Hot Hotel Stocks? Look Before You Leap

When most Americans think of hotels, they think of the most familiar names where, on every continent but Antarctica, they can get a room for the night or longer. Hotels mean temporary shelter, rooms with a very short minimum rental period to a maximum of staying forever. Most of them have already risen mightily this year.

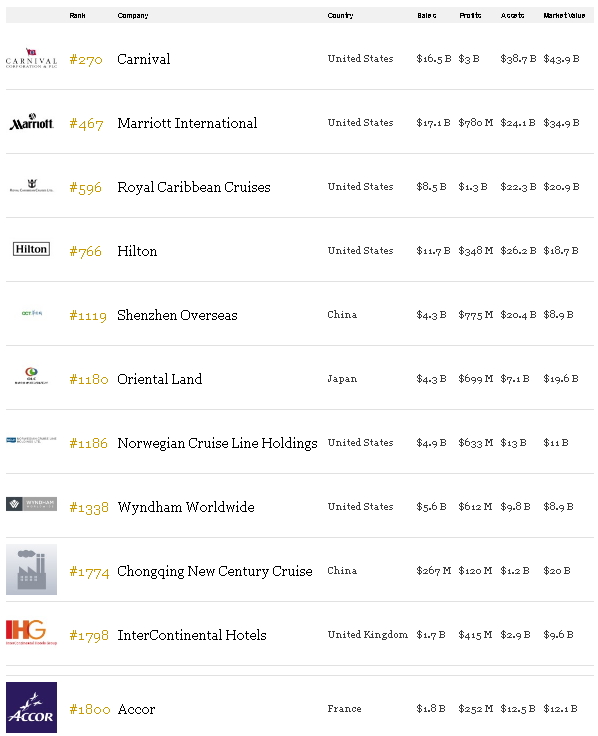

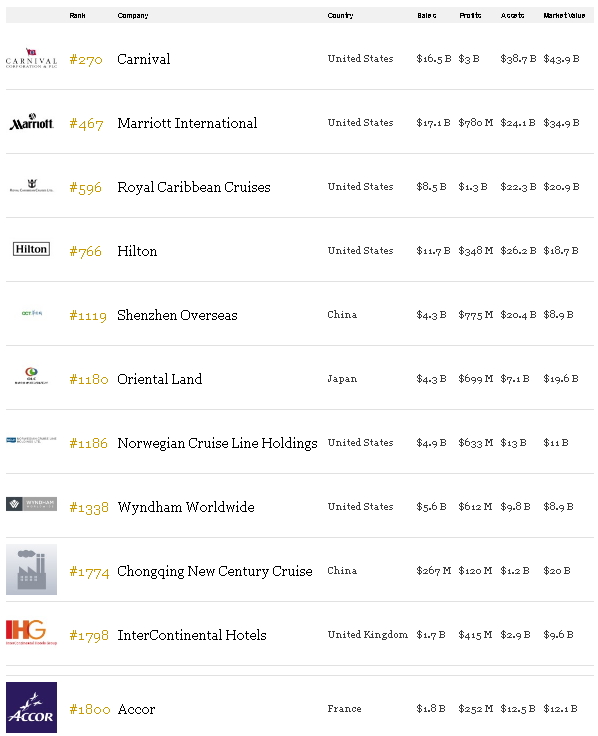

But here’s a slightly different take on what constitutes “lodging” courtesy of Forbes’ 2017 version of The World’s Biggest Public Companies, as measured by an amalgam of sales, profits, assets and market value.

The 270th biggest company in the world and the #1 company listed under the “Hotels & Motels” category does not provide land-based rooms at all. Who is it? Carnival Corp, which controls not just the estimable Carnival Cruise Lines but also all these independently-operated lines as well. (Think Berkshire Hathaway’s limited hands-on approach to its many subsidiaries. In cruise industry terms, each line appeals to a different demographic and psychographic.)

There is a certain logic to considering Carnival the world’s largest hotelier. After all, with the exception of repositioning cruises and those featuring extended sea time, your cruise includes a fine hotel room (from which you never have to unpack for the duration of your travels) in some of the world’s great destinations. Add up the cost of hotels in those cities and smaller venues, dining out every day and getting transportation arranged for whatever excursions you are taking and you may well conclude that it is not only cheaper than staying in land hotels, it is also less enervating.

There are even those who suggest that, as long as you don’t need regular medical care but are still considering moving to one of those buy-your-own-apartments at a care facility where meals and regular housekeeping, as well as movies and other entertainment and fitness classes and facilities, are provided, you might consider perennial cruising instead! Done right, it can be cheaper and the views more interesting…

But that’s an article for another time. Besides, much as I like to buy the cruise lines as a trade whenever they are depressed, they are not depressed today. They have moved up as a bloc along with the market so I can’t find compelling value here. For now, we’ll start our exploration of the “hotel industry” with the 467th biggest publicly-traded global company and the biggest land-based hotel: According to Forbes, that would be Marriott International (MAR).

