Individual Investor Sentiment Has Not Capitulated

Preamble

The world needs dollars, and the Fed is creating them. Stocks have no business being up here. They are here because the stock market is not the economy, and even though the economy is the scaffolding for the market, and eventually the stock market lines-up with the economic scaffolding, emotion often takes the stock market for a joy-ride, or a hell-ride.

The positive sentiment goosing the market higher is coming from two sources: the belief that all those dollars that the Fed is creating will come to the market for yield, and even more optimistically that the Fed at some point will buy the stock market. That latter optimism was reinforced on Thursday when the Fed said it was buying junk and high-yield bond ETFs.

In fact, there is a third source of optimism. With the disappearance of small business, comes a lack of diversity; what is left is a small number of large corporations. These few, larger entities that survived, can now easily and cheaply grab market share by expanding to fill the niches that were de-populated by the pandemic; McDonald's has its pick of new possible locations to expand into now that almost every restaurant has disappeared. Since technology companies, for the most part, have not been affected as badly as other sectors--fewer job losses, since working from home was easy. This may, at least partially, explain the under-performance of the tech sector during this rally; few tech niches were de-populated, therefore, few new opportunities for expansion. The diversity remains intact.

The truth on the ground, however, expresses a completely different sentiment and reality. 80% of small businesses are no longer fully participating in the economy, and small business accounts for 48% of employment. That implies a loss of 50 million jobs (assuming 155 mil jobs in total). The economy certainly isn't the stock market.

However, you do not want to stand in the way of the Fed with an infinite amount of funding...at least in the short-term. We are comfortable with our positioning; we know the market WILL go back up, but it is likely to fall first, so we remain mostly long (~75%), with some shorts and cash (~25%) in the likely case we take a trip south first.

Sentiment

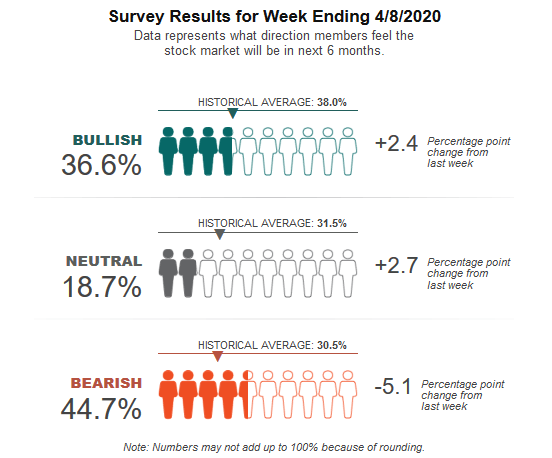

The AAII independent investor survey, again this week, registered an increase in bull sentiment, and an even bigger decrease in bear sentiment (table below).

(Click on image to enlarge)

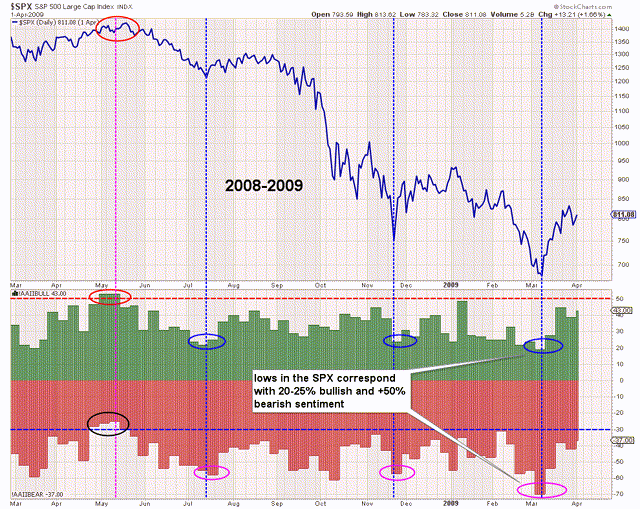

During the GFC, lows in the SPX corresponded with 20-25% bullish and greater than 50% bearish sentiment, and the final capitulation-low formed with 20% bullish and 70% bearish sentiment (chart below).

(Click on image to enlarge)

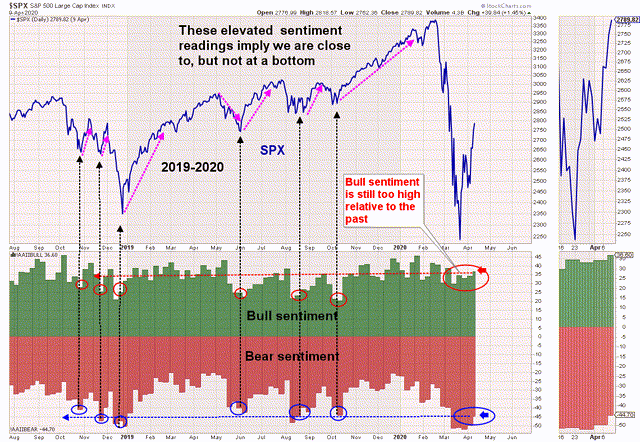

The elevated bull sentiment implies that, despite being close to a bottom, we have yet to see independent investors capitulate (chart below).

