IBM: Warren Buffett Is Holding On Despite The 5% Decline (And You Should Too)

Shares of International Business Machines (IBM) fell 5% on Wednesday, April 19, after the company posted a disappointing first-quarter earnings report.

Legendary investor Warren Buffett took a big hit from IBM’s decline. His investment conglomerate Berkshire Hathaway (BRK-B) is IBM’s largest shareholder.

At the end of 2016, Berkshire held 81.2 million shares of IBM, good for 8.5% of the company’s share count. Berkshire’s investment is worth approximately $13 billion. IBM is one of Buffett’s highest yielding holdings. After the 5% decline, Berkshire’s investment in IBM lost roughly $800 million in value.

IBM is a high-quality dividend stock. It is a Dividend Achiever, a group of 265 stocks with 10+ years of consecutive dividend increases. You can see the full Dividend Achievers List here. With four more years of dividend increases, IBM will join the ranks of the Dividend Aristocrats, a group of companies in the S&P 500 that have raised dividends for 25+ years.

Despite the one-day drubbing, Buffett likely has no intention to sell IBM—and neither should you.

Business Overview

IBM’s recent stock price decline stems from its first-quarter report. IBM reported adjusted earnings-per-share of $2.38, on $18.16 billion of revenue. Adjusted earnings-per-share beat expectations of $2.35, but revenue fell short by about $230 million. On a year-over-year basis, first quarter revenue declined 3%, while adjusted earnings-per-share increased 1%.

Cost discipline helped the company exceed earnings-per-share estimates. But investors seem to be focused on IBM’s revenue. Not only did it miss estimates, this past quarter represented the 20th in a row of declining revenue for the company.

IBM’s turnaround is fueled by growth in what the company calls its “strategic imperatives”. These include big data, security, mobile, analytics, and the cloud. IBM believes there is a huge market opportunity across these areas.

Source: March 2017 Investor Briefing, page 4

IBM’s headline results look weak, as the company still has large businesses in slow-growth segments. But underneath the surface, it is making significant progress. The strategic imperatives collectively generated $7.8 billion of revenue in the first quarter, up 12% from the same quarter last year. In the trailing 12-month period, strategic imperative revenue reached $33.6 billion.

The cloud is particularly attractive—cloud revenue reached $14.6 billion in the past 12 months, driven by 59% growth in cloud-as-a-service.

Other areas of strength in the first quarter include:

- Analytics: Up 6%

- Mobile: Up 20%

- Security: Up 9%

Among its various operating segments, IBM’s best performer last quarter was Cognitive Solutions. Revenue in this segment increased 3% for the quarter, thanks largely to Watson-based products and services.

The worst-performing segment was Systems, which should not be surprising since this includes the company’s hardware unit. Revenue in this segment declined 17% for the quarter, but it is gradually becoming a smaller piece of the company over time.

Growth Prospects

IBM is in transition. At the start of the decade, IBM had several businesses that were low-growth, many of which were not profitable. These represented areas of old technology, such as semiconductor manufacturing. IBM realized in order to keep up with changing trends, it would have to adapt. It divested several of its low-growth businesses.

In response, IBM steered investment toward areas that will lead the company’s future growth.

Source: March 2017 Investor Briefing, page 2

The strategic imperatives are gradually becoming a larger part of the overall company. Last year, IBM’s strategic imperatives represented 41% of the company’s total revenue.

Even though revenue is declining, IBM’s free cash flow is expected to remain steady from the previous year. This is because IBM’s areas of investment have much higher margins than the businesses it has exited.

For example, pre-tax profit margin in the Cognitive Solutions business was 21.8% in the first quarter. By contrast, pre-tax profit margin in the Systems business was -0.5%. IBM generated $1.89 billion of Systems revenue last quarter, but reported an operating loss of $10 million in that business.

If IBM returns to revenue growth over the next year, the stock has the potential to generate strong returns. The dividend will be a significant contributor to IBM’s returns, as will the company’s earnings growth. And, there is significant potential for expansion of the valuation multiple.

Dividend Analysis

IBM is an attractive stock on valuation and dividends. The stock trades for a price-to-earnings ratio of 11 on a forward basis.

There is a reason why the stock is cheap, which is its continued revenue declines. But, sentiment could change—IBM’s declines are moderating, and excluding non-recurring impacts like currency fluctuations and divestitures, revenue declined just 2% last quarter.

As investors become more confident in the company’s turnaround, its valuation multiple could expand. For example, a forward price-to-earnings ratio of 15 would represent a roughly 36% gain.

An expanding valuation could provide a significant return, as will IBM’s dividend.

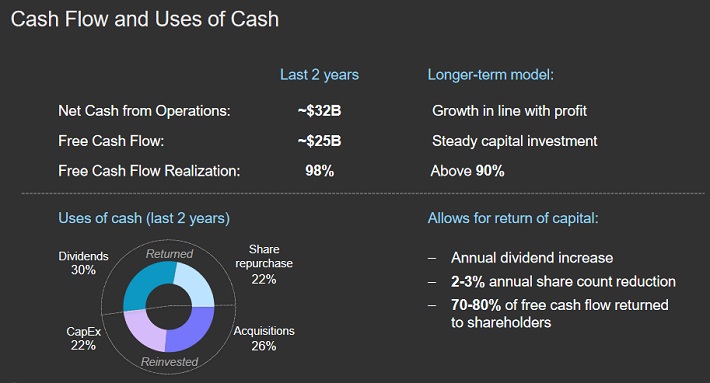

Even though IBM’s revenue is declining, the company still generates healthy cash flows. For example, IBM had free cash flow of $25 billion in 2014-2015.

Source: March 2017 Investor Briefing, page 23

Such a large amount of cash flow allows IBM to return sizable amounts of cash to shareholders, while continuing to invest in the business.

Going forward, the company plans to repurchase its own stock, at a rate of 2%-3% per year. This will provide a big boost to earnings-per-share, by reducing the number of shares outstanding. And, IBM has increased its dividend for 21 years in a row, including an 8% raise last year. IBM typically increases its dividend in May each year, which means another hike is right around the corner.

Investors should expect a high-single digit dividend raise this year, in-line with the company’s recent increases.

IBM stock has a 3.5% current dividend yield, which is well above the 2% average dividend yield in the S&P 500.

Final Thoughts

The investment case for IBM is straightforward. It is a blue-chip company with a world-class talent base and a leadership position in its industry.

The company is engaged in a significant turnaround. While it has taken longer than many investors would prefer, the turnaround remains intact. And, investors are paid well to wait for the turnaround, with IBM’s solid yield and regular dividend growth. None of this has changed from Wednesday’s report.

Investors looking for a quick buck should probably not invest in IBM—it is much more of the slow and steady variety. But these kinds of stocks are exactly the type that made Warren Buffett rich, and over time, investors are likely to earn strong returns from IBM stock.

more