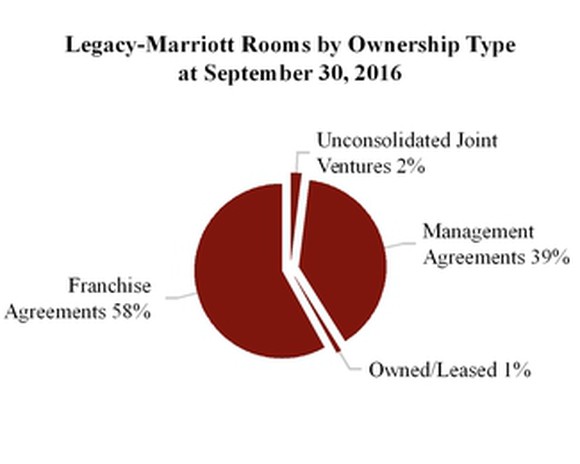

Not bad for a company that began as a nine-seat A&W root beer stand in Washington D.C. Today Marriott boasts more than 6,400 hotels with 1.1 million rooms in more than 120 countries. But when they say they “offer” these rooms you’ll notice they don’t say they “own” these rooms. They do own some of them, but therein lies the great lesson of how hotels really work.

You look at all these names above and wonder how any company could keep track of them all. It looks more like a conglomerate than a hotelier. But like Carnival and all the other lodging and travel specialists, Marriott realizes that the demographics and psychographics that draw travelers to one or a handful of hotels time and again require this kind of diversification. Budget travelers need the certainty of knowing they will be well-served along their way, business travelers demand something very different, those who have struggled and achieved much feel they deserve something still different, and so on.

It would be quite difficult to stay on top of all this if Marriott owned all these hotels, or tried to apply one particular management style to all of them. That is precisely why they typically do not even attempt to do so. Some hotels are owned, managed and branded by the same company. The J.W. Marriott in D.C. and the Key Bridge Marriott just a few miles away in Rosslyn VA, where I stayed on many a temporary duty at the Pentagon and other sites around D.C. are examples of how hotels used to do things. Both are company owned, managed and branded.

But the kind of debt a company would have to take on to buy the properties, and the different kinds of management each demographic might require, means that today when a company talks about its properties, as likely as not most if not all of those properties are owned by someone else or managed by someone else.

You see, hotels can be independently owned and operated/managed. But these days you need to be a legendary name with a robust clientele who embrace the hotel with every succeeding generation or the only hotel in town to be able to carry on the Grand Hotel tradition or the you-need-a-place-to-stay, here-we-are tradition.

Hotels can be independently owned but leased to an operator/manager. These may be further divided into those that choose to remain independent, those that share a common reservation system a la Best Western but are otherwise dissimilar, and those in which the manager decides to affiliate with a chain. In this model, a real estate investment trust (REIT) or a pension fund or a professional association of wealthy doctors or lawyers or such buy a property but don’t have the time or the inclination to manage it. Instead, they hire a firm that does all the hiring, firing, cleaning, maintenance, security, and all the other things that go into running a hotel – including deciding whether it is worthwhile to affiliate with one of the major chains.

As noted above hotels can be owned, operated and branded by a chain. The J.W. is an example of this approach – owned, operated and branded with the chain’s imprimatur.

Hotels can be franchised by one of the major chains. Here again, there can be disparate paths taken; the franchise might be a management company that manages for many unrelated hotel owners or the franchise might be the owners themselves who elect to hire the chain’s management team or an entirely different one. This is the path pioneered on a large scale by Kemmons Wilson, who started Holiday Inn back in 1952 and began offering franchises on his Holiday Inns in the early 1960s. Since then, this has become, especially recently, the favorite way for chain hotel brands to run their businesses.

Why has franchising become so much more attractive to the big hotel chains? (These are also sometimes called “branders” but most frequently referred to as “flags,” probably because the big chains’ marketing, loyalty programs, advertising and logos all set each apart in the same way that a nation’s flag does.)

The reason is simple: back in the day when hotels were few and far between it wasn’t that difficult to set your hotel apart. But today building hotels takes a whole lot of money as land has become less available and more expensive and a whole lot of time dealing with building departments, zoning issues, construction crews and so on.

So if a flag hotel company can simply license out its benefits to an existing property owner, or a group willing to deal with all those local issues when building a new hotel, they can simply can take a percent of the income. This relieves them from having to borrow money, or take the risks of cost overruns or neighborhood opposition. Mostly it means they suffer far less when occupancy declines, as they did during the recent unpleasantness of 2007-2009 and the long road back since that occurred.

