How To Replace FAANGs With Cloud

If you were hoping for yet another contrived acronym to describe a group of stocks, you can stop reading now.

But if you are in the market for fast-growing technology companies that don’t face the same degree of uncertainty from trade wars or antitrust scrutiny, we think cloud-based businesses represent an attractive alternative to mega-cap companies in the Technology sector.

FAANG (Facebook, Amazon, Apple, Netflix, Google)1 stocks have tripled their market capitalization over the last decade and have been the main drivers of the S&P 500 Index’s return. But in the fourth quarter of 2018, they suffered meaningful drawdowns and bouts of volatility. When political tensions ratchet up, some investors could question whether it may be time to seek out a new engine of growth and returns.

In our view, cloud computing could represent one compelling alternative.

Recent Drawdowns

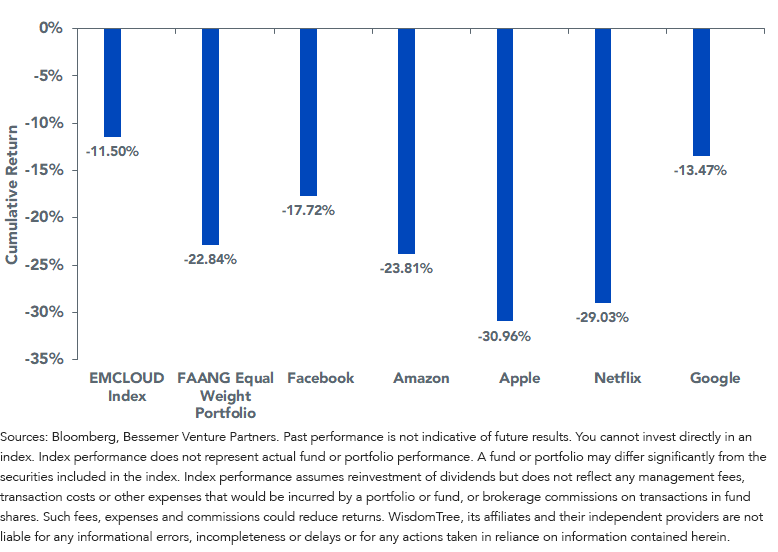

During the fourth quarter of 2018 market swoon, FAANG stocks declined by 23%, on average. By contrast, cloud computing stocks (as proxied by the BVP Nasdaq Emerging Cloud Index, or EMCLOUD), also experienced volatility but fell by half as much compared with the FAANGs. The parent company of Google, Alphabet, was the most resilient, but it still underperformed EMCLOUD by nearly 200 basis points (bps). This was surprising given that cloud companies tend to have higher volatility on account of their faster growth and smaller market caps, but they have also experienced greater total returns during the rebound as well.

Cloud vs. FAANG Performance (10/2/18 – 12/31/18)

(Click on image to enlarge)

For fund, performance click here

Comparing the performance since the inception of EMCLOUD on October 2, 2018, we observe that while most of the FAANGs had negative returns, the BVP Nasdaq Emerging Cloud Index generated a return of 27.47%.

Cloud vs. FAANG Performance (10/2/18 – 7/31/19)

(Click on image to enlarge)

.png)

The recent downdraft in high-growth stocks on September 9, 2019, has some investors questioning their decision to invest in software companies generally and cloud computing stocks specifically. While we note the rapid shift in sentiment, we still believe in the secular trend in adoption for the industry.

The Growth of Cloud-Based Businesses

Digging deeper, cloud computing’s unique subscription-based business model is one of the reasons we believe these companies could be less prone to market drawdowns compared with the FAANGs.

For cloud services, customers typically pay a recurring subscription fee each month/quarter/year rather than the one-time up-front fee they would pay to purchase a software license. This recurring subscription fee can provide a stable, predictable revenue to sustain a company’s growth amid market volatility. While certain elements of the FAANGs’ businesses may appear similar, we believe these differences can best be shown through a mega-cap tech name that transitioned to the cloud industry.

Company Snapshot

Adobe (ADBE),2 a cloud computing company that offers digital marketing tools, exemplifies how a subscription-based business model helped a licensed software company achieve explosive growth.

Before 2008, Adobe sold software in physical and boxed discs for customers to install. During 2008 and 2009, Adobe started considering the possibility of transitioning to the cloud for two reasons. First, the difficulty of pushing updates and delivering improved products to customers made Adobe’s tools less attractive to users. Second, the financial crisis in 2008 had a dramatic impact on its cash flow and exposed the limited resiliency of its business.3

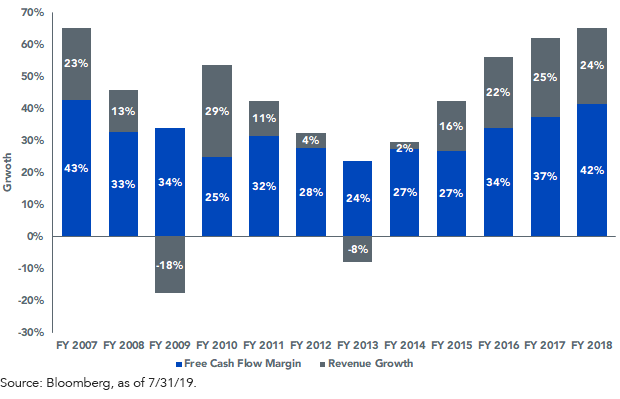

Adobe then undertook an expensive and arduous transition to the cloud that concluded in 2013. Since then, Adobe’s revenue has grown at a rate above 25%. Subscription-based revenue also started to account for more of its total revenue, reaching almost 90% in the fiscal year 2018.

(Click on image to enlarge)

An important rule of thumb for SaaS (software-as-a-service) companies is known as the “40% rule.” This states that if the sum of a company’s free cash flow margin and revenue growth both exceed 40%, the business has a solid balance of growth and profit that enables it to expand efficiently going forward.

From the chart above, we see that before 2013, Adobe’s growth was slowing and its free cash flow margin diminishing. But after 2013, it had a steady growth in revenue and a gradual increase in free cash flow margin. Now, with its established cloud subscription-based business model, Adobe has regained its status as one of the world’s largest technology companies, with a market cap of nearly $140 billion dollars.4

Conclusion

WisdomTree believes cloud computing has disrupted the software sector. While mega-cap tech is facing challenges due to increased government scrutiny, cloud computing could be in the middle innings of its growth curve. For investors seeking better returns but the same growth-oriented, technology-focused exposure in their portfolios, the WisdomTree Cloud Computing Fund (WCLD) could be a compelling alternative.

1WCLD does not hold any FAANG (Facebook, Amazon, Apple, Netflix, Google) stocks

2Adobe Inc. (ticker symbol: ADBE) has a 2.01% weight in the WisdomTree Cloud Computing Fund as of 9/24/19.

3 Sprague, Kara. “Reborn in the Cloud.” McKinsey Digital, 2015

4Source: Bloomberg, as of 9/6/19.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more