Intel Is Down - Not Out

Intel is one of the true heavyweights in the semiconductor industry. I own Intel (INTC) in my personal accounts, as well as my subscriber portfolio. I also own Taiwan Semiconductor (TSM) and Tower Semiconductor (TSEM) in both.

I would like to discuss with you why I think Intel is a sleeping giant ready to regain its territory. I will not be comparing AMD’s (AMD) 7nm, 8 core laptop products with Intel’s 10nm, 4 core Ice Lake, or discussing clock speeds and heat signatures and such. You can read this in any of a dozen articles at various sites likely posted the same day you read this.

Nor will I discuss the virtues or shortcomings of silicon versus silicon carbide versus gallium nitride et al. There are hundreds of articles that already reach deep into the weeds to shed light on why company X or company Y has the best chance of owning this space in the short term.

I instead offer a view on the investing merits of Intel. Of course, these are affected by staying on the leading edge of product development, but also by the strength of a firm’s marketing team, their reputation and longevity in delivering top-quality product, their ability to attract and retain top talent, their senior managers, national policies, global politics, and the depth and breadth of their R&D capabilities. These are the company-specific issues I am interested in.

To these I add the valuation metrics for the stock itself. It is easy to get lost in those weeds above, forgetting that we are trying to make great investments here, not out-shout someone about a particular chip or other product.

Yes, Intel stumbled when they announced they were behind schedule on delivering their new 7nm product. Companies announce delays all the time.

Is this a death-knell for Intel? No. Is it a wake-up call? Yes. And if the problem is one of manufacturing capacity rather than significant design flaws, there are other firms Intel can sub-contract to in order to get quickly up to speed.

I almost never buy 100% of my position at once. I am happy with a relatively small 350 shares for now. If it goes down and the metrics I use to analyze a company remain the same or improve, I will buy more in additional tranches. If it goes up, I do not marry any stock. As it rises, I will place trailing stops.

MANAGEMENT AND WORKFORCE

This seems to be a very big concern for many. The big knock against Intel’s CEO, Bob Swan, is that he is a “finance guy,” having been promoted from the Intel CFO position, not an engineer. The question seems to be, “How can he run a semiconductor company when he doesn’t understand the intricacies of the physics and engineering characteristics of the product?”

My answer is simple. I do not know Mr. Swan, who may or may not be a skilled CEO, but I know that there are hundreds of other executives who are fine leaders, keen judges of talent and excellent delegators.

Warren Buffett was never a railroad executive, bricklayer, candy-maker, or fast-food executive. Yet Berkshire Hathaway’s 100%-owned Burlington Northern, Acme Brick, See’s Candies, and International Dairy Queen seem to be doing just fine.

Chuck Schwab had never run a discount brokerage firm when he saw an unmet need in 1975, the year the SEC began to allow negotiated commission rates. I could name hundreds of other fine executives and strong entrepreneurs who succeeded in areas they knew little about or in evolving areas, like discount brokerage, that no one knew anything about.

How did men and women like these succeed? They knew their own strengths and their own weaknesses, and they surrounded themselves with talented individuals to do the things they were not good at. Let’s take a look at some of the senior folks at Intel.

First, a couple board members:

- Chairman of the Board: Dr. Omar, CEO and Chairman of Medtronic (MDT), a global leader in medical technology, from 2011 until April of this year. Ph.D. in electrical engineering.

- Director: Dr. Tsu-Jae King Liu, Professor, Electrical Engineering and Computer Sciences and Dean of the College of Engineering, UC Berkeley. Holds more than 90 patents. Current research focused on nanometer-scale logic and memory devices, and advanced materials, process technology, and devices for energy-efficient electronics.

- Director: Alyssa Henry, who oversees global engineering, product management, design, sales, marketing, partnerships and support for e-payment firm Square Inc (SQ). She was previously vice president of Amazon Web Services Storage Services (AMZN), and at Microsoft (MSFT) working on databases and data access technologies in a variety of engineering, program management, and product unit management roles.

- Director: Andrew Wilson, CEO of Electronic Arts Inc. (EA).

