In My Opinion, The Value Of The Fail To Redeem Clause Is Greatly Overstated Part II

<< Read More: In My Opinion, The Value Of The Fail To Redeem Clause Is Greatly Overstated - Part I

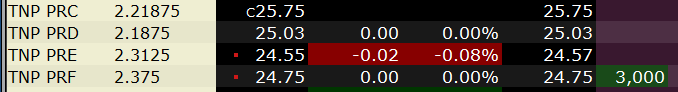

Revisit my Initial FTR article and now witness the continuing stupidity of many in the investment community. The following is a screenshot of a slice of my Interactive Brokers' trading platform, which I populated with preferred equities I watch and might consider an investment in:

To explain: The first column to the right of the stock symbols are the yearly dividends each preferred pays; the next column contains the latest price of each; the following 2 columns are concerned with the daily price movement; the next, the closing prices from the last trading day; and finally, in green, how many shares I hold of TNP-F.

As a side note and of no consequence for this article, I arbitraged for them when they were first issued, trading in the (as best as I can recall without researching it) D's I held at the time for the enhanced dividend yield of the F, which I have now held for several years.

However, the point of this article is to again enlighten my reader as to the stupidity of the investor who is willing to either hold or buy TNP-C, which contains the FTR clause that must be redeemed 10/30/20. At its current price, its owner will lose 0.75/share when it's called at $25. Granted he will collect 2.21875 in dividends, but by subtracting the 0.75 loss his profit will be reduced to 1.46875. The price of the TNP-C shares should never have reached this high level this late in the game. The holder of these shares is foolish, and any buyer at this time is a damned fool.

The smart investor should sell his shares and hope to earn the current $25.75 price per share and buy an equal number of the F shares at their current price $25.75. If he can accomplish this, he will have earned an increased yield while putting some cash in his pocket. Better yet, his shares will not be called and he will continue to reap those sweet dividends.

Now I know the argument of the lovers of the FTR clause: safety. Nonsense, as I have explained before, should the company fail to redeem the C-shares as dictated by the clause, all the various preferred shares will take the hit, including the C's that were NOT redeemed. Furthermore, why invest in a company you have little faith in?

I rest my case.

Disclosure: I hold TNP-F.

You made your case quite well.

Thanks, Sue.