How To Invest During A Market Bubble

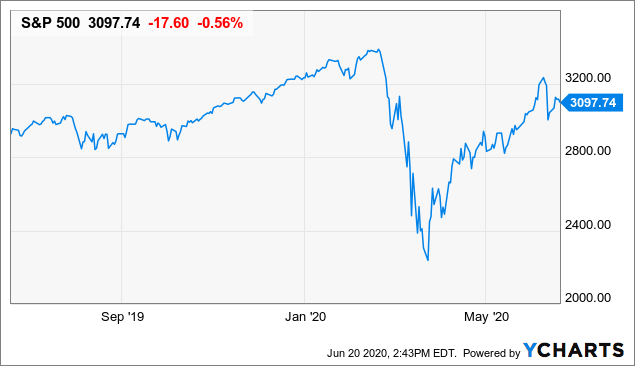

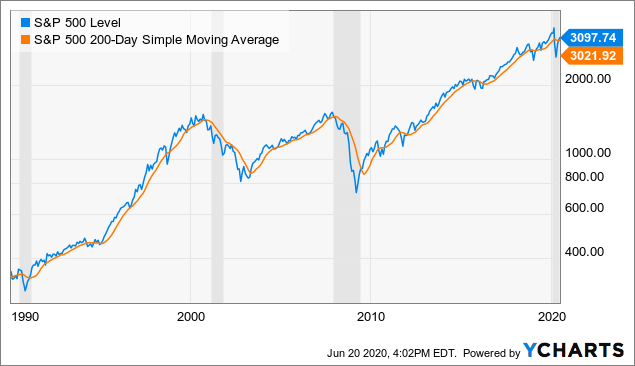

The economy is still in the midst of a recession, yet the S&P 500 has recovered most of its losses from the March collapse, and the index is even in positive territory over the past 12 months. Tech stocks are doing even better, and the Nasdaq reached new historical highs a few days ago.

Data by YCharts

With the markets rising strongly and valuations getting stretched while the fundamentals remain subdued, investors are wondering if we are in a stock market bubble. Personally, I believe that those concerns are being overblown.

Yes, the current rise in the market has more to do with fiscal and monetary stimuli than genuinely improving fundamentals, and expanding valuation levels in the market are always an important risk factor to keep in mind. However, the world "bubble" is being tossed around too easily nowadays.

This Is Not A Bubble - At Least Not Yet

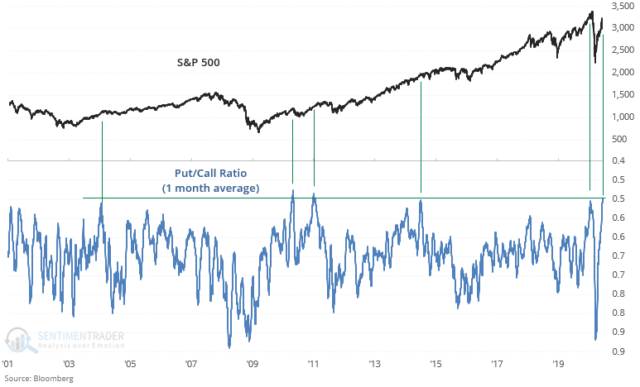

There are some pockets of speculation nowadays, especially in the short-term option markets and among intraday speculators, with the so-called "Robin Hood traders" getting a lot of attention in the media.

To consider one relevant indicator, the put/call ratio has reached highly speculative levels, and a short-term correction in the stock market would be no surprise at all based on the historical evidence.