(Click on image to enlarge)

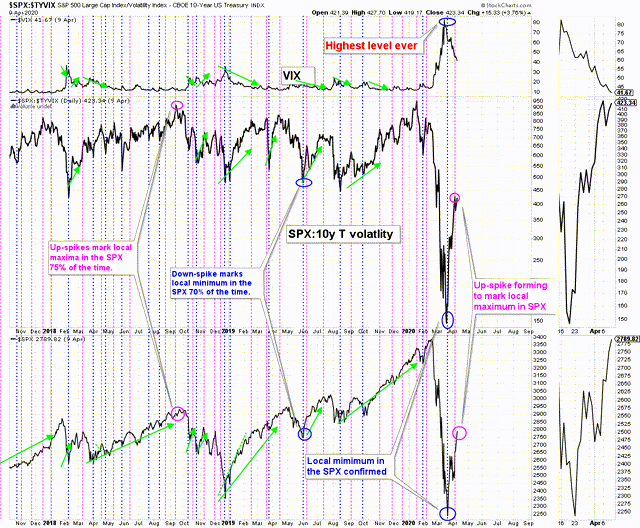

The SPX:10y Treasury volatility ratio is forming an up-spike which correlates with local maxima in the SPX (chart below).

(Click on image to enlarge)

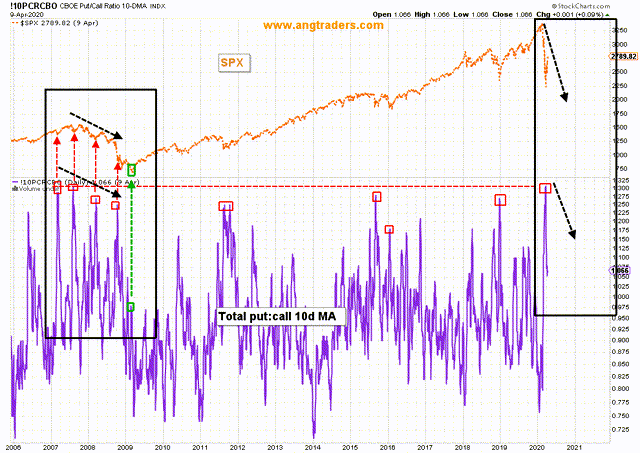

The 10-day MA of the total put:call ratio has spiked to a level not seen since the 2008 decline. During the 2008 decline, the p:c 10-day MA made a series of lower peaks as the SPX made lower-lows. Lower-lows remain a possibility in both the ratio and the SPX (chart below).

(Click on image to enlarge)

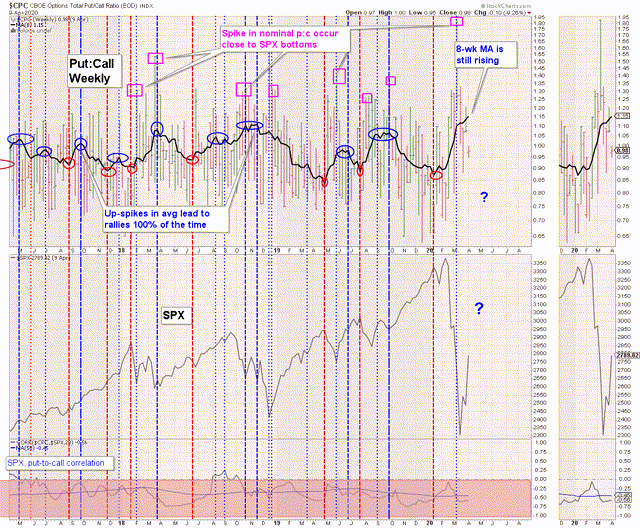

Up-spikes in the 8-week MA of the weekly put:call ratio, correspond to rallies (sometimes, only short ones) in the SPX 100% of the time. This average is still rising, which means the recent rally is likely not sustainable (chart below).

(Click on image to enlarge)

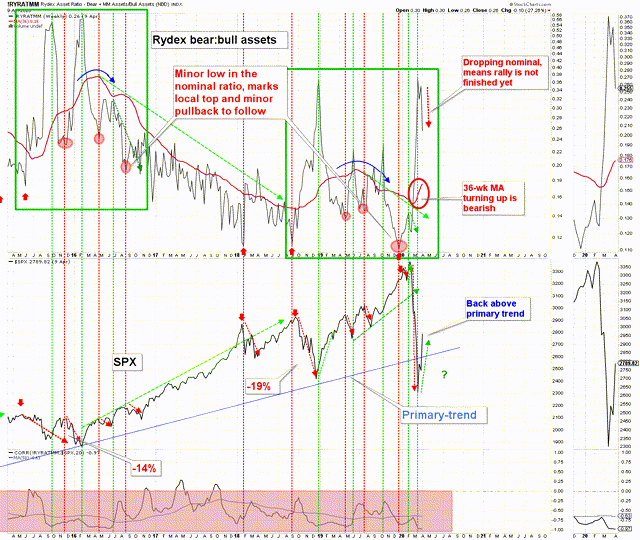

The nominal bear:bull ratio of the Rydex asset allocation is dropping, which means that the recent rally is likely not over just yet. The 36-week MA, however, continues to move higher, indicating a bearish medium-term outlook (chart below).

(Click on image to enlarge)

In summary: The independent investors have not capitulated and are still too bullish. Short-term, the recent rally could go further, but medium-term, it is unlikely to be sustained.