How We Saw CrowdStrike Stock, And What To Expect In The Coming Months

CrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services.

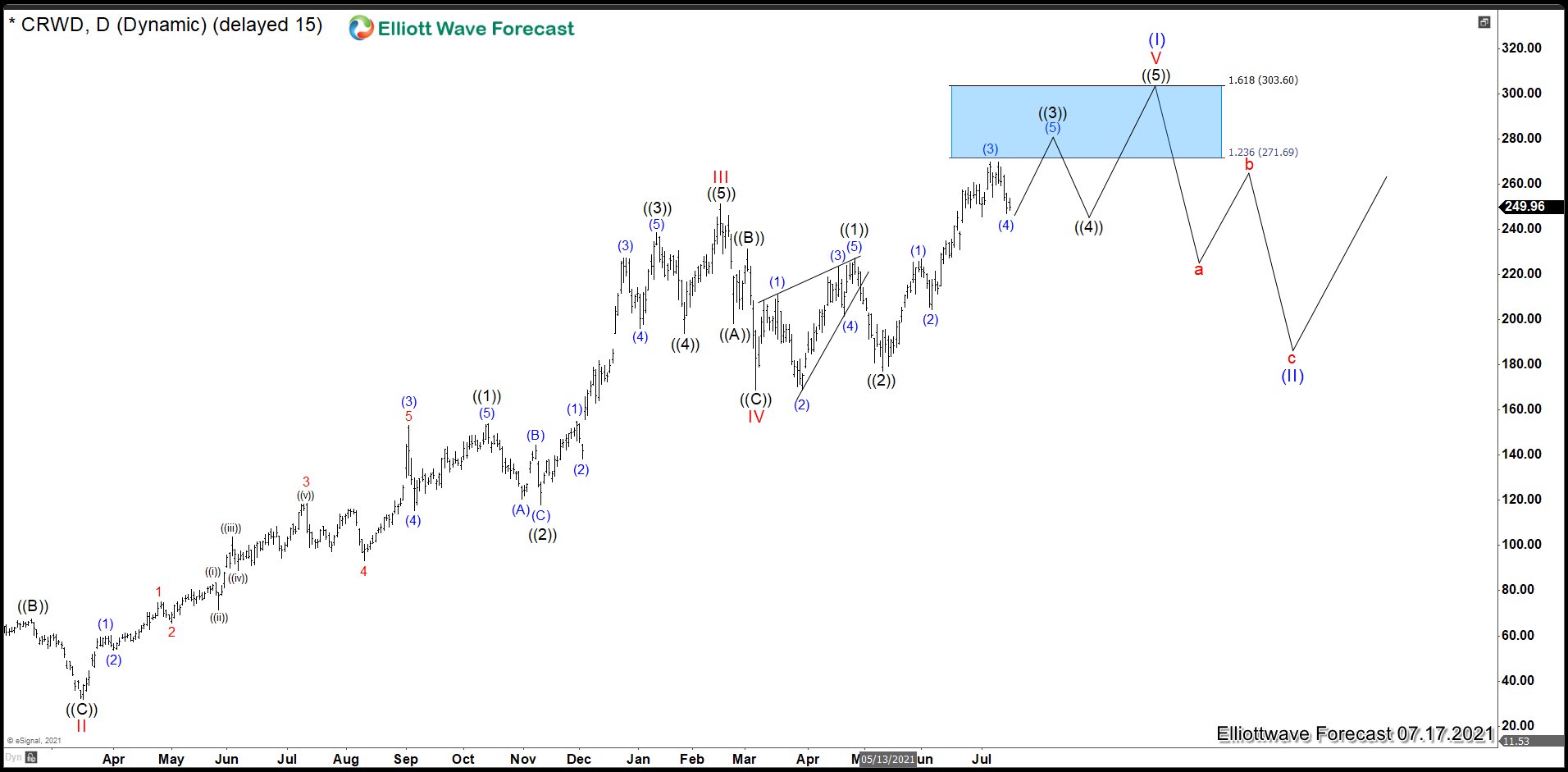

CrowdStrike July 2021 Daily Chart

On July 22, we stated that CRWD was showing a structure which suggested that a very important market cycle was nearing an end. That is, the whole market cycle from its foundation in 2011.

We were expecting it to peak after moving 5 waves up from the 168.67 wave IV low, and we provided a blue box area around the 271.69–303.60 levels as a possible zone to finish this Super Cycle and start a huge pullback.