And here are a couple management team members, chosen at random since there are so many:

- Dr. Peng Bai is vice president of the Technology and Manufacturing Group and director of the Derivative Logic Technology Development at Intel Corporation. Dr. Peng has numerous published papers in science and engineering journals and holds two U.S. patents. He has won four Intel Achievement Awards. He received his bachelor's degree in physics from the University of Bucharest in Romania and his Ph.D. from Rensselaer Polytechnic Institute.

- Lisa A. Spelman (General Manager of Intel® Xeon® products and data center marketing.) Before joining Intel IT operations, Spelman spent two years as technical adviser to Intel’s chief information officer.

- Richard L. Coulson (Senior Fellow and director of the Storage Technologies Group.) Holds more than 40 Patents. He also has a BS in Electrical Engineering and Computer Science from University of Colorado, and a MS in Electrical Engineering from Stanford.

Leading-edge companies attract great talent. If Mr. Swan can continue Intel’s history of creating a workspace that rewards innovation, he does not need a PhD in electrical engineering. He just needs to determine the course, express it clearly, and reward the innovators.

MARKETING AND REPUTATION

“Intel Inside.” The complexities of brilliant marketing would demand a book-length analysis – and there are many out there. Suffice it to say that the goal of marketing is not only to sell a product but to make the buyer integrate the experience of so doing with an emotional sense of well-being, cleverness, group identity, community, or some other factor.

“Intel Inside” does just that. At the consumer level, buyers feel much more comfortable with a product they already know and trust when considering a new product. Apple (AAPL) is a past master at this. Apple sells wonderful cell phones and I imagine still sells great computers.

But where Apple excels is in making people believe that quality workmanship and superb customer service are not the point. Being up-to-date, cool, kicky – that is what is important. People will take a perfectly wonderful iPhone they paid $700 for and trade it in for half that just so they can buy another iPhone, incrementally different, for $1000.

Intel doesn’t have to work that hard. After years of reinforcing the brand, most people accept the fact that if it has Intel inside it is a higher-quality product and probably also ahead of the competition.

Many times in the past, the competition has stolen the march on Intel. Their product may actually be better – but the buyer does not get the same warm feeling from the competition’s product. This is one of those times. I would suggest that because of Intel’s reputation -- and marketing – that there are many, both consumer and corporate, that would rather have what they perceive as the higher reliability, after-the-sale service, and willingness to work together with the buyer, who will still buy Intel.

Intel has been leapfrogged before. It seems to bring out the best, and the beast, in INTC’s corporate culture. Competitors need to enjoy their day in the sun. Intel will not take being the #2 for long.

One final thought on reputation and how marketing, no matter how expensive or seemingly persuasive, can not overcome a declining reputation:

I wrote a “Bearish” article on Boeing (BA) in January that engendered lots of disagreement. The stock was at 316 when I wrote it. It is nearly half that today. My primary argument against Boeing was and is that this great American company has destroyed its reputation by taking shortcuts with the t37MAX, covering up those shortcomings, then screwing up the defense side of their business by delivering shoddy product to the US Air Force.

Boeing may once again be a great company. If it succeeds, it will not be because they spend hundreds of millions of dollars on slick marketing and advertising. It will be because they have restored their reputation for building quality products and are honest and transparent in their dealings. Reputation trumps billions in mere advertising.

RESEARCH AND DEVELOPMENT

No competitor has anywhere near the R&D budget that Intel has. If we combine that resource with Intel’s continuing cash flow, a work force that feels proud to say they work at Intel, and the appropriate rewards for those loyal employees, Intel will once again regain its #1 title.

In the fast-changing world of semiconductors you must devote appropriate amounts of capital to R&D. INTC spends more on R&D than Taiwan Semiconductor, Advanced Micro Devices, and NVIDIA. I do not mean they spend more than each of these fine firms. I mean they spend more than all of them combined.

One might say, “Yes, but Intel doesn’t spend the money as wisely as, say, Competitor XYZ.” Maybe not. But if you need to chop firewood, a brilliant crafted hatchet is still not as effective as a finely honed axe. In R&D in this industry, Intel wields the logger’s axe.

