Intel Corp. – Showing It's Age

Intel Corp. (INTC) clearly has not been one of the leading Dow 30 Companies since April 2012. Looking back is fine, but my job is to provide "fore-sight" and I do! It is currently on a Hold, and my Indicators are continuing to break down.

My previously written articles on INTC (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

My previously written articles on INTC (just click) provide you the history of my forecasting, its accuracy and support for my performance. For over 50 years my management objective is to identify changing trends for my forecasting analytics. I simple want to have current notes to quickly refer to on the anticipated direction of this company and its industry peers.

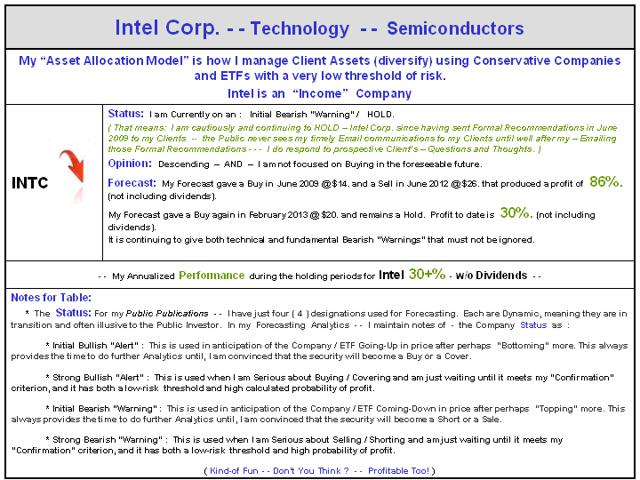

My Performance for Intel can be found in the table below and has provided 30+% per year during holding periods.

This is a study that is of particular interest to me because I have spent so much time and experience in the study of excellent Companies like (INTC).

My management objective is to identify changing trends for my forecasting analytics. Simple stated, I want to have current notes to quickly refer to on the anticipated direction of this sector and industry group.

A Special Note for Seniors & Retired Investors - Dividend Yield: 3.37%

Forecast w/ Performance:

Note: The below Table is for your review, questions and perhaps thoughts. If you would like to "Invest Wisely" in my Income Asset Allocation Model," please email me to open a dialog on how I go about providing superior performance with a very low threshold of risk.

(click to enlarge)

My Current Forecast is not as bright as you may think! (I will be more specific upon your email request).

If you own or are considering owning semiconductor companies, the securities are becoming a mixed and rather negative bag. Intel Corp. is currently relatively weak technically and I have reservations about my fundamental valuation; however, it is on my Initial Bearish Forecast - "Warning."

My Current Opinion is to Hold. Profits were taken in July and cash is my current safe haven. For me, cash is a balancing of my below three (weighted) pillars of research.

Fundamentally - ( weighting - - 40% ), my Valuations remains relatively strong but are "Poor - Flat" and on the Decline. That produces future declining valuation projections.

Technically - ( weighting - - 35% ), my Indicators are clearly breaking down. The highs were registered inn early 2012 at about $26 with a current price of $24. That is not the kind of performance you should be expecting, be it your financial advisors guidance or your own!

Consensus Opinion - ( weighting - - 25% ): My third pillar of research is one that is always distorted to the positive by most all financial analysts. That's because they are afraid of being bearish. I am not! My articles on "reality" are supportive of the below 20 year Chart.

I will personally and promptly reply to any serious investor's inquiry as to my very cautious position for INTC !

If you are seeking guidance or direction, please feel free to email me. My personal blog or site is: Investing Wisely.

Smile, Have Fun, "Investing Wisely,"

Dr. Steve

None.