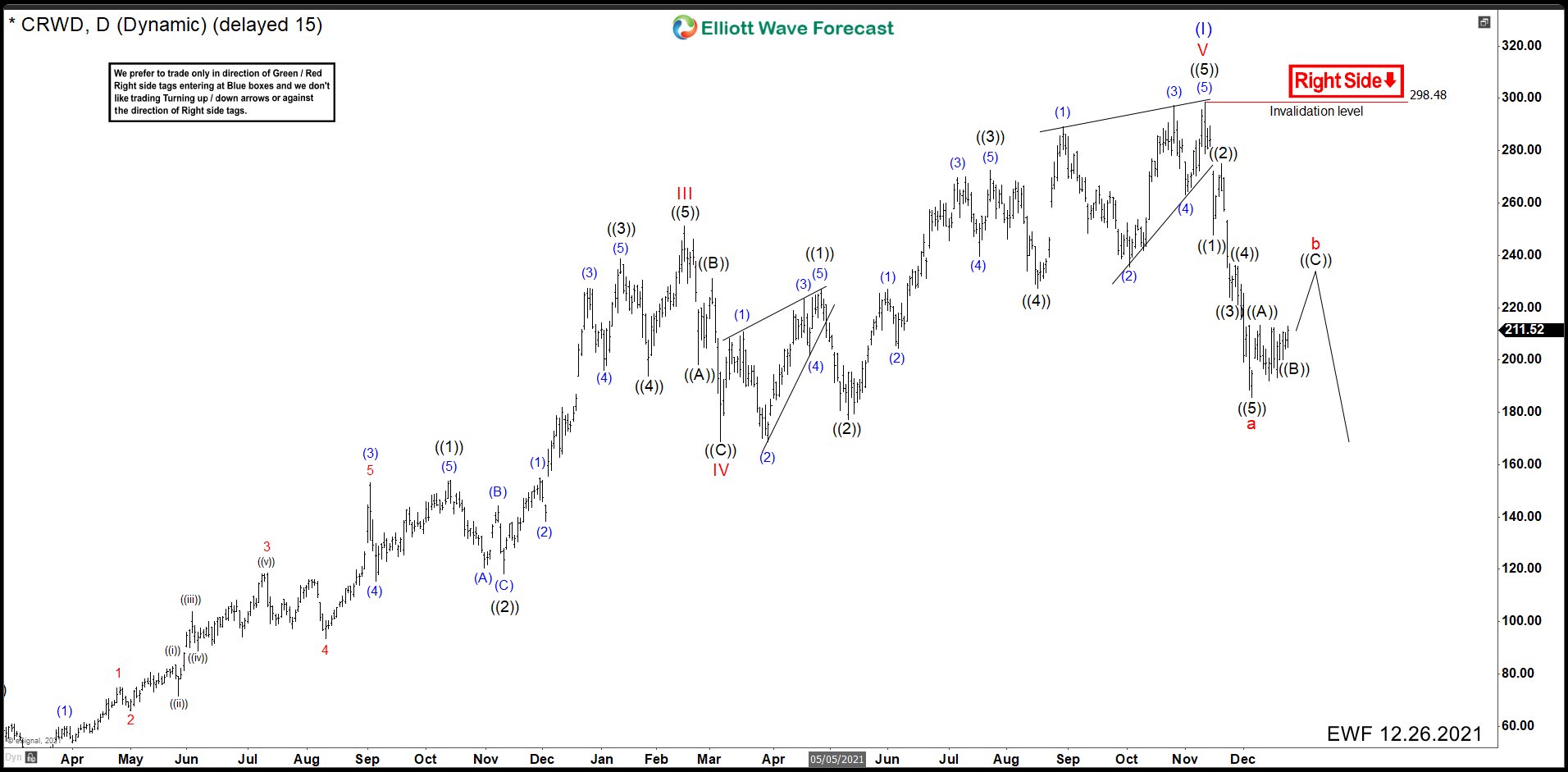

CrowdStrike November 2021 Daily Chart

In November, the structure of CRWD displayed enough swings to believe that the 5-wave impulse and the Super Cycle had ended. The impulse started with wave I and ended at the 101.800 level. The wave II pullback finished at 31.95 on March 2020 due to the pandemic drop.

From there, the rally continued and wave III ended at 251.28, and corrective wave IV completed at the 168.67 level. At this point, the last push to complete wave V higher began. As expected, CRWD made 5 swings up to form the last wave ((5)) of (V) an ending diagonal. The cycle ended at 298.48 inside our possible target area 271.69–303.60, and we were expecting a very important drop in the stock.

CrowdStrike December 2021 Daily Chart

The dip was very strong. In three weeks, CRWD hit 185.71, losing 37.78%. We changed our first view for a possible 'wxy' correction to an 'abc' correction, and we marked that an impulse structure from the top ended wave “a” at the 185.71 level. We suggested that we might see a pullback in wave “b” before continuing with the downtrend.

CrowdStrike January Daily Chart

The corrective wave “b” was small, ending at 217.11, and CRWD kept dropping. Therefore, we began to build the next impulse to complete wave “c,” the last one of the 'abc' correction, and finish the whole correction as wave (II). We were calling for one more low to end wave ((1)) and for a correction as wave ((2)) to see further downside in the stock.

CrowdStrike Feb. 12, 2022 Daily Chart

After 3 swings down from wave “b,” CRWD bounced from the 150.02 level, and the rally was stronger that we thought. That made us return to the original plan of a 'wxy' correction and we labeled the fall in that way, given the end of the 'wxy' structure and wave (II) at the 150.02 level.

From there, the rally looks like a leading diagonal, which would end the wave (1) at 193.40. Currently, we see a wave (2) pullback developing. As we stay above 150.02, we should continue with the rally.

To conclude, there is still a possibility we will see 3 more swings down in CRWD. We still suspect that we will see a ((W)), ((X)), ((Y)) structure build from wave “b.” We are looking to complete wave (2). In case the invalidation level gives up, we could continue down to the 110.90–126.64 area in 3 swings and resume the rally from there.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more