Instructure IPO Lockup Expiration Could School Investors

Instructure Incorporated (NYSE: INST) - Sell or Short Recommendation - $18.50 PT

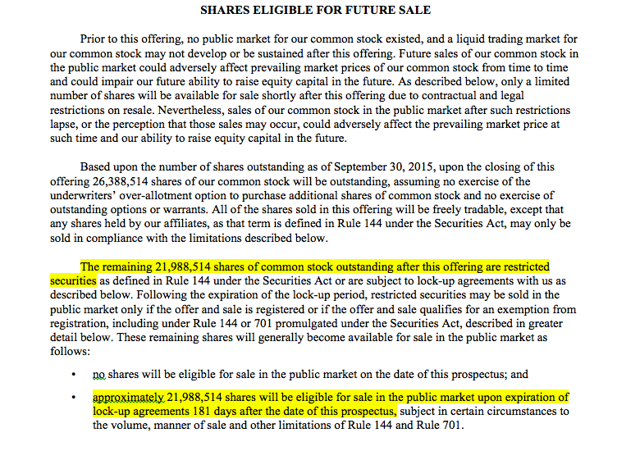

May 11, 2016 concludes the 180-day lockup period on Instructure Incorporated.

When the lockup period ends for INST, its pre-IPO shareholders, directors and executives will have the chance to sell their 22 million shares. The potential for a sudden increase in stock available in the open market may cause a significant decrease in the price of Instructure shares.

We see a short opportunity for experienced investors.

Business Summary: Software Developer with Learning Management Platform

(Source)

As per Instructure's SEC filings, the company is a software developer that created and offers cloud-based learning programs used by businesses and educational institutions. Its two main platforms are Canvas and Bridge. Instructure launched Canvas for the education market in 2011 and Bridge for businesses in 2015.

The company's applications facilitate corporate and academic learning by providing its proprietary platforms for educators, instructors and students, thus enabling open and frequent interactions, allowing the sharing and creation of content with anywhere, anytime access to data, and streamlining workflow. Its platform also offers data analytics that enable real-time responses to data and benchmarking in order to improve efficacy in the learning process and customize curricula.

The company markets its proprietary platforms through the Software-as-a-Service ((NASDAQ:SAAS)) model. Clients can develop, customize and manage their online learning modules, and Instructure estimates that over 1,600 educational and business institutions worldwide use its products.

According to Instructure, it has just over 700 employees and is located in Salt Lake City, Utah. In its SEC filing, Instructure noted that it currently has no specific use for the proceeds of the IPO other than general corporate purposes and to create a secondary market for its stock.

Year-End Financial Highlights Show Some Revenue Growth, Operating Loss

For the fiscal year ended December 31, the company reported the following:

- Non-GAAP revenue gross margin reached 67.6 percent versus 66.7 percent in 2014.

- Operating loss was $41.4 million versus $29.28 million in 2014, an increase of 41 percent.

- For the first quarter of 2016, Instructure expects revenue to reach $22 million, which would be a non-GAAP net loss of ($13.2 million) and a non-GAAP net loss per share of ($0.49) per common share.

Management Team & Competition from Moodle, Desire2Learn and Blackboard

According to the filings, CEO Joshua Coates has served in his position since October 2010. In addition, he serves at Strategic Advisor of EPIC Ventures and Chief Technology Officer of Scale8. He founded Mozy.com and Scale8. In 2007 he began volunteering as an adjunct instructor in the Computer Science Department at Brigham Young University. In 1998 Mr. Coates graduated with a degree in Computer Science.

EVP of Worldwide Sales has served in his position since September 2014. His previous experience includes senior positions at HireRight and Certico Verification Services. Mr. Maloy holds a B.S in both Operations Management and Human Resources Management from Indiana University's Kelley School of Business.

Instructure faces significant competition in this market, and other companies that offer electronic learning systems include SumTotalSystems, Saba Software, Cornerstone On Demand, Moodle, Desire2Learn, Moodle, Sakai, Person Ecollege, Lore, Myedu, and Goingon.

Strong Early Market Performance

Instructure's IPO priced at $16 per share, at the low end of its expected price range of $16 to $18. The stock opened on the first day of trading at $16 and closed at $18. Since then the stock climbed to reach a high on December 24, 2015 of $22.64 then dropped to a low of $13.79 on February 26, 2016. Currently, the stock trades around $20.00.

(Click on image to enlarge)

(Nasdaq.com)

Conclusion: Short Opportunity Ahead of Lockup Expiration

With just 4.4 million INST shares currently trading, if even some of INST's insiders sell on May 11, they could push INST stock price down.

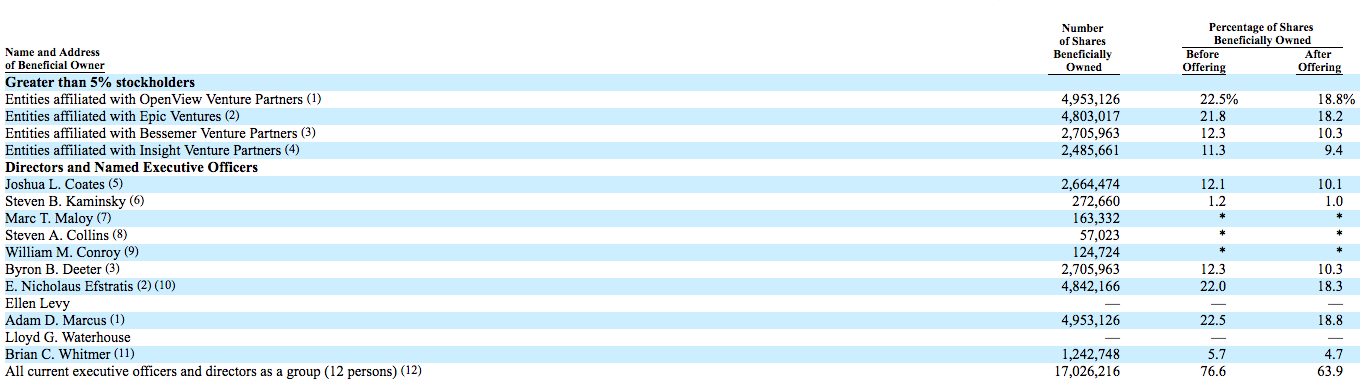

Four firms and over ten individuals will have a chance to sell; these include OpenView Ventures, Epic Ventures, Bessemer Venture Partners, and Insight Ventures.

(Click on image to enlarge)

We see a short opportunity. Our firm has found abnormal negative returns of 4.2% in the two weeks surrounding many lockup expirations, particularly tech firms like INST, with strong VC-backing.

Disclosure: I am/we are short INST.

I wrote this article myself, and it expresses my own opinions. I have no business ...

more