Intel Powered By Solid Earnings And An Attractive Valuation

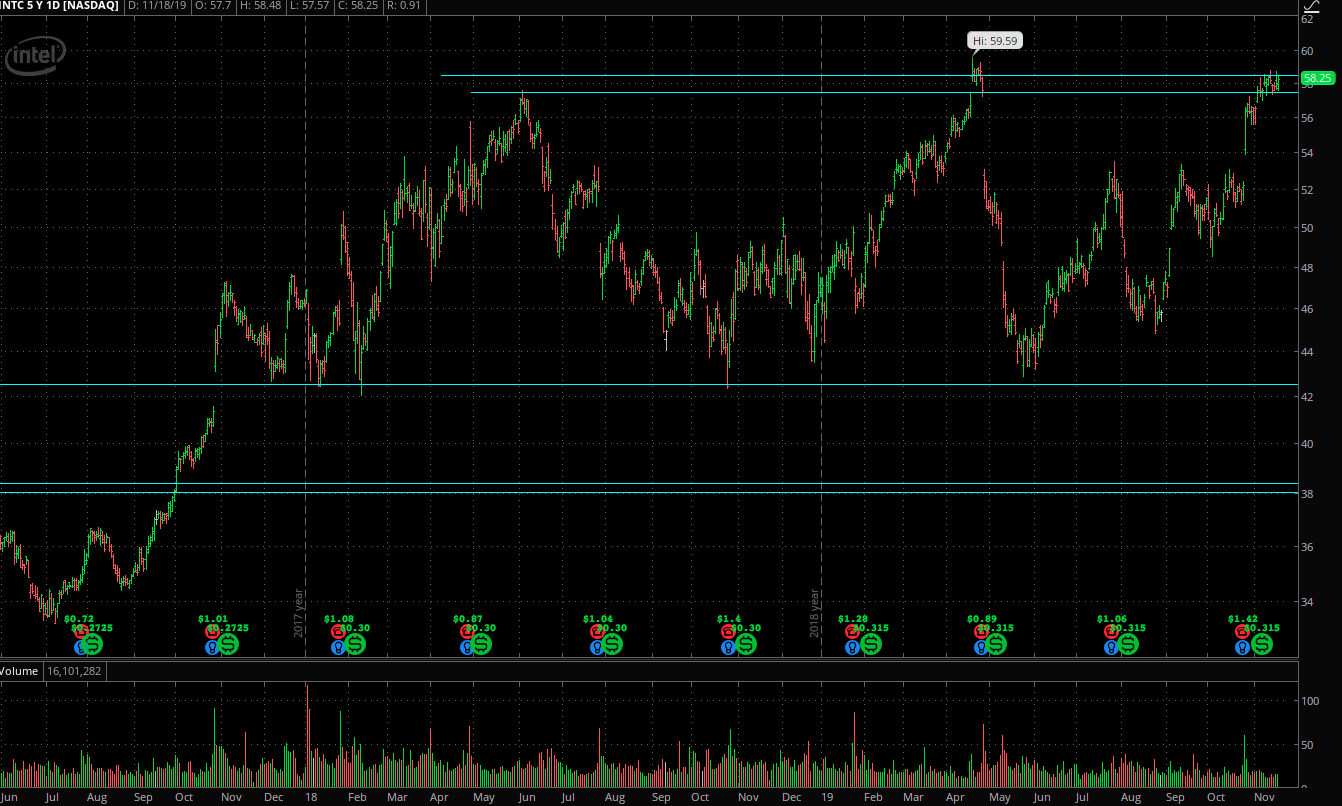

Intel's (INTC) stock has been consolidating in a sideways range for several months, and the area around $58-$60 per share has been a major resistance for the stock since June of 2018. The stock is once again approaching this area, which raises the question of whether a sustained breakout is coming or just another failed attempt.

(Click on image to enlarge)

Source: TOS

The final outcome will depend on a multiplicity of variables, many of them related to the market environment and investor sentiment in addition to the company's fundamentals. However, this new breakout attempt is fueled by better than expected earnings from Intel, and the stock is attractively valued at current levels.

Solid Earnings

Intel is going through a transition, the PC industry is languishing, and the company is facing growing competitive pressure across the board. However, the most recent earnings report from Intel surpassed expectations, proving that the company is strong enough to continue delivering in all kinds of environments.

Revenue in the third quarter of 2019 amounted to $19.2 billion, surpassing the company's guidance and beating Wall Street expectations by $1.13 billion. Non-GAAP earnings per share came in at $1.42, surpassing expectations by $0.18 per share. In a sign of confidence, management also raised guidance for the rest of the year.