Source: Sentiment Trader

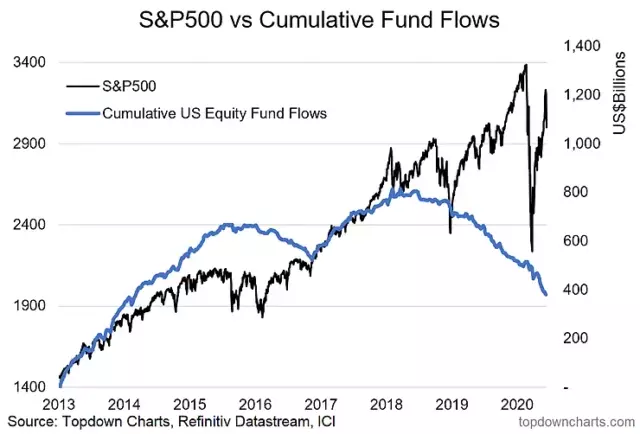

On the other hand, the net fund flows to equities have been negative over the past two years, and most of the serious big-money investors remain either cautious or downright pessimistic about the market.

Source: Topdown Charts

Michael Santoli has recently published a great column entitled: The stock market may be pricey, but it’s nothing like the genuine market bubbles of the past. The article nails the point quite well:

"Typical features of a bubble include pervasive optimism about future profits, heavy flows into stocks without regard to valuation and massive share issuance by new companies – all animated by “New Era” delusions and driving unchecked momentum in prices.

What do we have now? Persistent skepticism by traditional retail investors, as gauged by the predominance of bears over bulls in recent American Association of Individual Investors surveys. More money flowing out of stock funds than in over the past few months. A sense among the public that “everything has changed” as a result of the COVID-19 epidemic – but not for the better."

I do believe that there is an above-average risk of a correction or at least a sideways consolidation in the short term, and the overall impact of high valuations in the context of a recession and unprecedented monetary stimuli is a very important uncertainty factor for the market.

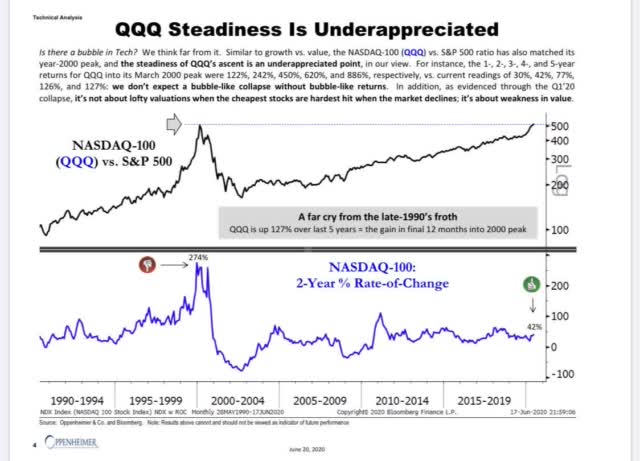

Nevertheless, saying that we are in a stock market bubble such as the one of 1999 is not really a rigorous comparison. Even among high-flying tech stocks, the returns have been very different. The following chart from Oppenheimer shows it very clearly, and the note is conclusive: "We don’t expect a bubble-like collapse without bubble-like returns".

Source: Oppenheimer

In my opinion, we don't have enough evidence to say that the market is in a bubble right now. But, I am closely watching for this possibility going forward, especially if the market keeps producing big returns without a material consolidation along the way.

In a scenario of relentless market gains, this could create some dangerous incentives for traders and investors. A non-stop rally could cause the impression that all market dips should be bought regardless of the risks because the Fed is always there to save us from our mistakes, and this can create some really destructive delusions.

For the time being, though, this is only a possibility to keep an eye on, and the current market context is not what we typically see during full-blown bubbles.

Trend Following During A Stock Market Bubble

Both life in general and the market in particular have to be lived by looking through the windshield, as opposed to the rearview mirror. It is easy to see the bubbles from the past, but it is much more difficult to predict a future bubble and to say when it will come, how far it will go, and when it will explode.

Trying to predict market bubbles is futile and potentially very expensive if you stay away from the market for too long in anticipation of a bubble. As opposed to making predictions, investors should consider making plans for different scenarios, and trend-following strategies can be very effective during market bubbles.

In essence, trend-following means that you only remain invested in an asset while its price is rising. We can use a simple trend indicator such as the 200-day moving average as the main trigger for entries and exits.

