Inovio Pharmaceuticals Offers Upside Potential With Its Lead Drug

On September 9, Inovio Pharmaceuticals (INO), provided business updates at the H.C. Wainwright 21st Annual Global Investment Conference. Following the favorable updates, the stock has seen quite some interest, and shares rose by more than 19% in subsequent days. In this article, we intend to review its lead candidate, VGX-3100, alone. The drug has successfully met its efficacy endpoints in mid-stage trials and is now investigating in a Phase 3 REVEAL trial. So, we want to dive into the VGX-3100 data to see if Inovio is a great “Buy” candidate at current levels.

Company description

Inovio Pharmaceuticals is a clinical-stage biotechnology company that concentrates on developing DNA-based immunotherapies and vaccines for the treatment of cancers and infectious diseases. The company, based in Plymouth Meeting, Pennsylvania, was founded in 1979 and went public in December 1998. Inovio Pharmaceuticals is led by J. Joseph Kim who joined the company in 2009 from VGX Pharmaceuticals. Currently, the company has a market cap of ~ $200M and trades around $2.3 per share.

VGX-3100 Overview

In our opinion, the most promising medicine in INO’s pipeline is VGX-3100, a DNA-based immunotherapy designed to increase T cell immune responses against the E6 and E7 antigens of Human Papillomavirus (HPV). The drug is being considered for several indications. Accordingly, VGX-3100 is being studied as a treatment for Cervical High Grade Squamous Intraepithelial Lesion (HSIL), Vulvar HSIL, and Anal HSIL.

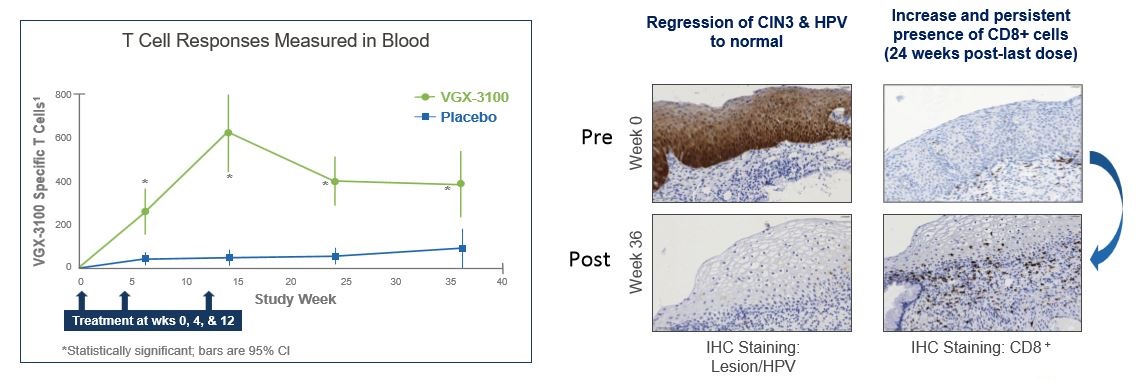

Data from the Phase 2 trial of VGX-3100, which was published in the Lancet Journal in September 2015, demonstrated promising results. As we can see below, the drug met its primary endpoint, showing superb efficacy versus a placebo, with a histologic regression observed in 53 out of 107 (49.5%) women treated with VGX-3100. The results were statistically significant to the placebo arm, with a p-value of 0.017. From the safety standpoint, the drug was generally well-tolerated with no unexpected toxicities.

Source: Corporate Presentation

With these outcomes as a basis, VGX-3100 is being evaluated in the Phase 3 REVEAL trial, which consists of a primary study (REVEAL 1) and confirmatory study (REVEAL 2), that will access both its efficacy and safety and will be a double-blind, randomized 2:1 (VGX-3100 arm:placebo), controlled trial comparing VGX-3100 to a placebo. In the trial, the company utilizes its proprietary DNA delivery device, CELLECTRA, which is designed to deliver optimized DNA into cells with high efficiency and minimal complications.

The initial goal of this trial will be demonstration of statistically significant improvement in:

- Regression of high-grade squamous intraepithelial lesions (HSIL).

- AND clearance of HPV 16/18 in the cervix.

To reach a statistical significance, the study required enrollment of 200 patients in the REVEAL 1 trial and 198 patients in the REVEAL 2 trial. If the results turn out favorable, the company indents for submitting BLA to the FDA for VGX-3100 to treat Cervical Dysplasia by the end of 2021 with potential launch in 2022. In our view, this long-term catalyst will likely have the largest impact on the stock. However, any positive updates on progress concerning their pipeline and platform development programs would also serve as a catalyst, sending the stock price higher. In future articles, we will review other Inovio’s assets, especially dMab Technology, for the prevention and treatment of infectious viruses and cancer.

