Indices Looking To Challenge Monday's Lows

Monday's buying should have followed with gaps higher and the start of a recovery rally. Instead, we had no gap, a tentative bounce, and now a move into the spike lows of Monday - rarely a good sign for bulls.

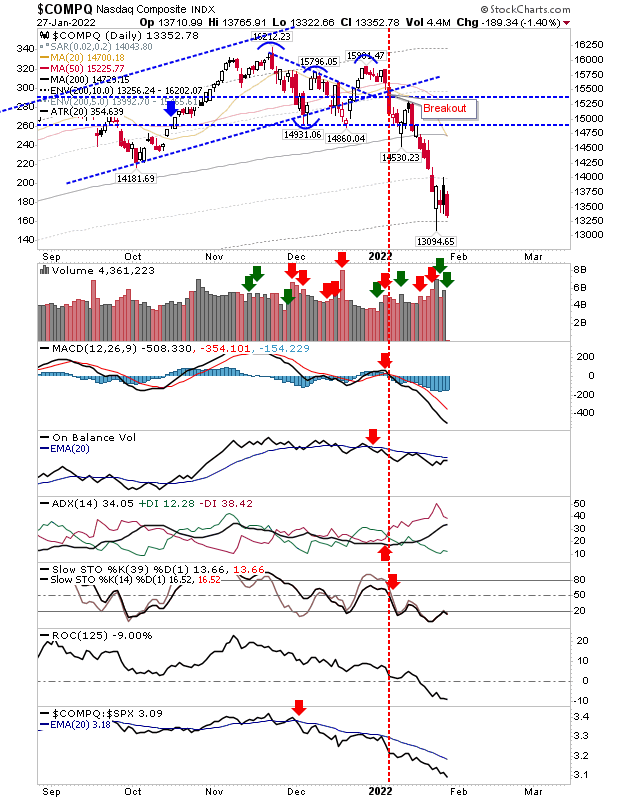

The Nasdaq is easing back to its 200-day MA for a second test in less than a week. A second test over such a short period is rarely a good thing and despite registered accumulation, it's hard to see how accelerating technical weakness could deliver a bounce now.

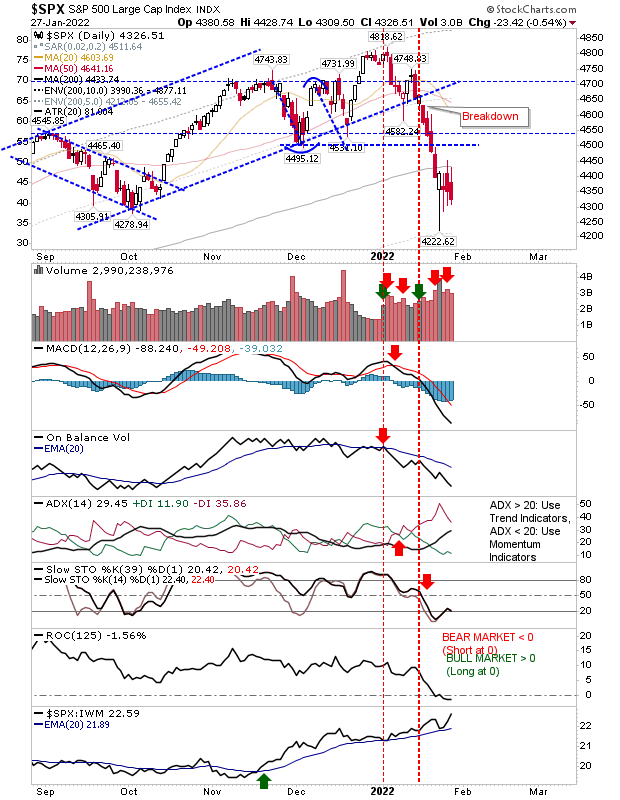

The S&P is suffering like the Nasdaq, except its struggling below the 200-day MA. The last couple of days of trading have seen upper spikes into the 200-day MA that have left traders struggling to confirm this key moving average as support. Technicals are net bearish but the index has been outperforming both the Nasdaq and Russell 2000 since November, and if there is an index to recover its losses its the S&P.The problem is that the candlesticks of the last couple of days favor a move lower and likely an undercut of 4,222.

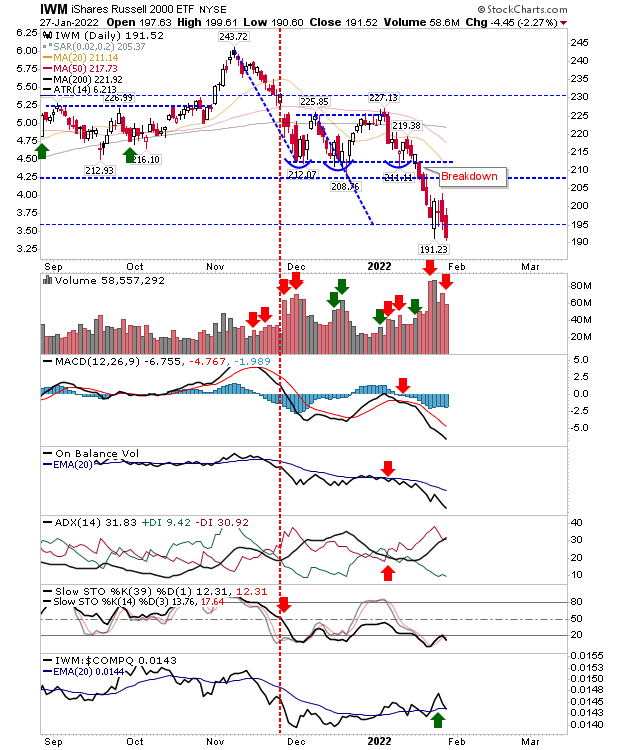

The Russell 2000 has started to move beyond its measured move target, albeit on light volume. Of the lead indices, it's the first to challenge Monday's lows, and given today's finish it's not looking like the latter level will hold as support. Expect this weakness to spread to the Nasdaq and S&P.

The week is finishing softly with a likely move to break below Monday's lows. Such breaks may not occur until next week, but there could be a bit of a struggle to find next support.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more