Introducing The S&P Sustainably Screened Index Series: A Mainstream Approach To Sustainable Investing

As a pioneer in the index space, S&P DJI has long understood the necessity for evolving indices to address the changing needs of the investor. In recent years, one significant development has been the growing focus on sustainable investing and an increased demand from investors to find strategies more in line with their value and belief systems.

In response to such demand, S&P DJI has looked to diversify the ways in which market participants can gain access to more sustainable investment strategies. The launch of the S&P ESG Index Series in January 2019 represented a momentous step in integrating ESG metrics and scores into the core of an investor’s portfolio. With the recent launch of the S&P Sustainably Screened Index Series, investors now have yet another opportunity to access broad market exposure to S&P DJI’s headline benchmarks—S&P 500®, S&P MidCap 400®, S&P SmallCap 600®—but in an even simpler way. Instead of screening companies by ESG scores and seeking to maintain industry neutrality to the benchmark index, the S&P Sustainability Screened Indices focus only on screening out companies with exposure to controversial business activities, regardless of how that might impact sector or industry composition.

The S&P Sustainably Screened Indices—S&P 500 Sustainably Screened Index, S&P MidCap 400 Sustainably Screened Index, and S&P SmallCap 600 Sustainably Screened Index—seek to exclude companies with specific fossil fuel reserves,1 as well as companies with involvement in controversial business activities widely accepted as conflicting with responsible investing practices (see Exhibit 1). A company’s level of involvement is defined via various revenue thresholds and eligibility criteria that determine the basis for which a company is excluded from the eligible universe. For example companies that are found to be involved in the manufacturing, sale, or distribution of assault weapons and/or small arms, as well as their key components, are deemed ineligible for inclusion in the index.2

(Click on image to enlarge)

In addition to these key business involvement screens, companies are also assessed based on their compliance with the principles of the U.N. Global Compact.3 Companies that do not act in accordance with the associated standards, conventions, and treaties are ineligible for the index. The addition of this screen allows for the index to account for companies with violations linked to human rights, labor, environment, and corruption abuses.

Last, but certainly not least, it is also essential that the index series address any controversial events that could adversely affect both the reputational standing and shareholder value of the company. In order to appropriately address such events, the indices have a built-in review process known as the SAM Media and Stakeholder Analysis (MSA).4 The MSA was developed to formally review and remove those companies involved in activities related to economic crimes, fraud, and human rights issues. In essence, the MSA is used as a system of “checks and balances” to ensure that a company is upholding the policies and business standards that they claim to their stakeholders.

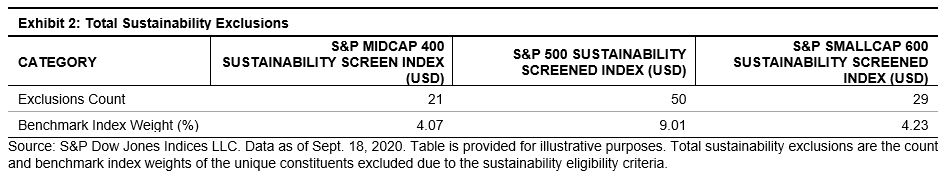

Once the sustainability eligibility criteria are applied, the remaining constituents are weighted by market capitalization and rebalanced on a quarterly basis. The end result is benchmark-like exposure to the S&P 500, S&P MidCap 400, and S&P SmallCap 600, but with a notable decrease in allocation to companies and industries deemed undesirable in the eyes of the sustainably minded investor (see Exhibit 2).

(Click on image to enlarge)

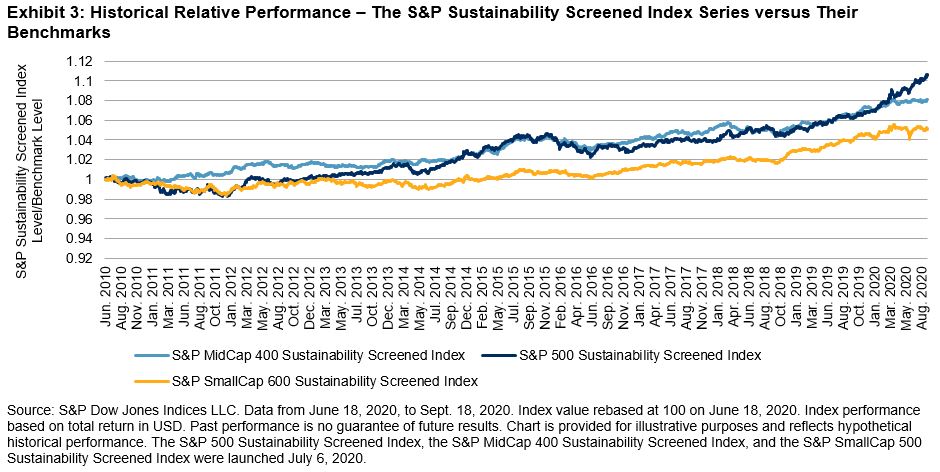

While these new indices are straightforward in their approach to sustainable investing, the outcome of applying such screens has proven positive from both an investment returns perspective—all three of the S&P Sustainably Screened Indices have historically outperformed their respective benchmarks (see Exhibit 3)—as well as delivered on numerous sustainable outcomes such as zero exposure to companies with fossil fuel reserve emissions or those that directly manufacture tobacco-related products, just to mention a few. With such favorable results, these indices provide an appealing sustainable investment option for those on a mission to better align their investment objective with their values and what an admiral quest it is!

(Click on image to enlarge)

1 Fossil fuel reserves are calculated by Trucost, part of S&P Global. Fossil fuel reserve exclusions include cases where Trucost does not cover constituents, in addition to the constituents excluded due to their fossil fuel reserves.

2 As of each rebalancing reference date, companies with specific Levels of Involvement, as specified and measured by Sustainalytics.Level of Involvement refers to the company’s direct exposure to such products, while Significant Ownership indicates where the company has indirect involvement via some specified level of ownership of a subsidiary company with involvement. Please refer to www.sustainalytics.com

3 Companies are assessed according to Sustainalytics’ Global Standards Screening (GSS). For more information on Sustainalytics, please refer to www.sustainalytics.com

4 For more information on SAM’s approach, see https://portal.csa.spglobal.com/survey/documents/MSA_Methodology_Guidebook.pdf

Please read our Disclaimers.

Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights ...

more