Again using Marriott as an example (though it might as well be all the other major flag chains as well) you’ll note that just *1%* of Marriott’s hotels are company-owned or –leased!

This model lets the flags plant their flag in a whole lot of new destinations and grow their share of mind with travelers who continue to see that flag popping up whenever they travel. This is especially beneficial to the big flags because, on their own, they might not consider the risk/reward to be favorable if opening in smaller demographic areas. As long as someone else is paying the freight, it bodes well for continued consolidation.

Marriott and Hilton (HLT) have done particularly well with this model, leapfrogging much of the competition. Hyatt (H) has joined this party late and is trying valiantly to keep up with having many different “brands” under its Hyatt logo. (I’ll be writing about Hyatt’s success or failure in Part II of this article.) Franchising also means that the flags can take a risk on a rather small hotel in terms of a number of rooms and amenities, a risk they certainly would not take if they were paying in time and money to create a presence in these Tier 2 and 3 markets.

In a nutshell, for the big flags, the logic is that it is better to get 10% of the gross income from 2000 properties than 100% from 50 properties – while taking on virtually 0% of the risk in the former example and 100% of the risk in the latter!

What’s in it for the hotel owners who took all or almost all the risk? The big flags use their “known product” status, their reservation systems, their advertising and marketing, their hospitality training and their loyalty programs to deliver far more guests to hotels that would otherwise have to scream and shout on expedia.com, hotels.com, booking,com and all the rest of those sorts of sites. The fees from these sites would be as much or more as the franchise fees and the hotel owners would be unlikely to get the loyalty program guests from the flags. 100% occupancy is the goal. The big flags come closest to delivering that.

If this is the case, who then are the real hotel "owners", those who own or lease the land and own the physical structure? Most often they are real estate investment trusts (REITs) or other real estate companies that are the experts in site selection, negotiating price, arranging financing and dealing with local building codes and construction firms. This reveals yet another benefit to the actual hotel owner of allying in advance with a flag hotel company: it is much easier to attract investors or appeal to lenders if they know that your hotel will come under the umbrella of a well-known and dependable flag.

Referring back to the Forbes list of big hotel companies…

…Hilton (HLT) is the 2 nd biggest flag. Like Marriott, it’s rapid rise this year has made it somewhat less compelling as a buy. Still, on any pullback, Hilton is my #1 choice. My bias comes from many years of close affiliation and hundreds of stays. I have been an HHonors (loyalty program) member for more than 30 years. That has earned me luxurious stays at a number of Waldorf Astorias and Conrads (on points, of course!) I’ve had truly memorable stays around the world at the Conrads in Cairo and Singapore, the Waldorf Astorias in New York, Phoenix, Key West, La Quinta and New Orleans and countless stellar Hiltons from Paris to Bangkok.

I’ve also stayed at a lot more Hamptons, Hilton Garden Inns and the rest of the less expensive Hilton properties around the world in order to earn those points. The attraction of Hilton as an investment is that they have been brilliant not only in segmenting the market but have also been very clever in their geographic dispersion. Some of the smallest towns along well-traveled roads midway between two destinations will have a Hampton Inn, Hilton Garden Inn, or even a Doubletree or Embassy Suites from time to time. Hilton makes it easy to be an HHonors member and very fair in rewarding their members with incredible stays in incredible places. (Ditto for Hyatt but, remember, I’ll cover Hyatt in Part II of this look at hotels and hoteliers.)

Next is Shenzhen Overseas (China) which does not trade in the US.

Then comes Oriental Land, also known as OLC Group (Japan: US ADR symbol is OLCLY). I like the company just fine but it isn’t a pure play hotel company. Even though Forbes ranks it as the 1180 th largest company in the world and shows it under "hotels", it derives more of its revenue from its primary sources of income, the management of Tokyo Disneyland and Tokyo DisneySea (the only ocean-themed Disney park in the world.) Hotels (including an under-construction Hyatt Regency beach resort on Okinawa) account for just 13% of earnings. Still, on a pullback I’ll likely revisit this one; Disney never goes out of style.

Next is Wyndham Worldwide (WYN) which claims on its website: “There’s no one else like us. Wyndham Hotel Group is the world’s largest and most diverse hotel business, with a global portfolio of more than 8,100 hotels and over 705,700 rooms in 79 countries.” It is true that it is quite diverse but it doesn't have the margins of MAR and HLT. Most of its properties are of the limited-service variety like Days Inn, Travelodge, and Ramada, but WYN also has Wyndham, Wyndham Grand and Dolce under its wing. Having risen from 3 dollars and change in 2009, it is now 112, where it sells at a reasonable 20 times earnings. My biggest concern here is that as deeper-pocketed Marriott acquires more Fairfield Inns and Hilton does the same with its Hampton Inns, Wyndham’s properties will likely need significant renovation and upgrading to compete.