Cash flow generation is more than healthy. Year-to-date, Intel produced a record $23.3 billion in cash from operations and $11.7 billion in free cash flow. The company returned approximately $14.3 billion to shareholders during the period.

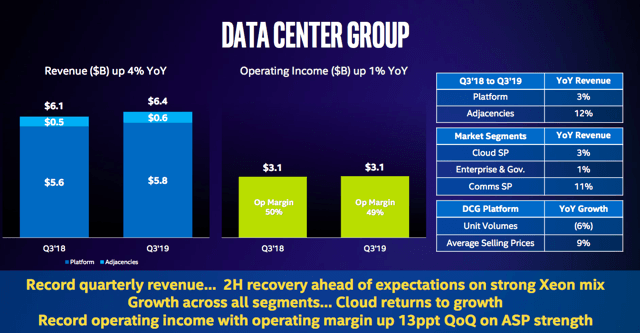

The main growth engine during the quarter was the data center business, with data-centric revenue reaching $6.4 billion, up 4% from the prior year and up 28% sequentially. Over time, the high growth segments should account for a larger share of total revenue at Intel, which should have a positive impact on revenue growth in spite of the stagnant numbers in the PC Centric segment.

(Click on image to enlarge)

Source: Intel

Intel has been heavily investing in Artificial Intelligence over the past several years, and management is quite optimistic about the company's potential in AI, not only in the future but also in the present.

From the conference call:

AI is becoming a pervasive use case. According to IDC, 75% of enterprise applications will use AI by 2021, and that's why we're infusing AI in everything we build. ...But this isn't just about the future. We are driving meaningful AI revenue Inside Intel now. With products spanning from the Data Center to the Edge, we expect to generate more than $3.5 billion in AI driven data-centric revenue in 2019, up more than 20% year-over-year.

The road ahead for Intel will probably be bumpy, and investors need to closely watch the competitive landscape in such a dynamic industry. However, the fact remains that Intel is producing a solid performance in a difficult environment, and this speaks well about the company and its management team.

Attractive Valuation

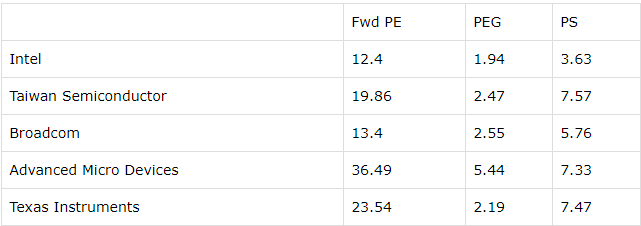

Intel's stock is performing strongly in the short term, but the stock is still very reasonably valued in comparison to other big players in the industry.

The table below compares forward PE, the price to earnings growth (PEG) ratio, and the price to sales ratio for Intel versus Taiwan Semiconductor (TSM), Broadcom (AVGO), Advanced Micro Devices (AMD), and Texas Instruments (TXN). Intel is the cheapest stock in the group across the 3 valuation ratios considered.

(Click on image to enlarge)

Data Source: Seeking Alpha Essential

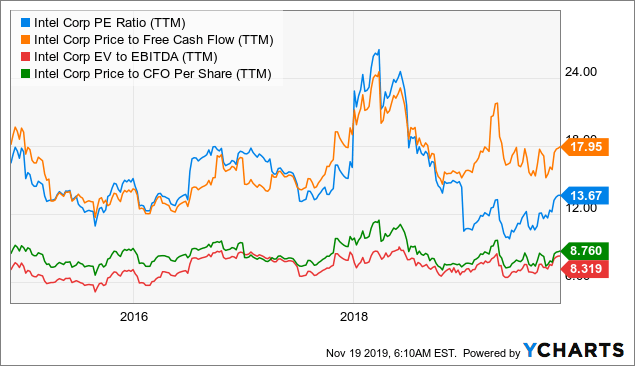

Valuation is also more than reasonable by historical standards. Comparing current valuation ratios versus historical valuations for Intel, metrics such as price to earnings, price to free cash flow, EV to EBITDA, and price to operating cash flow are in line with historical standards of the company.

(Click on image to enlarge)

Data by YCharts

Intel has recently increased the share buyback authorization, and management is intending to repurchase $20 billion in stock over the next 15 to 18 months. This represents nearly 8% of the company's market capitalization.

In addition to this, the dividend yield stands at 2.2%. This is not particularly high, but the dividend payout ratio is comfortably low at 27% of earnings. This is indicating that Intel has plenty of room to continue increasing dividends in the future as long as earnings and cash flows keep moving in the right direction.

