Introducing The Dorsey Wright MLP Index

MLP History

The Master Limited Partnership (MLP) structure was created to allow certain partnerships to gain the liquidity of a publicly traded security, like a stock, while maintaining the tax benefits of a partnership. The MLP structure provides a tax advantage to the business and to the shareholders. MLPs do not pay tax at the company level and distribute the majority of their cash flow to the unitholders.

Apache Corporation created the first MLP in the United States, Apache Petroleum Company, in 1981. Shortly thereafter other energy MLPs were formed, followed by real estate MLPs, amusement park MLPs, and arguably the most famous MLP, the Boston Celtics. Congress put an end to the growing types of companies utilizing the MLP structure with the Revenue Act of 1987 which states an MLP must earn at least 90% of its gross income from qualifying sources, which is limited to transportation, processing, storage, and production of natural resources and minerals.

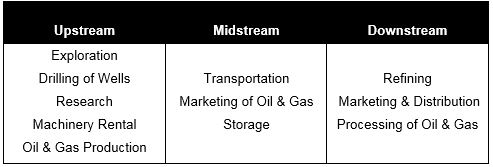

MLPs are now largely dominated by energy companies with business structures that typically can be categorized into three segments: Upstream, Midstream and Downstream.

Indexing MLPs

Energy prices are a significant risk to MLPs. Typically, midstream MLPs don’t own the oil or natural gas that is transported. Instead, the company receives payment for the transportation of the resources. While some Midstream MLPs only transport oil and gas, they can be impacted by the fluctuations in the price of oil and gas. For example, if the price of oil or gas decreases, an MLP’s price could also decrease because of the risk that the oil producer decides to reduce oil production capacity, thereby reducing the amount of oil needed for transport.

Similar to investing in other assets, there can be benefits to holding a basket of MLPs to offset the idiosyncratic risk of owning an individual MLP. Alerian launched the first real-time MLP index (the Alerian MLP Index) in 2006. This index is largely considered to be the MLP benchmark. While new and novel at the time, the Alerian index has stayed the same while the MLP landscape has evolved. The Alerian MLP Index limits its investable universe to Midstream MLPs (MLPs that earn a majority of their cash flow from transporting, storage and marketing of oil and gas). Similar to investing in a diversified basket of stocks, wouldn’t it seem prudent to invest in a diversified MLP index?

Introducing the Dorsey Wright MLP Select Index

The Dorsey Wright (“DWA”) MLP Select Index is designed to select the best performing MLPs based on their relative strength every month. While most MLP indices simply track midstream MLPs, the selection universe of the DWA MLP Select Index includes all MLPs with the exception of financial MLPs. In addition, eligible MLPs in the DWA index must, have a minimum market cap of $1B and each MLP must have one month average daily trading volume of $2 million per day on its primary exchange.

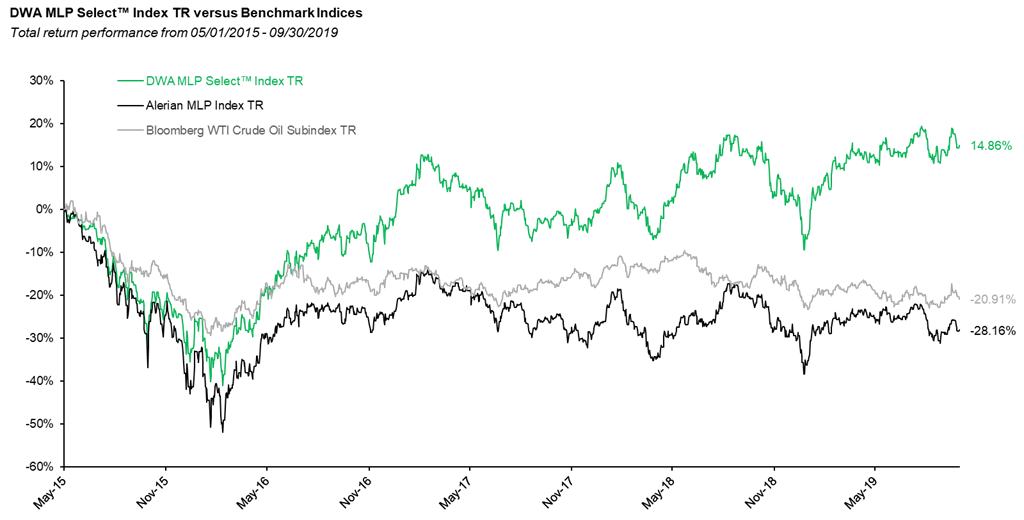

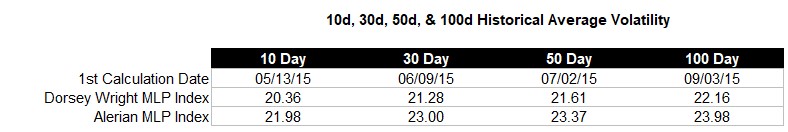

On a monthly basis the Dorsey Wright MLP Index selects the top 15 MLPs based upon Dorsey Wright’s proprietary Relative Strength Ranking methodology and equally weights them. Combining this relative strength based selection and equal weight methodology has resulted in historical outperformance and lower historical volatility than the Alerian MLP Index.

