Inflation: Friend Or Foe?

Probably all of us have thought about the rising prices and how much more expensive life has become in contrast to one or two decades before. No, I am not going to rant about how much better everything was back in the day. Today’s topic is inflation. With the current correction that has hit the global stock indices, seemingly every minute, another article is popping up on news pages about why this decline has hit the indices so hard. Most of the articles link the decline to inflation. According to the Bank of America, the word “inflation” was used 800% more in the current quarterly publications in comparison to last year’s quarterly earnings releases – quite inflationary, isn`t it?! But what is behind this term, and what is linked to it? In this article, I want to sketch the fundamentals of inflation broadly. The term describes a lasting increase in the price level of goods and services. This has different causes and the understanding of it is always linked to our own perspective.

In principle, we need to assume that a capitalistic economic order is based on the idea of the free market. This idea posits that the dynamics of demand and supply interact to achieve so-called market equilibrium. Paired with the concept of private property, an intrinsic motivation emerges for each actor within such an economic system to increase monetary means to afford a better standard of living. That means that supply and demand are subject to constant pressure to grow. The supply side, because the producing actors want to sell more, while the demand side needs to grow as consumers want to consume more quantitatively and qualitatively.

Demand-side factors heavily influence the current situation at the capital markets. The leadership of the biggest economy in the world has poured out 3 stimulus payments to its citizens, while the third one alone has had a volume of over $1.3 trillion, which exceeds the GDP of Saudi Arabia, the Netherlands and Indonesia, respectively. Also other countries paid out stimuli to their citizens or plan on doing so in the near future. In general, it is believed that fiscal measures, such as these payments, will not be saved by the citizens but rather spent and, thus, the money re-enters the economy quickly. As a result, the demand for goods and services increases, while the suppliers of these increase the prices – inflation is the result. Because of the increased income, the investment rate increases, too. Whether the investment comes in the form of increased wages, new machines, software, innovation, or other companies does not matter here. The premise is that more money attracts more money.

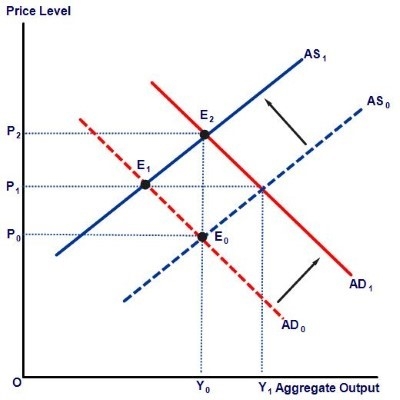

Unfortunately, we are currently in the middle of a global pandemic and the fiscal policies merely try to absorb the negative effects of the pandemic on the economy. This means that the policies only fill holes rather than stimulate growth. Since prices are sticky and only adapt slowly (even more so on the downside), the measures come in when prices remain the same. Thus, the monetary expansion falls flat and the prices increase, just as the uncertainty about the future value of our money. In the figure below, we can see that the so-called “demand-pull” inflation. Here, the starting point is E0. The fiscal policies increase the demand (AD0 -> AD1). Ideally, this creates economic growth and the GDP increases from Y0 to Y1. The supply (AS0) needs to remain stable, however.

The problem is that many companies needed to restructure their businesses and these changes were, in part, quite fundamental. Changes of such a large scale within such a short period of time consume massive monetary means. The additional help from governments only cover a small part of those changes and often not even the incurred losses. Additionally, the political elites of the USA continues to press for higher taxation of companies, which would increase the burden on companies. AS0 becomes AS1 and leads to higher prices without moving us away from Y0 in the end.

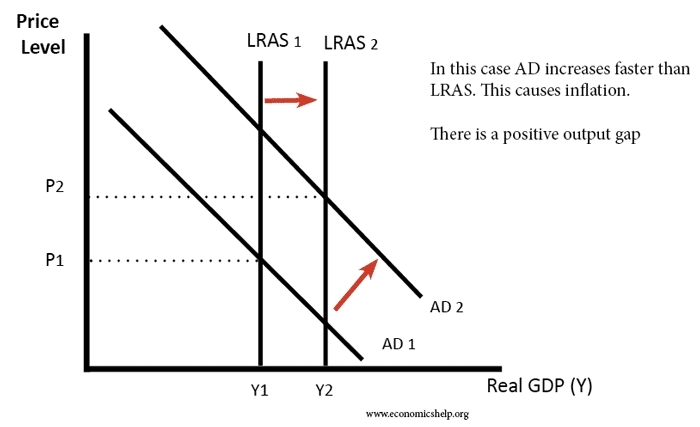

In the next graph, there is an example of healthy inflation. Here, we can see that the long-term aggregate supply increases (LRAS1 -> LRAS2). This does not simply happen by itself. Through technological advances, innovations, better economic circumstances, and external factors, the total economic potential is increased. As an example, we could think of a sudden increase of immigrants who increase the human capital of an economy. Likewise, we can think about the emergence of the internet, which heavily increased the economic output globally.

Thus, whether inflation is our friend or foe is strongly influenced by the overall situation and our own perspective. Regarding the growth and technology stocks, which incurred heavy losses over the last couple of days, there are fears of future value decline, as the expansive monetary policy does little to foster growth while reducing monetary value through inflation. Therefore, instead of progressive growth, the capital markets turn towards a more status quo solution to bridge the current low by turning towards more cyclical assets. What is clear, however, is that the sustainable value increase will always be the single most important aspect of the stock market in the long run.