How To Spot A Winner – American Software

The Broad Market Index was up 1.76% last week and 23% of stocks out-performed the index. With the recent SEC filing update only 2% completed, expect the volume of SEC filings to increase in coming weeks. One early filer showing continued growth potential is American Software, Inc. (AMSWA).

The hunt for bargains is less successful now that the population of depressed-share-price stocks is dominated by weak growth and poor financial conditions. This is a concern for income strategies where dividends will be cut at falling cash flow companies. The focus will be on improving cash flow and improving the financial condition of companies.

American Software at $15.690 is a Buy, this rich company is getting better

American Software has been an exceptionally profitable company with persistently high cash return on total capital of 26.9% on average over the past 21 years. Over the long term the shares of American Software have advanced by 31% relative to the broad market index.

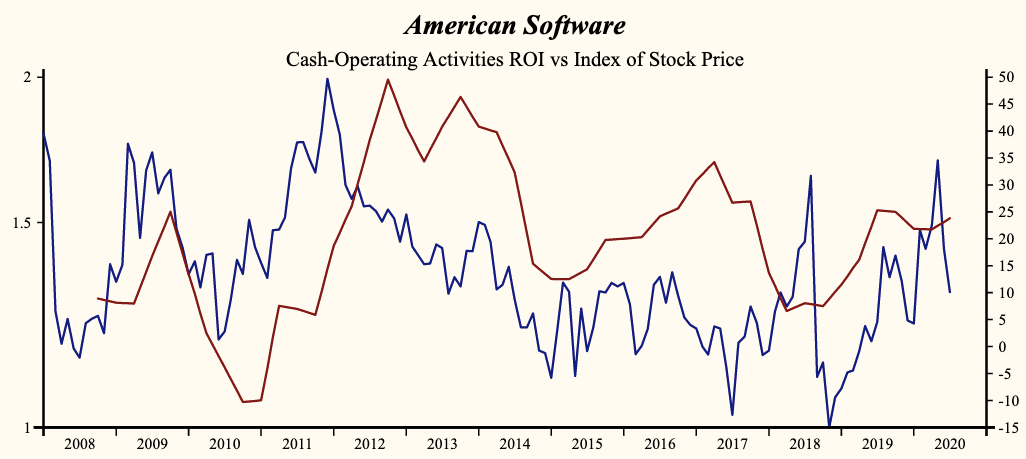

The shares have been highly correlated with trends in Growth Factors. A dominant factor in the Growth group is Free Cash Flow Margin which has been correlated with the share price with a two-quarter lead.

Strong Growth

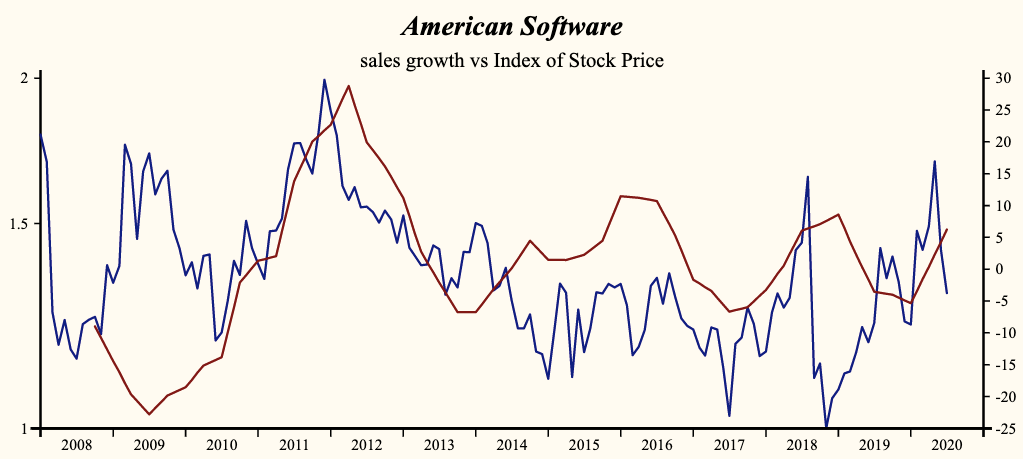

Currently, sales growth is 6.2% which is high in the record of the company and higher than last quarter. The shares have been highly correlated with the direction of sales growth. Receivables turnover has been 73% correlated with the direction of the share price with a four-quarter lead and continues to fall. Receivables are falling indicating that the company is reluctant to finance its own sales by borrowing against future sales growth. Declining receivables relative to sales reflects continued improvement in the quality of sales growth.

Financially Sound

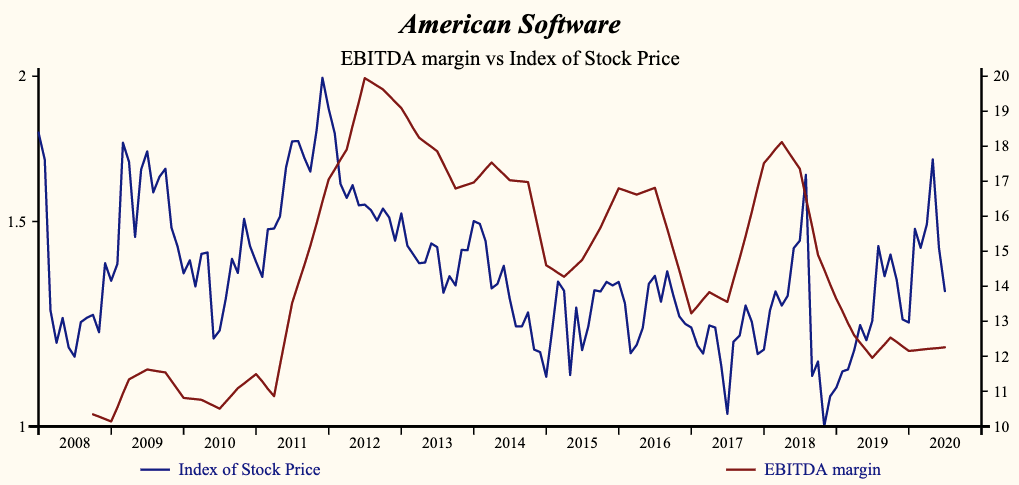

The company is recording a high gross profit margin but slightly lower than the last quarter. However, the EBITDA margin has been stable since early 2019 and is now rising.

Free cash flow as a percentage of sales measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have aided to support free cash flow which has been 36% correlated with the share price with a two-quarter and rising.

Depressed Share Price with 2.6% Dividend Yield

More recently, the shares of American Software have advanced by 23% since its November, 2018 low. The shares are trading at the lower-end of the volatility range in a 20-month rising relative share price trend. The current indicated annual dividend produces a yield of 2.6%. Five-year average dividend growth is 2.7%. Current trailing operating cash-flow coverage of the dividend is 0.9 times.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

Investors do not wait. Get ready for Active Management now!

Buy stocks of companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot) and improving cash position or profitability (Green Crown of the MoneyTree). In other words, the more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more