(Click on image to enlarge)

Source Bloomberg, 05/01/15 – 09/30/2019

Staying allocated towards the stronger performing members of the MLP universe may help diversify risk away from those MLPs that may be underperforming.

MLP Index Comparison: Alerian vs. Dorsey Wright

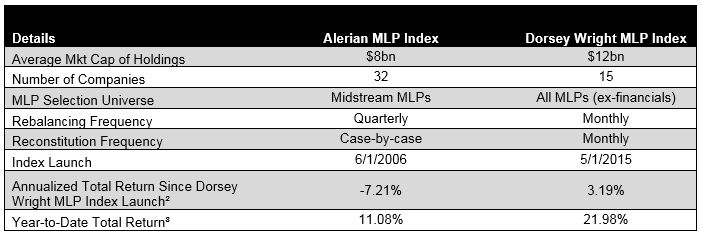

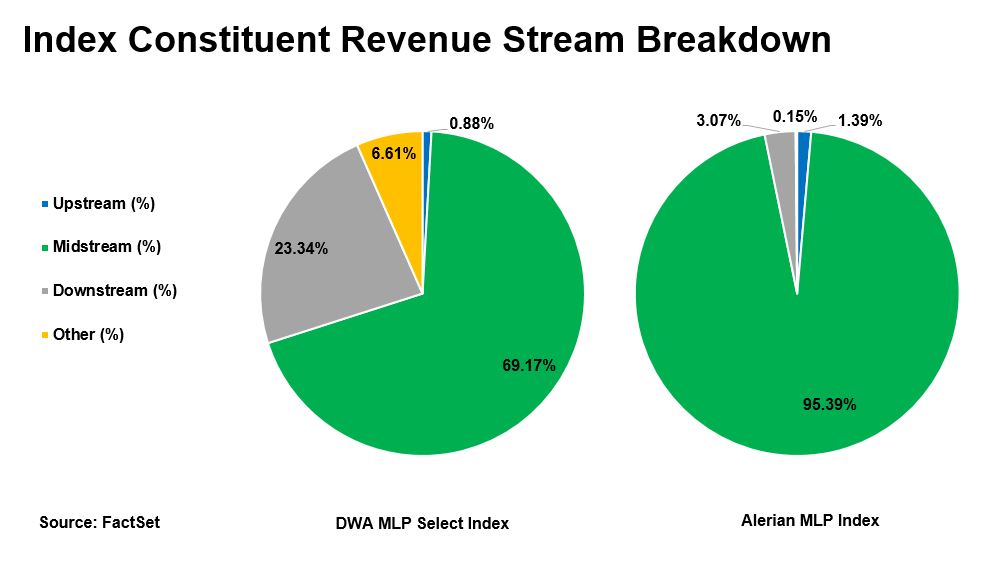

The most popular benchmark of the MLP sector is the Alerian MLP Index (AMZ). Despite being a standard for MLP’s, the index is limited to midstream companies. While the Energy Infrastructure Council classifies roughly half of all MLPs as midstream, they do not make up the entire MLP marketplace. The Dorsey Wright relative strength index methodology screens all MLPs (with the exception of financials) and picks the 15 MLPs with the highest ranked relative strength regardless of whether or not a company is upstream, midstream, or downstream.

The below table compares the Alerian MLP Index to the Dorsey Wright MLP Index.

Source: ² Annualized Total Return, ³ Bloomberg 12/31/2018 - 09/30/2019

Illustrating the difference in constituent selections, the below graphs break down the Revenue Stream of the Alerian and Dorsey Wright MLP Indexes.

(Click on image to enlarge)

Source: FactSet 09/19/2019

Bottom Line

MLPs offer investors a unique way to access exposure to this diversified asset class. MLPs are notable for their yield which is often substantially higher than the average dividend yield of comparable stocks. Using Dorsey Wright MLP Select Index allows you to invest in the best performing MLPs, not limited to midstream activities, based on their Relative Strength Ranking Methodology.

Disclaimer: Each index has limited actual historical information. The Index Calculation Agent (as defined in the applicable pricing supplement), may adjust the index in a way that may affect its ...

more