I Can't Trust This Rally

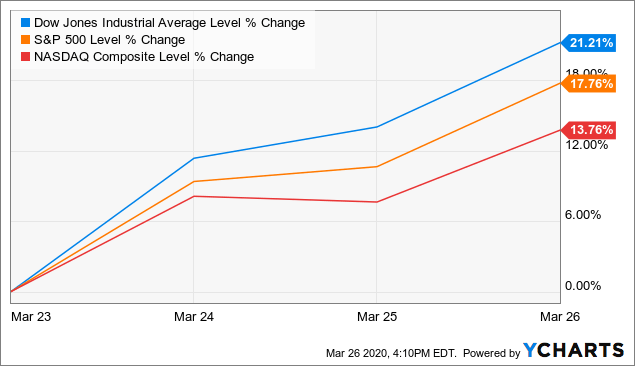

Markets rallied boldly this week, the Dow posting even a mini-bull-market just these past few days since almost falling below 18,000, even as it seems the global fight against coronavirus has only steepened in its ferocity. Optimists may say that the market has already priced in the possible outcomes of the pandemic and maybe even too much so, bolstered in that view most recently by Thursday's soaring rally in the wake of news that weekly U.S. new unemployment claims reached 3.28 million, almost double expectations of 1.5 million and multiples ahead of the prior record of 695,000 in 1982.

(Click on image to enlarge)

Data by YCharts

It is difficult to have any certainty about any but the most cash-rich, defensive companies in these extraordinary times. Even the most careful predictions of the fallout from this coronavirus fight are inaccurate and wild at best as we saw Wednesday evening when Singapore reported a -10.6% annualized GDP contraction as compared to roughly -4.4% expected.

With the few, immediate economic numbers we have already appearing worse than predicted it is difficult I believe to argue that markets have already correctly predicted the true earnings, market, and broader turmoil likely let alone possible from the coronavirus pandemic. Just like how the Dow was still trying to pass 30,000 at the same time it was clear coronavirus was spreading to multiple nations at astonishing, and devastating, speed, it appears now there may be froth again as the understanding of the potential financial contagion is lost to day-trading.

Downgrades For You, Downgrades For Everyone!

We are nearing earnings season and already we see every day that not only does nearly is every sell-side equity rating a downgrade but, shockingly, even S&P 500 titans - Ford, Delta, etc. - are having their credit downgraded by the rating agencies not just a rung or two but to junk. As the financial situation is more clearly revealed for many companies, for example as The Cheesecake Factory said on Wednesday night it wouldn't be able to pay its April rent on any of its roughly 300 stores, and potentially worsens as the cycle of spending and credit shrinks many more companies may soon face even further credit downgrades too.

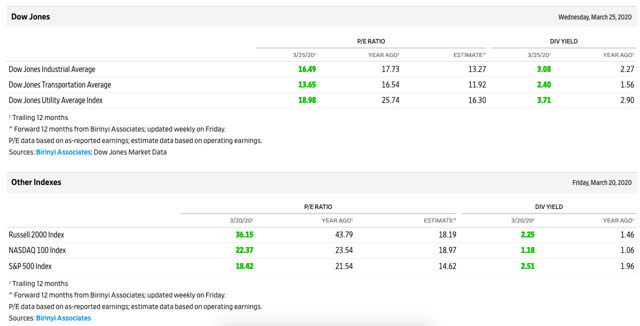

In many ways right now the market does look attractive. The S&P 500's P/E ratio, even after some of the rallies this week, is still well-below much of its recent history and touching its historical lows in all except for times when there was a recession, depression, and expectations for a long-one at that.

(Click on image to enlarge)

(Source: The Wall Street Journal)

Even with this week's rallies so far markets are still well below their historical highs just barely over a month ago. As the grossly inaccurate and big-range guesses on recent financial and economic data have shown it is hard to predict whether the decline is too much, too little, or just right in expectation of the downturn companies are facing right now.

Unlike 2008 This Is Not Just A Financial Crisis

Yet I believe a reason why the uncertainty is more than just a coin-flip but leans towards hedging towards still some more downside to come is that the coronavirus fight in the United States and dozens of other countries is now seemingly only intensifying. Dr. Schuchat, CDC Principal Deputy Director, in an interview with The Hill on Thursday, said that the hospital overcrowding and draconian total lockdowns in the Greater New York area right now may in a few weeks be replicated in increasingly numerous across the country.

We have only seen the beginning of the coronavirus fight. In 2008 the implosion, even as just a financial crisis, still took months to wreak its havoc, for the dominoes to fall across industries, and for the market to bottom let alone find a sturdy growth footing again. Here we are facing a public health crisis that hasn't even been solved yet and barely truly begun - how long it lasts and the companies it tears apart on the way still remains to be seen.

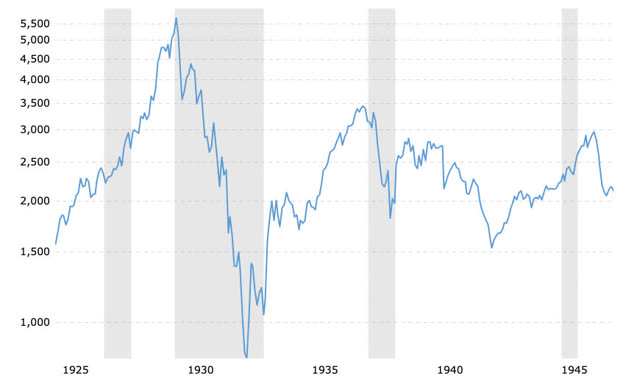

This week was one of new records in an already-record setting month and, unlike the past month, positive achievements. The Dow posted its biggest one-day gain since 1933, posted its first back-to-back day of gains since February, and its strongest 3-day gain since 1931 in the midst of the Great Depression. Yet before you let those records make you think that all is well for the market from now on, let alone for the economy, let me leave you with this chart of the Dow from the 1930s and the difficult, futile struggle it still often had:

(Click on image to enlarge)

(Source: MacroTrends)

Disclaimer: These are only my opinions and do not constitute investment advice.