Insider Buying Indicator

“Davidson” submits:

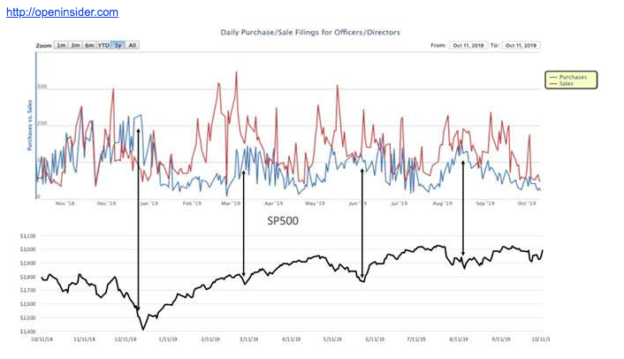

Periodically it is worthwhile to take the pulse or the financial health of the market. This is accomplished by monitoring the daily pace of insider buying relative to daily market prices. Corporate insiders are deemed the most informed Value Investors regarding the future prospects of their individual companies. If corporate insiders are buying at lower prices when investors are pessimistic, then it is assumed that insiders see better value in their company shares than perceived by most investors. Insider buying is a good contrarian market signal generally. The past 12mos of market dips has been accompanied by insider reports over 100/day. Experience indicates that daily reports of 100 Buys/Day is a positive signal of higher equity prices ahead.

(Click on image to enlarge)

Insider buying as a signal becomes more useful when individual historical business financial performances and share-pricing metrics such as Pr/Sales ratios are correlated to economic metrics such as the Chemical Activity Barometer(CAB), the Trucking Tonnage Index(TTI), employment, retail sales, and personal income. While the chart of insider activity vs SP500 provides a broad financial health measure, it is in the details of individual companies where insider buying is most active where one gains the best insight. Managements with exceptional financial histories sometimes extending decades are managements with better economic/business judgment. Their commentary in quarterly reports and media interviews tend to correlate strongly with economic trends, Monitoring the commentary of 100+ managements is like having a staff of experts on one’s investment team spanning the entire marketplace. Adding well-managed companies to portfolios at times when other investors have discounted prices during periods of economic expansion is an exceptional stock selection technique and is beneficial for overall portfolio performance over time. It is in the buying of good companies at discounts with the patience to let other investors recognize the developing returns that is the Hallmark of Value Investors. Holding periods of several years are necessary in this process.

Insiders have provided positive signals with every dip in the SP500 the last 12mos.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more