Financials

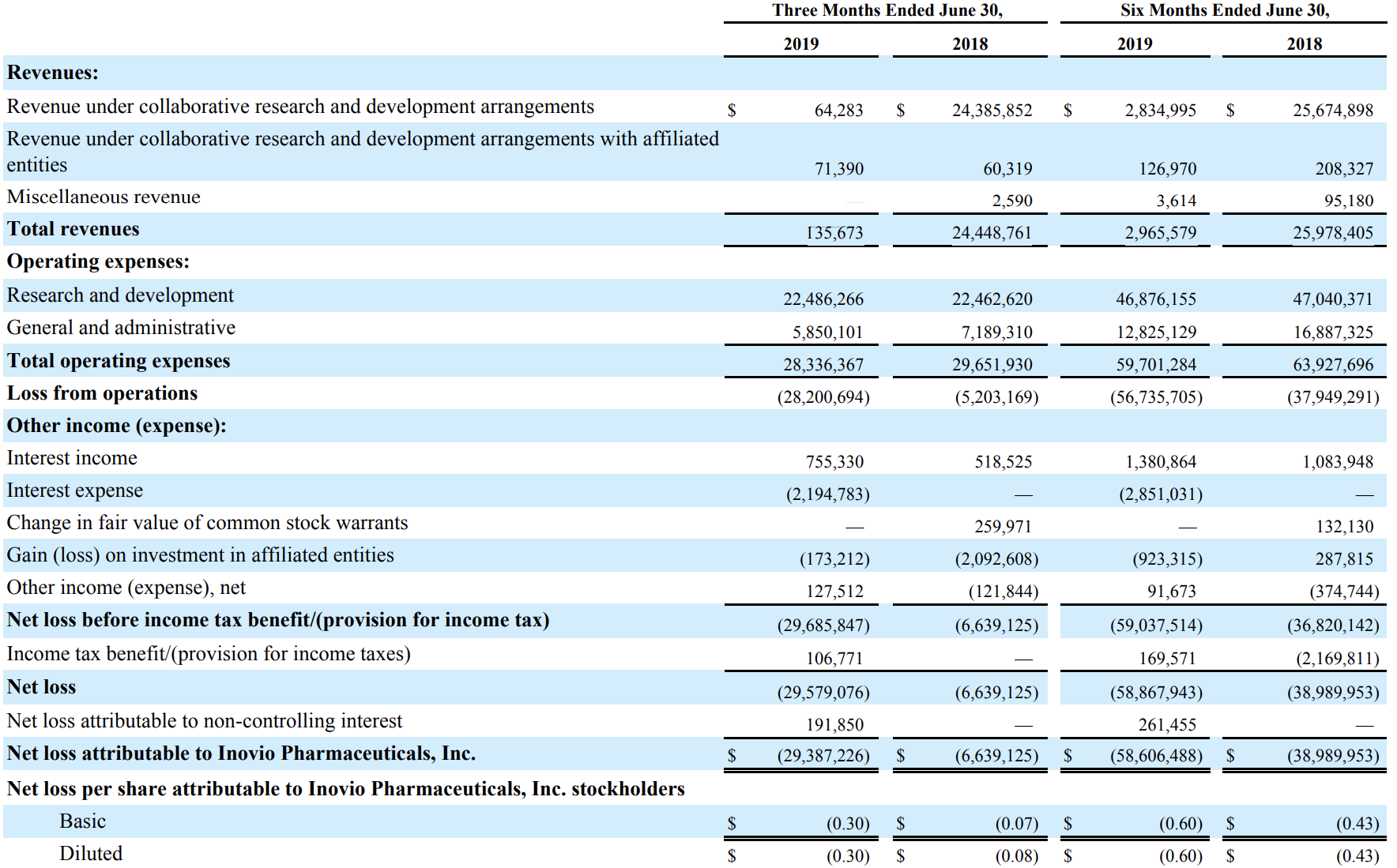

As is typical for a clinical-stage biotechnology company, Inovio Pharmaceuticals is currently bringing in only limited revenues (royalty, collaboration, license revenues) while spending significant amounts on R&D and G&A:

Source: Company’s 10-Q filing (As of June 30, 2019)

In Q2, R&D expenses registered at $22.48M compared to $22.46M for the same period year ago. The 1% year-over-year (YOY) R&D decrease is mainly related to the decrease in R&D pre-clinical expenses. That aside, the general and administrative (G&A) expenses came in 19% lower at $5.8M. The decrease was related to lower employee compensation expenses.

As of June 30, 2019, had total cash of $105.9M and total debt of $86.2M, bringing its total net cash to $20M. Cash used to run the company's operations during the first half of 2019 was roughly $58M. Based on that, we would expect the cash on hand to be sufficient for at least 12 months. Moreover, management also expects that its cash and short-term investments are sufficient to meet planned working capital requirements for at least the next twelve months from the release date of the Q2 results.

