How The Black Swan Portfolio Is Positioned At Record Highs

This is a short update on how the model portfolios of the exclusive research service The Black Swan Portfolio have been doing. I will also briefly discuss some of our favorite holdings within the portfolio. You can read more about the methodology used here.

Within the service there are two model portfolios:

- The Black Swan Portfolio which is a very aggressive portfolio. (Very aggressive equity investments but no options.)

- The Numeraire which is a very defensive portfolio. (Think a cash alternative.)

The aggressive The Black Swan Portfolio is what I’ve been running since inception of the service in 2015. It exceeded all expectations and shows a 29.66% annualized gross return. I expect this performance to come down to earth over time.

There’s no doubt there have been some lucky events like the acquisition of Dreamworks Animation (DWA) and the reverse merger involving Magellan Petroleum (MPET), which we bought when it was a sub <$20 million market cap near bankrupt pre-revenue Exploration & Production company.

It went up 1380% at one point. It only added up to a 350% return for our portfolio, albeit within a few months, because I missed the fantasy required to perceive value beyond that point. Meanwhile, the company transformed from a below $20 million near-bankrupt company into a $1.7 billion powerhouse chaired by ex-Cheniere Energy (LNG) celebrity CEO Charif Souki and became backed by major oil corporations.

That’s how a 350% gain can be a huge mistake at the same time.

TELL Total Return Price data by YCharts

Year to date the aggressive portfolio returned 17.96% gross which is still very strong. If we could manage to generate something along those lines over the next decade I would be extremely content.

Interesting small-cap

One of our interesting large positions is a small-cap called Psychemedics Corporation (PMD). A hair-testing company that profited off new regulation in Brazil that forces every truck driver in the country to get a hair test every 5 years if they want to renew their license. I first wrote about it in 2013 and it beat the S&P 500 since.

PMD Total Return Price data by YCharts

Earnings growth has been even more impressive.

PMD EPS Basic (TTM) data by YCharts

Lately, it has come down somewhat because there are some distribution problems in Brazil. This after an important partner got sued for anti-competitive practices. I still expect the share price will ultimately follow its earnings trajectory and maintain the position.

The Numeraire

The Numeraire also performed quite well. It has only been a part of the service since early 2017. So far I’m happy with its apparent stability and it doesn’t lag a medium-term bond ETF which is quite an accomplishment with a mix of very safe, negative carry and a few risky equities that I believe help to mitigate some flaws of the ultra-safe securities.

It contains land companies like Howard Hughes (HHC) which I wrote about recently. But also very short-term bonds, agricultural DB Agriculture Long ETN (AGF) and metal ETFs like the UBS ETRACS CMCI Industrial Metals (UBM). The most adventurous holding has been Bitcoin which has recently been falling again and becoming interesting to accumulate or add.

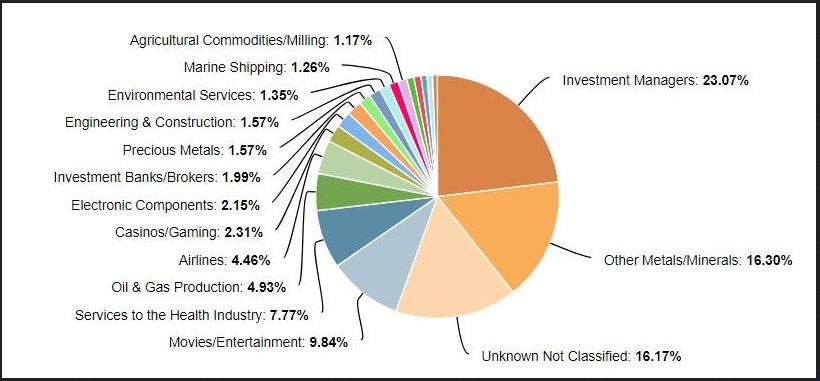

Industry allocations

I’ve also pulled a report on the industry allocation of the aggressive portfolio. The aggressive portfolio mostly contains individual equities and I’m not sure if there’s one S&P 500 company in there. I’m quite bearish on the S&P 500. So are insiders; see chart below. I’ve only used the S&P 500 as a benchmark because most people view it as the go-to alternative for their allocations.