It is one thing to say that a stock is undervalued based on the earnings and cash flows that the company produces. But when it comes to cold-hard distributions via dividends and buybacks, this undervaluation is far more tangible

Valuation is always a dynamic concept, meaning that it changes over time with fluctuating expectations for the company. Current valuation ratios are reflecting a particular set of expectations about the future of the business. If the company can consistently outperform Wall Street estimates, then those estimates will tend to increase over time. In order for the valuation to remain stable, the stock price needs to increase too when the earnings expectations are rising.

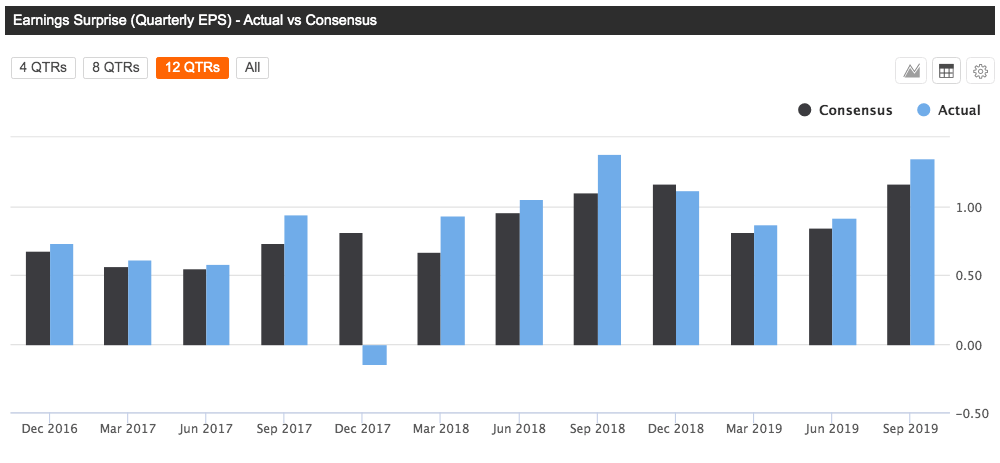

Intel has delivered earnings numbers above Wall Street expectations in 14 of the past 16 quarters, quite an impressive track record of consistency coming from a company that operates in a cyclical and competitive industry.

(Click on image to enlarge)

Source: Seeking Alpha Essential

The fact that the company has outperformed expectations in the past does not guarantee that it will continue doing so in the future. However, it's good to know that management tends to under-promise and over-deliver.

If Intel continues beating expectations in the future, that would mean that the stock is actually cheaper than what current ratios are indicating, and fundamental momentum could provide further upside fuel for the stock price.

Valuation should always be analyzed in the context of other return drivers. A company with strong financial performance and outperforming expectations obviously deserves a higher valuation than a business producing mediocre financial performance and weakening momentum.

In order to see the complete picture from a quantitative perspective, the PowerFactors algorithm is a ranking system that grades companies in a particular universe according to a combination of factors, including financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term. Intel is one of the top-ranked stocks in the US market right now, with a PowerFactors ranking of 98 as of the time of this writing.

Backtested performance numbers should always be taken with a grain of salt. The data shows that companies with strong quantitative attributes tend to deliver higher returns over the long term, but this does not say much about how Intel, in particular, is going to perform in a specific period.

The numbers in the ranking system are based on past financial performance and current expectations about future performance. This necessarily carries some limitations. At the end of the day, the true value of the business will depend on the earnings and cash flows that Intel can generate in the years ahead, so current numbers are meaningless if the company fails to sustain financial performance by expanding into key growth areas such as data centers and AI.

In a nutshell, quantitative metrics can be very valuable because they provide an objective and clear assessment of a stock. However, you need to understand the business behind the numbers in order to tell if the numbers are representative of future performance or not. The research process starts with the numbers, it does not end there.

That being acknowledged, when analyzing valuation ratios in comparison to other big players in the industry, in comparison to the company's historical standards, and from a multi-factor quantitative perspective, Intel's stock looks attractively valued.

Risk And Reward Going Forward

Intel is facing considerable challenges due to declining PC sales and increasing competitive pressure from players such as AMD. The company's ability to successfully overcome these challenges in the years ahead still remains to be seen, and this is a major risk factor to keep in mind when analyzing a position in Intel's stock.

However, these risk factors are well known by the market and reflected on valuations to a good degree. The most recent quarter was quite encouraging, mostly due to vigorous growth in data centers. If management keeps leading the company in the right direction, then Intel's stock should offer attractive upside potential from current levels.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my own ...

more