The chart below shows the S&P 500 and its 200-day moving average since 1990. Even if there are some false signals along the way, the indicator does a solid job in terms of differentiating periods of big uptrends and downtrends.

Investors following this trend indicator would have avoided most of the losses during the 1999 tech bubble explosion and during the 2008 financial crisis caused by the credit bubble.

Data by YCharts

The conclusions from the chart are backed by research. A historical research paper authored by Mebane Faber shows that "a trend-following approach improved returns in every bubble (except one) and reduced volatility and drawdown in all twelve of them."

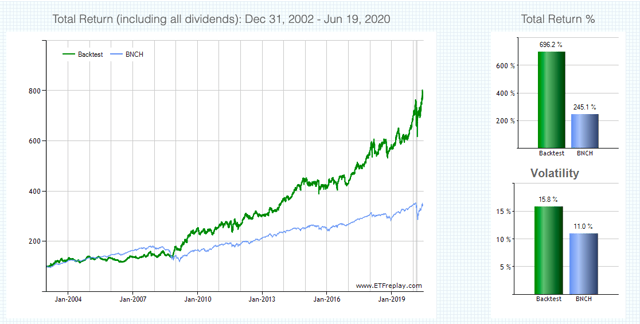

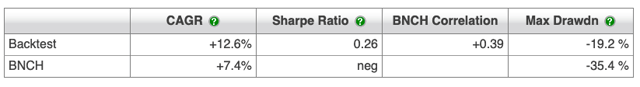

Even better, we can combine different trend indicators to rotate between stocks and bonds. The Triple Trend QQQ model is a quantitative model that uses multiple moving averages to build a balanced portfolio of growth stocks and safe haven assets based on trend considerations. The model is highly invested in QQQ when the trend is up over different time frames and it rotates toward Treasury bonds when the trend is down.

The backtested performance numbers are quite strong; the annual return is 12.6% for the model versus 7.4% for the benchmark, and the maximum drawdown for the model is -19.2% versus a maximum drawdown of -35.4% for the benchmark.

Source: ETFreplay

These kinds of trend-following models will work very well when markets are trending strongly, either up or down. However, performance can be disappointing during periods of sideways market action and weak price trends.

But, the main point is that a market bubble is generally characterized by a strong uptrend followed by a collapse in prices, and a trend-following strategy such as this one can be quite effective in terms of capitalizing the upside movement in prices and protecting the portfolio when the trend turns around.

The Bottom Line

The current market environment is clearly not reflecting the characteristics of a bubble, although there are material risks and signs of too much speculation in the short term. On the other hand, the market could enter a bubble territory if investors start putting too much faith on the Fed and all risks start being permanently ignored. This is just a possibility worth watching.

In case we do enter a bubble, I would materially reduce my exposure to stocks because you never know when the bubble will explode, and there is no guarantee that you will be able to exit rapidly enough.

However, the data shows that trend-following strategies can produce attractive returns while the bubble is inflating, and they can also provide clear signals to exit the market when the trend is turning around. No strategy can be perfect, but trend-following has proven to be consistent during market bubbles.

In a market bubble context, it can make a lot of sense to allocate a small share of your capital to a trend-following strategy if you are looking to benefit from rising prices while also having a clear exit signal when prices start moving in the wrong direction.

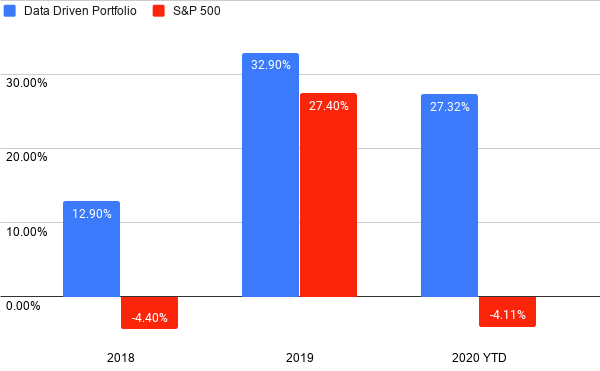

Performance as of June 20, 2020

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and ...

more