The industry allocation looks like this:

Unknown not classified is a 16% slice consisting mostly of cash and slivers of alternative assets and cryptocurrency exposure. Cash is also Seth Klarman’s largest position.

Metals/minerals

Metals/minerals make up 16% of the portfolio. I view it as an undervalued industry and happen to find many bargains here.

Investment managers

The largest allocation is towards investment managers with 23%. It’s hard to find a company in this industry I don’t like but our portfolio consists of what I deem the truly excellent values to own at this time. I may add more as the industry is out-of-favor based on the flows towards ETF’s. A potential financial drama. One very interesting example is Oaktree Capital (OAK) which is led by the wise Howard Marks, author of The Most Important Thing, which is full of important things.

It’s a private equity firm that is specialized in distressed debt. It is a great example of the type of investments I’m interested in with the S&P 500 near highs. Asset managers are often valued using a % of assets under management metric. Generally trading between 2%-6% of AUM. Private equity firms tend to trade near the high end and can go up to 8% because they take management fees, performance fees and they lock up funds for up to a decade. It doesn’t get much better then that.

Oaktree has about $100 billion of assets under management and its market cap is $7.5 billion which makes it appear to be about fairly valued. However, it has a 20% stake in Jeffrey Gundlach’s Double Line which could be worth $1 billion. In addition the firm has been actively turning away funds. This is an environment where Masoyoshi Son raised $100 billion at egregious terms for those providing the funds.

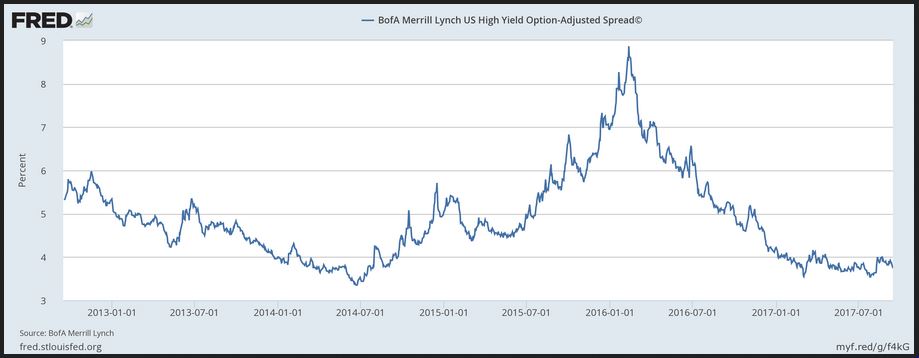

Oaktree doesn’t want the money because there is nothing distressed to invest in. The graph below shows the premium high yield aka junk bonds trade at over the risk free rate. It shows investors are very eager to provide money to risky companies and don’t perceive there to be any risk.

At some point, a lot of leveraged companies are going to crash and burn as rates rise or wages rise. The junky companies will bankrupt and there will be lots of opportunities for Oaktree. At that point, many funds will have taken a hit and clients will remember that Oaktree did not take their money to make bad investments. They have the reputation to raise money AFTER a crash and assets under management will grow at that time. You could view Oaktree as having an invisible reservoir of AUM based on its reputation. Because private equity AUM is the most valuable kind, the firms value is widely underestimated.

The movies/entertainment industry is a bit outsized because one small holding gained 450% year-to-date and I’m not eager to sell yet as an important court case remains to be resolved and can potentially unlock further value.

Summary

The Black Swan Portfolio is currently heavily invested towards

- asset managers

- minerals and miners

- many owner/operated companies

- idiosyncratic situations (return not as correlated to general market movement)

as we view the State of the Market as highly precarious.

Disclosure: long OAK, PMD