NATIONAL POLICIES & GLOBAL POLITICS

Politicians can screw anything up. “At their best,” they produce only the appropriate amount of regulation to ensure a fair and equal playing field within which companies and individuals can excel. Anything is possible even if it makes no sense whatsoever.

Companies will simply have to adapt. One of the things that makes Intel unique is that some 80% of its manufacturing is done in the USA. Nividia, AMD, and others already outsource all or most of their manufacturing to Taiwan, South Korea, the PRC, or elsewhere. Difficult as the politicians can be in the US, it sure beats the worst-case possibilities overseas.

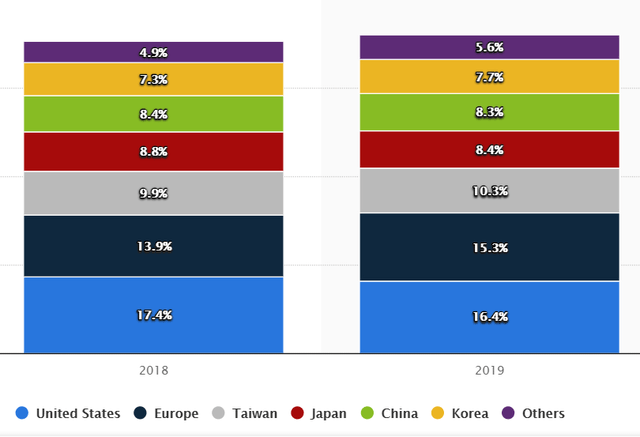

We live in interesting times and national policies, global and national trade policies, conflict, intimations of war, etc. can all raise their head at any time. Finally, while on the subject of national and global politics, please note that the largest R&D country spending is still the US:

R&D Spending by Country 2018 and 2019 Final

Source: Statista

VALUATION

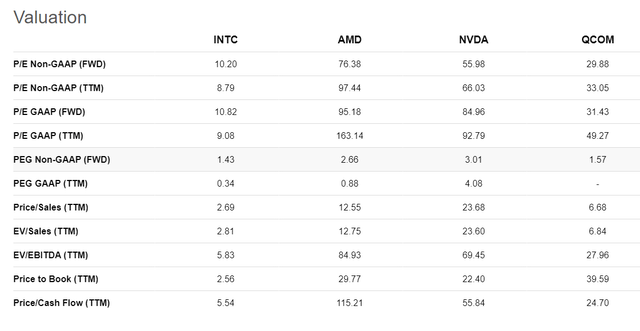

I consider Intel a good purchase at current prices. Here are a few valuation metrics that reinforce my confidence in buying INTC today:

Source: SA

You may note that every single valuation metric favors INTC. Intel has the lowest trailing twelve-month PE ratio as well as the lowest forward estimate. It has the most favorable PEG ratio. Its Price/Sales ratio is well ahead of the pack, as is the EV/EBITDA metric, Price/Book and Price/Cash Flow.

However, Intel’s revenue growth metrics are behind AMD and NVIDIA in some areas, besting only QCOM in most growth metrics. Looking ahead, most analysts are predicting lower growth than among the three competitors above. I think they are wrong.

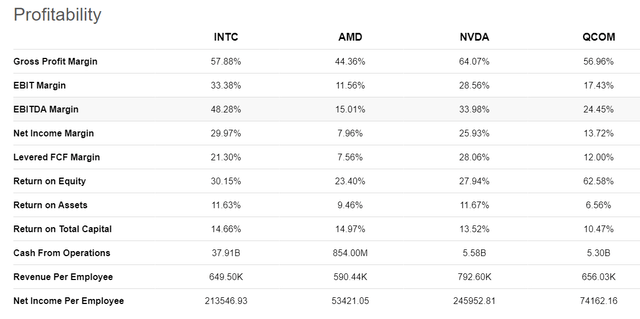

Source: SA

In terms of profitability, again INTC is number one in all metrics, but Net Income per Employee which NVIDIA is a nose ahead. Remember, however, that these profitability metrics only measure the present. If you are a hard-core believer in AMD or some other competitor you might believe all this is just current history and will somehow change going forward.

I don’t think so.

Disclosure: I am/we are long INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company ...

more