Investors Flood Into Tech Stocks Just As Wall Street Agrees Long Tech Is "Most Crowded Trade" Of All Time

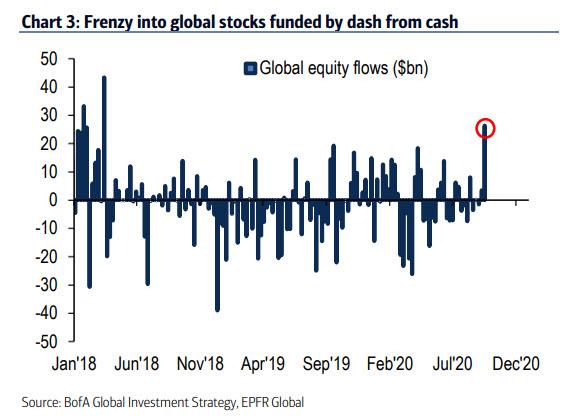

After weeks of tentative fund flows throughout the market's rally from the post-March lows, and certainly the August meetup, investors finally flooded into stocks, and especially tech names following the tech selloff at the start of the month.

According to EPFR data compiled by Bank of America, the week ended Sept 16 saw $26.3BN of new capital deployed into equities, the largest inflow since March 18...

(Click on image to enlarge)

... with another $9.1BN going into bonds, funded by a massive $58.9 billion outflow from cash - the 9th largest outflow ever -in what BofA's Michael Hartnett dubbed "massive weekly rotation to stocks from cash."

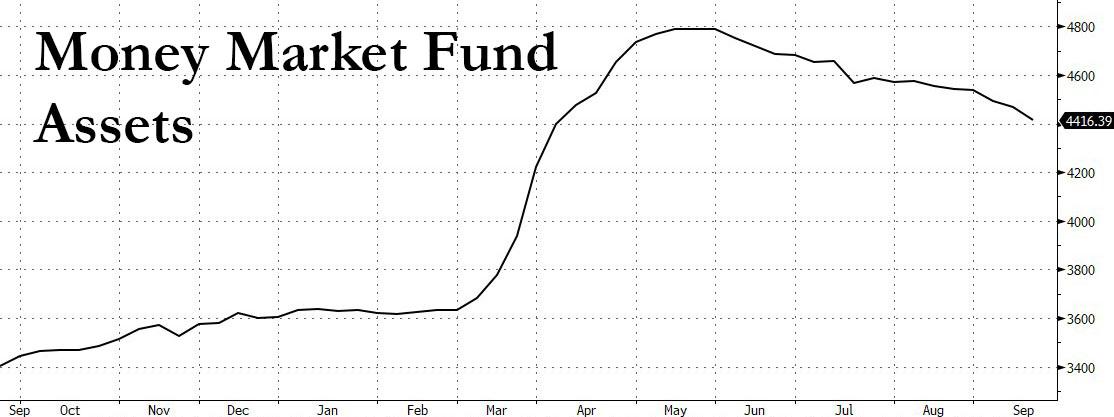

And he is right: the $184bn in cash outflows from money markets - which now hold $4.4 trillion compared to #3.6 trillion before March...

(Click on image to enlarge)

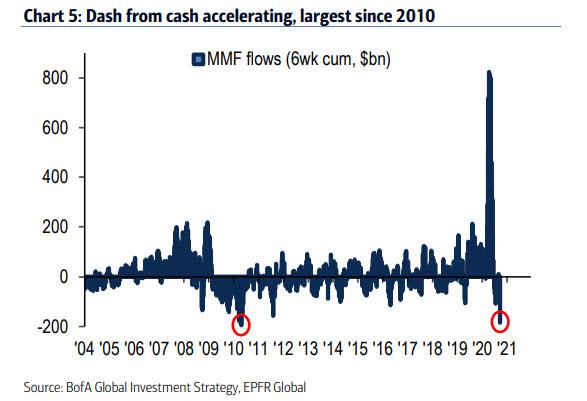

... over the past 6 weeks were the biggest since Apr’10.

(Click on image to enlarge)

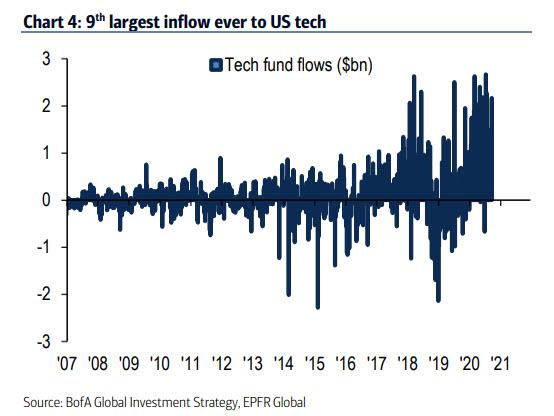

Other notable flows included an "inflection" from gold & credit with gold funds seeing their first outflow in 4 months, while IG & HY bond saw their smallest inflow in 6 months;

But it was the frenzy into US stocks in general, and specifically the 9th largest inflow ever to tech, that stole the show.

