IBM Reports Lowest Revenue This Century And Grotesque EPS Fudge; Pulls Guidance But Keeps Dividend

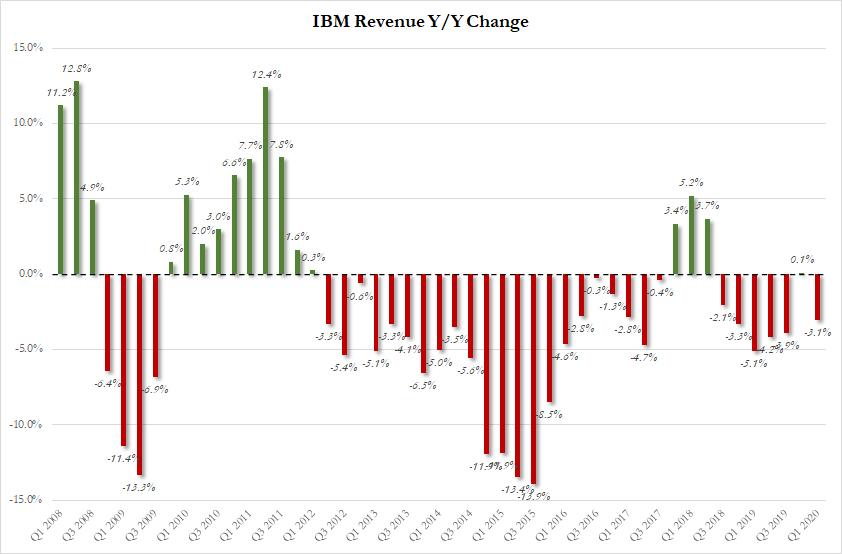

There was some hope last quarter that IBM was finally turning things around: after all, after 5 consecutive quarters of declining revenues, the company had just managed to grow its top-line for the first time since Q2 2018, and only for the 4th time in the past 8 years. Alas it was not meant to be, and moments ago IBM revealed that revenue once again declined in the first quarter, down 3.1%, amid the spread of COVID-19, even as Red Hat sales boosted its cloud business.

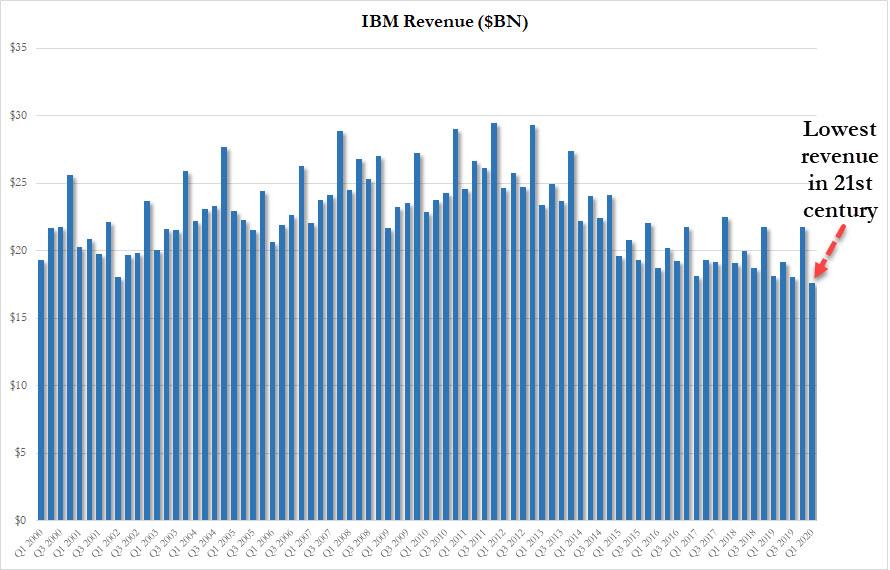

Then again "boosted" may be using the term loosely: at $17.6BN in total revenue, and missing consensus expectations of a $17.7BN print, IBM's Q1 2020 was its worst quarter for sales this century.

Some more details:

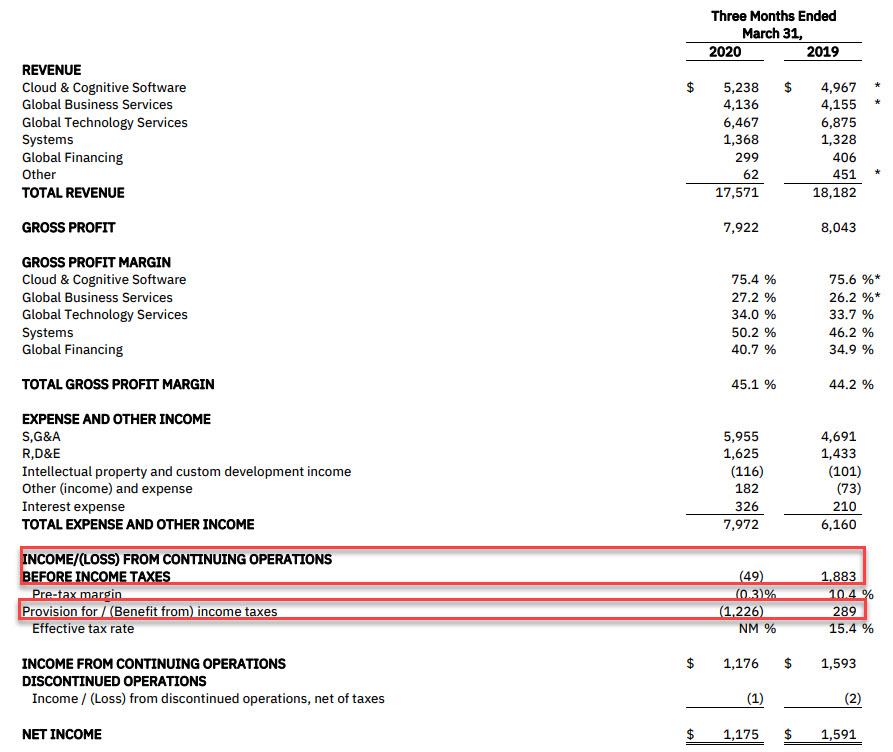

- Cloud and cognitive software sales, which includes the recently acquired Red Hat, came in at $5.24 billion, which while 5% higher from $5BN a year ago, missed analysts estimates of $5.3 billion.

- Systems revenue, which includes mainframes, was $1.37 billion also missing the $1.42 billion consensus .

- Global technology services revenue, which represents about 37% of IBM’s total revenue, continued to decline, and the technology consulting unit had sales of $6.47 billion, down 5.9% from the same period last year, and completing the revenue miss trifecta (Exp. $6.51 billion)

- Global business services revenue was the only beat, coming in at $4.14 billion and above the $3.91 billion forecast.

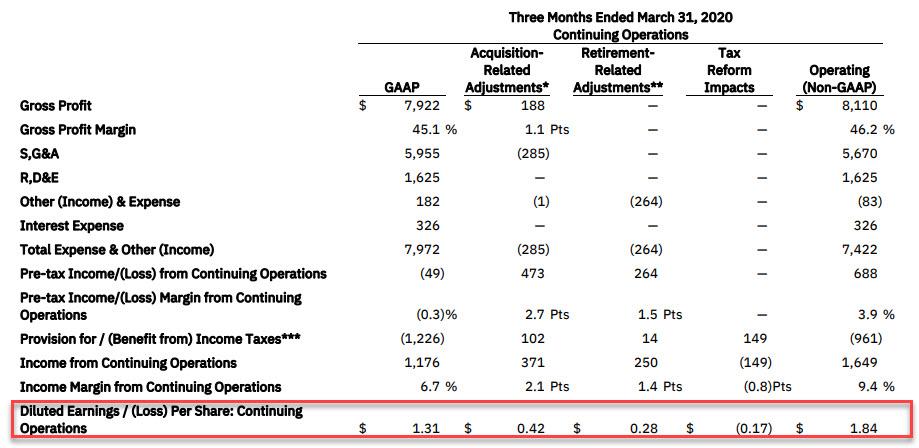

Hilariously, even with revenue missing and sliding, and the world around it burning, IBM still felt compelled to "beat" sellside EPS estimates which were $1.80, reporting $1.84 in adjusted EPS (down from $2.25 a year ago).

As usual, this number was total garbage for two reasons:

- First, the unadjusted EPS was $1.31, or 40% below the adjusted number. The GAAP to non-GAAP bridge was, as usual, absolutely ridiculous and a continuation of an "one-time, non-recurring" addback trend that started so many years ago we can't even remember when, but one thing is certain: none of IBM's multiple-time, recurring charges are either one-time, or non-recurring.

- Second, and as has become an IBM habit in recent years, the company's entire net income was thanks to a tax benefit, because whereas per-tax net "income" was a loss of $49MM, the company added a $1.2BN benefit from taxes to get an after tax "Net Income" number of $1.175BN. The fudge was so grotesque, IBM was even embarrassed to point out what the effective tax rate was and simply said "Not Meaningful", when it clearly is meaningful for anyone who believes foolishly that the company beat earnings.

Of course, none of this matters as the only thing investors care about is the company's future in a post-corona world, and here IBM had absolutely no clarity as it pulled its profit forecast for the year, signaling that the Covid-19 pandemic has become another hurdle for the company in its transition to cloud computing.

IBM is withdrawing its full-year 2020 guidance in light of the current COVID-19 crisis. The company will reassess this position based on the clarity of the macroeconomic recovery at the end of the second quarter.

As Bloomberg adds, IBM's new CEO Arvind Krishna, who took the reins from Ginni Rometty earlier this month, has the challenge of leading the 108-year-old tech giant through the economic shocks stemming from the coronavirus.

Many organizations have delayed major information technology purchases to avoid projects that are expensive, complex and sometimes disruptive to existing business processes. Even before the coronavirus emerged, IBM had struggled to increase sales on a consistent basis.

IBM has been trying to boost its share of revenue from hybrid-cloud software and services including those of IBM rivals Amazon and Microsoft, even as it aggressively keeps growing its quantum computing practice in hopes of becoming the first company to have a comprehensive quantum computing platform. In 2018 IBM bought RedHat for a massively overvalued $34 billion (the price represented more than 30x EBITDA) to boost this effort.

“IBM remains focused on helping our clients adapt to the immediate challenges of the Covid-19 pandemic, while we continue to enable them to shift their mission-critical workloads to hybrid cloud and expand their use of AI to help transform their operations,” Krishna said in the statement.

And while IBM has no idea what the future holds, it was confident enough that no matter what happens it will keep handing every penny it makes to its shareholders, as was the case in Q1, when IBM’s free cash flow was $1.4 billion. That's also how much the returned to shareholders in the form of dividends.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more