In "Stunning Decision" Bayer Shareholders Dump CEO Over Disastrous Monsanto Purchase

Bayer, also known as IG Farben back in the day, survived World War II (which it helped fund for Hitler's war effort while recruiting a an army of slave workers), but it may not survive the worst acquisition in its history: the disastrous $63 billion purchase of Monsanto in 2018, which also brought over the infamous carcinogenic weed-killer Roundup, and with it countless lawsuits and legal charges.

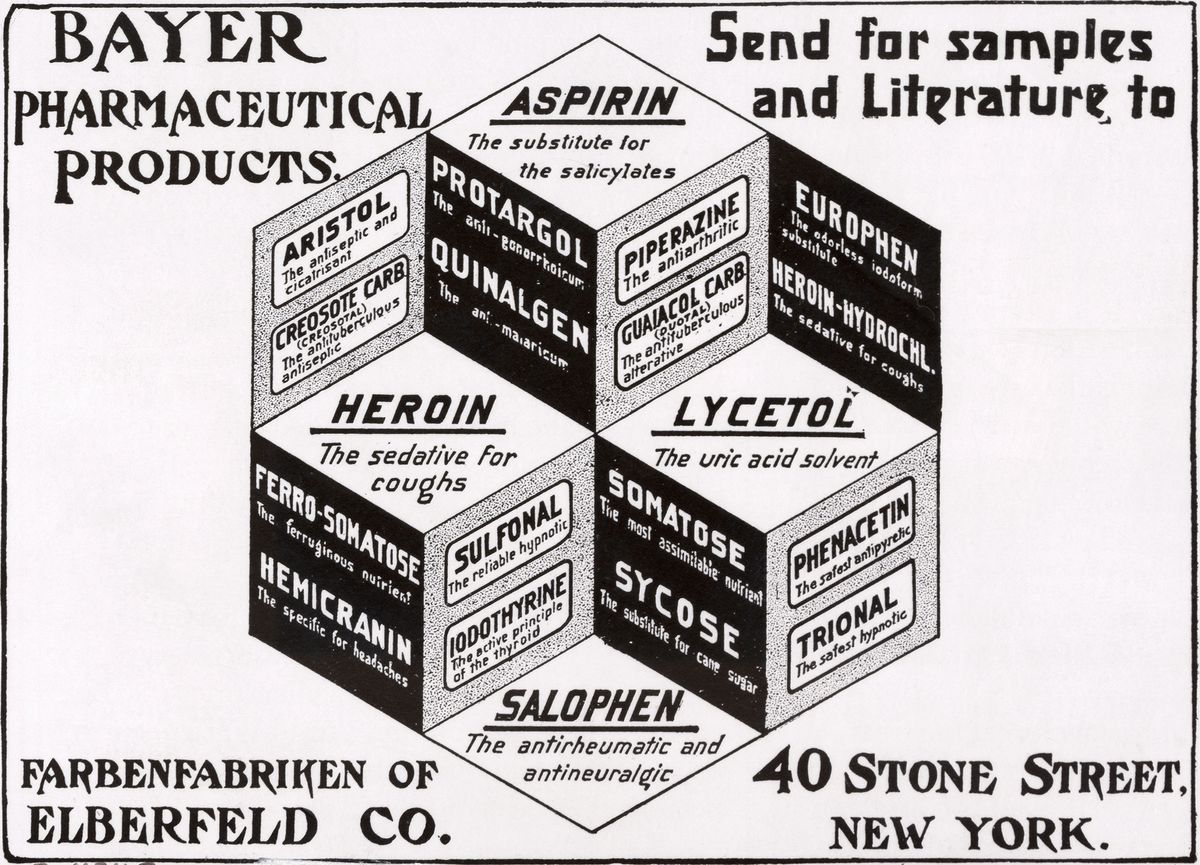

And while the future of the iconic company which brought "cough medicine" Heroin to the world remains in question, as it is slowly been buried under an avalanche of lawsuits emerging from Monsanto's legacy misdeeds which have slammed its stock to seven-year lows ... that of its CEO appears to be now sealed.

Late on Friday, in what Bloomberg called a "stunning development" for the German drugs and chemicals company, a majority, or about 55% of shareholders, voted against absolving CEO Werner Baumann and other managers of responsibility for their actions in the Monsanto takeover last year. Though the result isn’t legally binding, it throws his future into question and prompted an immediate supervisory board session. Similar rejections have cost German CEOs their jobs.

“Mr. Baumann, what have you done with our stable company?,” said Joachim Kregel, a representative of German shareholders association SdK. In just two years, “the erstwhile pharma giant has mutated into a dwarf,” said Ingo Speich, chief of sustainability and corporate governance at Deka Investment.

Bayer Chairman Werner Wenning said the board is taking the vote “very seriously” and would “do everything to win back the trust of shareholders as quickly and completely as possible” adding that "we regret this exceedingly."

"Nevertheless, the voting results show that the stockholders’ meeting wanted to send a clear signal."

The vote, which took place at around 10 p.m. local time, capped a tumultuous meeting in Bonn, with investors berating Baumann, arguing with Wenning and demanding explanations for the erasure of some 35 billion euros ($39 billion) in market value since the deal. At the heart of the debate was whether Baumann, Wenning and other leaders properly assessed the legal risks of Roundup, the controversial weedkiller it acquired together with Monsanto, according to Bloomberg.

“The loss of a nonbinding confidence vote at Bayer’s annual meeting may hasten management changes and the eventual logical split of Crop Chemicals and Pharmaceuticals into separate companies,” said Bloomberg Intelligence’s Christopher Perrella.

The outcome of the vote was historic because before the ballot, Bayer said a majority of shareholders opting not to endorse its managers’ actions at such a meeting hasn’t happened "possibly for its entire history." Former Deutsche Bank AG co-CEO Anshu Jain stepped down in 2015 after a 61 percent approval vote from investors. In a separate motion, some 66% voted to clear Wenning and the rest of the supervisory board.

As a reminder, Bayer's headaches started last summer, shortly after Bayer completed the Monsanto takeover last June after years of wrangling with antitrust regulators. Then in August, a California jury found that glyphosate, the main ingredient in Roundup, caused a school groundskeeper’s cancer. Lawsuits have multiplied since then, totaling 13,400 U.S. cases by April 11. Bayer has vowed to fight in court and says there’s no scientific proof that glyphosate causes cancer.

In the meantime, Bayer's stock has tumbled about 40% from its mid-2018 level of about €100/share.

Earlier, Wenning and his protege Baumann sought to reassure stockholders even as hundreds of protesters outside erected the CEO’s effigy from bales of hay and shouted “shame on you.” Inside, investors demanded explanations, with one likening the company to “a pile of broken glass.”

“The supervisory board is convinced that the strategy of management, including the takeover of Monsanto, was the right path,” Wenning said. “We have the fullest trust that Bayer under the leadership of Mr. Baumann will be very successful.”

All that appeared to change just hours later following the shocking outcome of the shareholder vote. Moments after the vote to effectively remove Baumann, Bayer's supervisory board called an emergency meeting on Friday, whose outcome has yet to be determined but will likely cost the CEO his job.