(Click on image to enlarge)

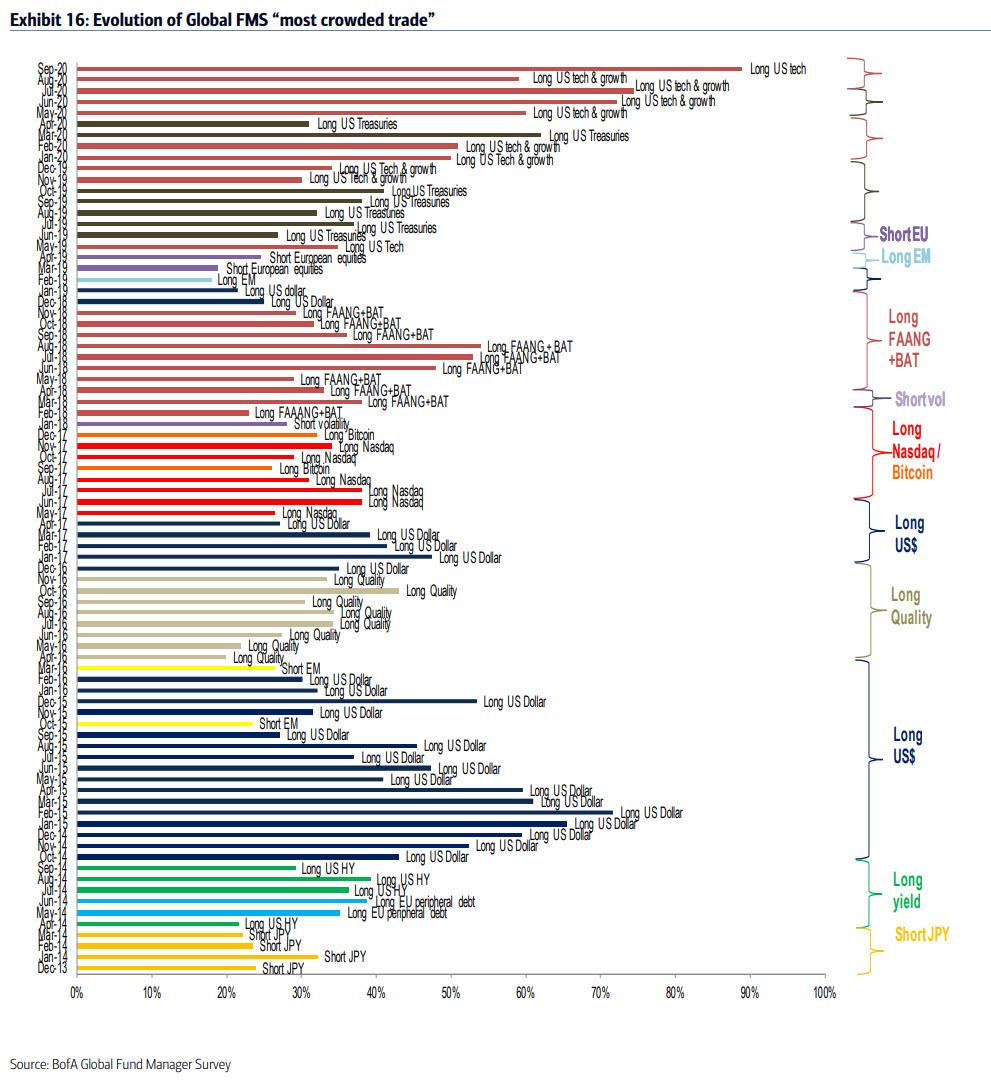

What is hilarious about this FOMO move is that it comes just as the latest Fund Manager Survey published earlier this week found that Wall Street is "paranoid tech" because when asked what they think is the most "crowded trade", 80% - an all-time high consensus - said "long tech"...

(Click on image to enlarge)

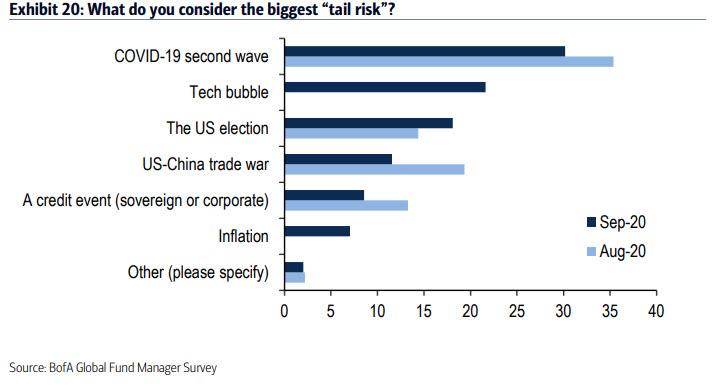

... with fund managers declaring that the "tech bubble" is now the second biggest tail risk for the market after a "second wave" of COVID-19.

(Click on image to enlarge)

This once again shows just how much credibility these Wall Street "surveys" have, as investors respond as they know they should - after all it not a secret to anyone that tech is now the biggest bubble since the dot com days - even as they rush to put their money into this bubble.

Well, maybe it was a secret to at least one person: Willem Sels, the chief market strategist at HSBC Private Bank, told Bloomberg that he doesn’t see signs of overexuberance in the market and says client positioning in equities isn’t at risky levels.

"We remain invested in U.S. tech stocks because in a low-growth environment, investors are interested in companies that can show growth," he told Bloomberg. We wonder how many percentage points lower in the QQQs William will change his mind.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more