Ownership and Analyst Coverage

Institutional ownership is approximately 46.18% of diluted shares. Most of this is BlackRock Fund Advisors, which owns around 7M shares or 7.08%. Next are Wasatch Advisors, Inc., Nikko Asset Management Americas, Inc., Nikko Asset Management Co., Ltd. and The Vanguard Group, Inc. at about 6.80%, 4.93%, 4.93%, and 4.71%, respectively. The rest of the owners hold relatively small stakes. According to CNN Business, approximately 5.56M shares were bought by institutions, and 4.87M shares were sold during the second quarter of 2019.

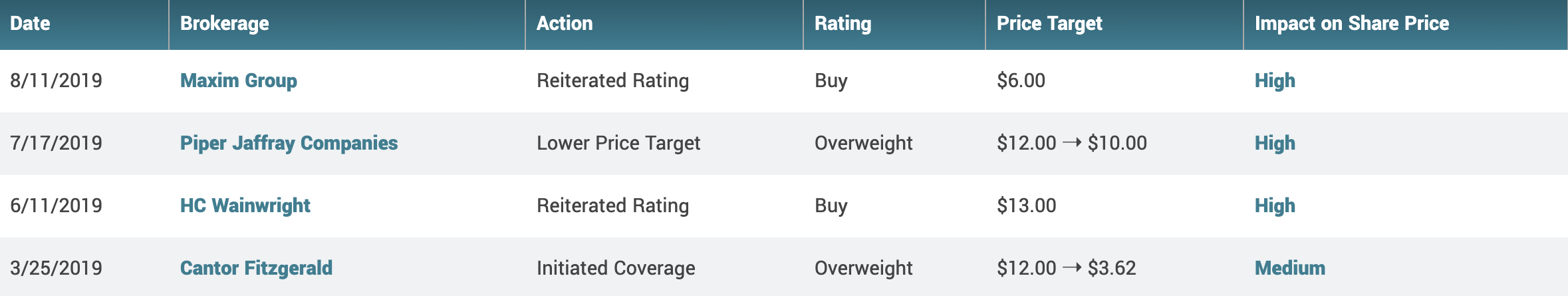

What is more, a few analysts upgraded the company in the last six months, targeting the share price in the $6.00-13.00 range.

Source: Market Beat

Technical analysis

Looking at the daily chart, we can see what is going on with INO. Currently, the stock has held firm at technical support around the price of $2.50. It is also trading 59% off the 52-week high reached in July. To the upside, the $3.00 price level continues to remain the key area to watch. If INO can rise above this level, there is a high probability that the shares will rise to around $4.00. Also, the chart shows that MACD is rising, indicating that bullish momentum entering the stock.

Source: Think or Swim platform

Options analysis

Looking at the November 15, 2019 options, we see a bid/ask for the $3.00 CALL option of $0.10/$0.25, and a bid/ask for the $3.00 PUT option of $0.50/$0.70. Keep in mind that the options strike closest to the previous INO closing price of $2.59. We can calculate the expected price move using the mid prices of these options:

0.60 (3.00 Put) + 0.175 (3.00 Call) = 0.775/2.59 = 29.9%

As seen above, the options imply that the stock could rise or fall by ~30% by the November expirations from the $3.00 strike price using the long straddle strategy. It would place the stock in a trading range of $1.81 to $3.36 by the expiration date. Moreover, the calls at the $3.00 strike price outweigh the put options about 6 to 1 with 639 open calls to 162 open puts. A buyer of the calls would need the stock rise to $3.25 by the expiration date, a gain of about 25.4% from the stock’s current price.

Risks

Investing in clinical-stage biotechnology firms is associated with many risks, including a significant amount of cash required for R&D in the absence of revenues, risks around drug development, and competition from other firms in the biotechnology industry. We think the main risk for Inovio Pharmaceuticals arises from the prospects of VGX-3100: The value of the company as a whole highly depends on the success of its drug. If its lead drug fails to realize its growth prospects, INO’s stock might fall significantly. However, regarding the downside, the company has ~$105.9M of cash on the balance sheet, equivalent to $1.06 per share, with a burn rate of approximately $0.29 per share, per quarter. We would not find it unlikely for the stock to decline below these levels.

Additionally, the company operates in a very competitive space and several companies like Janssen Pharmaceuticals, Merck (MRK), Pfizer (PFE), AstraZeneca (AZN), Novavax (NVAX), and others are developing competing therapies. Finally, there are inherent multiple risks as biotech stocks move out of favor in the market. However, in our case, INO has tracked the SPRD Biotech ETF (XBI) insignificantly over the last year at a correlation coefficient of 0.03.

Recommendation

We believe INO at these levels of $2.6 per share is a “Buy”. Even without upcoming catalysts, we would expect the stock price to be $3.00, assuming a recovery to the technical levels. According to TipRanks, INO is a “Moderate Buy” with an average Price Target (PT) of $9.50, representing a 270% upside.

Thank you for reading. If you liked my article and would like to receive our future articles covering the biotech field, please click the green “Follow” button.

Disclosure: No positions in any stock mentioned

Any updates on $INO?

Good read, but hard to see the images. Can you please fix?