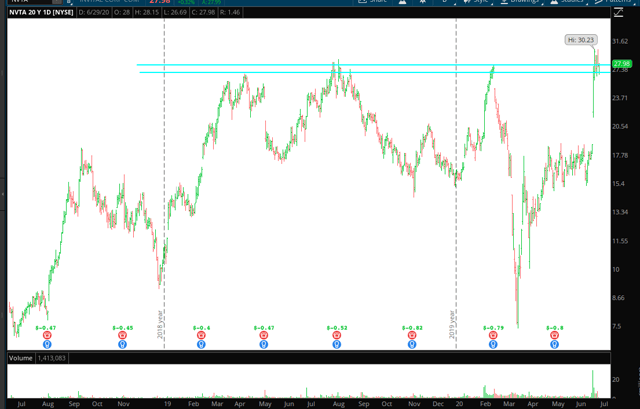

(Click on image to enlarge)

The stock has appreciated substantially in the short term, but it is still trading at the same levels it reached in March of last year. The area around $27 seems to be very important for Invitae in terms of supply and demand dynamics. A sustained break above this level could open the door for further gains, and a move above $30 would be very painful for the short-sellers in Invitae.

On the other hand, rejection at this key area could set the conditions for a deeper pullback considering that the stock has rallied significantly in recent weeks.

(Click on image to enlarge)

Source: TOS

From a long-term perspective, however, the main point is that valuation is not unreasonable at all, and it is clearly not too late to consider a position in Invitae with a long-term time horizon.

The Bottom Line

Invitae is at the forefront of the genetic testing revolution, and the company is well on track to delivering outstanding growth in the years ahead. On the other hand, Invitae is still losing money at a large rate, and share dilution is a major negative for Investors.

Invitae is a high-risk stock, no doubt about that. But it could also produce outstanding returns for investors in the long term. With a market capitalization of $3.5 billion, Invitae has enormous room for appreciation if the company succeeds in consolidating its leadership position in such an enormous market. The best-case scenario would be if Invitae can sustain rapid growth and also start delivering improving profitability in the middle term, which could be a powerful tailwind for the stock price.

For growth-oriented investors who are willing to tolerate the uncertainty and the price volatility in Invitae, the stock is a fairly unique opportunity to consider.

Disclosure: I am/we are long NVTA.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more