Intrinsic Value Of Yahoo

Alibaba has started trading at around $91 and Yahoo started trading down at around $41. Being a 22% share holder of Alibaba, Yahoo is supposed to get all of the benefits of Alibaba ownership. Why is the market trading Yahoo downwards? How much is Yahoo truly worth after the Alibaba IPO?

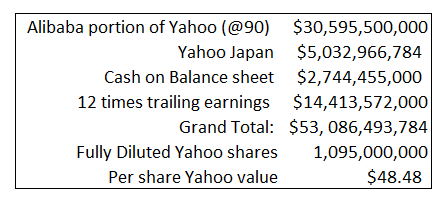

Yahoo owns 523 million shares, or 22.4%, of Alibaba. At $90, Yahoo’s ownership is worth $47 billion; after paying a whopping 35% tax, it would be valued at $30.5 billion. Yahoo owns 35% of Yahoo Japan and at current market value its worth is $7.7 billion; again after paying 35% tax it's worth $5 billion. Yahoo has $2.74 billion cash on its balance sheet; for the past twelve months Yahoo made $1.26 billion on earnings. At twelve times past earnings Yahoo's estimated value is $14.7 billion.

If we sum all of the parts, Yahoo's value is way over the current trading price.

Again this is a conservative approach on Yahoo's valuation. Yahoo can play its Alibaba stake in a tax efficient way, such as spinning its Alibaba stake into a different entity and allocating new entity shares to shareholders. Yahoo's brand is worth a lot more. If someone wants to purchase Yahoo in its entirety, shareholders would demand a much higher price than it is now. Let’s say you want to ignore earnings metrics, and adopt a conservative 8 times trailing EBITDA ($1.28 * 8) which is $10.24 billion, putting Yahoo's fair value at $44.40. Also every dollar change in Alibaba is worth $0.34 for Yahoo on an after tax basis.

Disclosure : Long on Yahoo.

Mr. Meka, I liked your analysis but what did you have to say about Mr. Chen's comments?

Thanks Mr.Winslow. The quick analysis I have done on Yahoo was due to special situation, that is Alibaba IPO. The analysis on Yahoo was summ of part business.

If you see seventy percent of the Yahoo valuation at that time (according to my view) was from its outside holdings. Fundamental Analysis addresses rest of the thirty percent or so of the Yahoo valuation which I did not want to go through. Because my sole intent was to express my opinion that Yahoo is worth more than its trading price.

Thank you for the explanation and taking the time to respond. I hope to see more of your analysis. Anything in the works?

Doing a detailed analysis on one of the popular equity. I will inform you once it gets published.

Thank you

A company’s intrinsic value is estimated through a fundamental analysis, both quantitative and qualitative. All of the parts mentioned before are not enough to form a fundamental valuation, therefore those evidences are insufficient to interpret Yahoo’s intrinsic value. Alibaba’s IPO is good news for its major shareholder Yahoo, but this is only a small portion of Yahoo’s overall business. The picture I see is critical challenges ahead Yahoo would need to manage.