Intercontinental Hotels (IHG) is the now-British owned parent of Holiday Inns. It would take a book to track all the different buys, sells, buybacks, and so on that led to the current structure. Here’s what it looks like today:

Add to these the upscale Kimpton brand. (Thanks to the wonders of modern website animation – “never let a pair of eyeballs rest or, God forbid, leave!” -- I was unable to capture the full current roster.) IHG, too, spans the spectrum from limited-service to extended-stay to mid-range to full-service to luxury, just like MAR and HLT have. I see the investment case here as ranking just under Hilton.

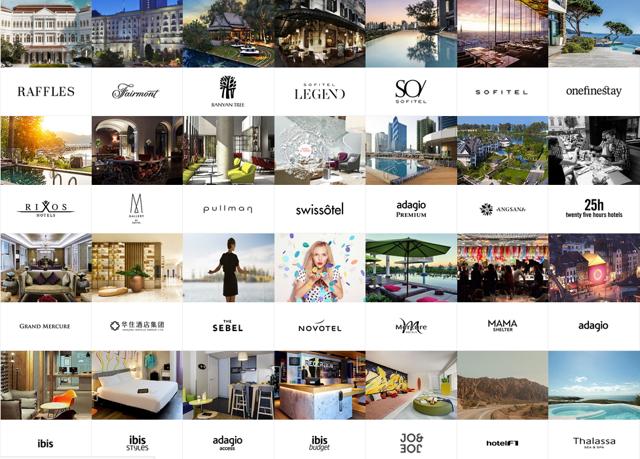

Finally (!) and still among the Forbes 2000 is Accor Hotels (France – USADR: ACCYY). Accor has brought segmentation to a whole new level. I have had truly memorable stays with Accor – the Sofitel Saigon comes immediately to mind (and yes, I still call it Saigon.) The Fairmont Olympic in Seattle is no slouch, either! But I’ve also had some of my worst stays with Accor while trying to save money at their spartan F1 and “Ibis Budget” brands – calling to advise I’d be late, assured it was no problem, then finding they’d given my room away, etc.

I won’t let those experiences sour my opinion of the company’s prospects, however. They’re doing some really smart things. Taking the Marriott, Hyatt and Hilton vacation timeshares (oops! The industry prefers “VOCs” – Vacation Ownership Clubs) to the next logical step, Accor has an extensive network of private villas, city apartments and beachside homes they have assembled (mostly for 3 night or longer stays.)

These are all very high-end places so Airbnb needn’t panic just yet. Airbnb has a few showcase offerings but by and large they compete more for budget-conscious travelers. Of course, the margins on Accor’s top-drawer properties are significantly better than those Airbnb and the various vacation rental sites will enjoy. (In Part II, I will discuss the threat possibly posed to the hotel industry from Airbnb, VRBO/Homeaway and other “alternative lodging” players.) It is possible, of course, that Accor is cannibalizing its own upscale hotel clients with this move. The other big flags are watching closely but haven’t yet moved in this direction. If it turns out that all Accor has done is lower the occupancy of its Fairmont, Sofitel and other luxury brands this will all have come to naught.

The other problem with Accor is that it is French. That means it is saddled with French rules and regulations and a government that has traditionally strived for full employment or at least the appearance thereof and in so doing made it nearly impossible to fire bad employees. Previous French president Francois Hollande carried on in this socialist tradition with gusto. It remains to be seen if current president (since May 2017) Emmanuel Macron will reverse this trend. As evidence of the problem, revenue per employee at Accor is higher than at most of its competitors.

Even so I see the possibility of good things happening for Accor. If I were looking purely at the numbers – PE, Price/Book, Price/Sales, Price/Free Cash Flow, EV/EBITDA, Cash/Debt. ROIC, etc.) I would select IHG as the “current” best buy of the above. If I were looking purely at my personal experience with all these and my gut feel for how successful I think they will execute, it would be HLT.

But for the best combination of both right now I am going with Accor. For US citizens I suggest the ADRs for your continued due diligence – if you buy now, these are selling for just under $10 US. I believe Accor has segmented the market well, is particularly strong internationally, where I see the greatest growth prospects, and is gaining a first mover advantage in taking on Airbnb, VRBO et al head on. It should be an interesting battle.

I will publish Part II next Tuesday, the day after Christmas. In it I will discuss publicly-traded alternative lodging choices (like Expedia, parent of Homeaway and VRBO), one flag hotel I see as flagging and want to warn you about, and my favorite way to play continued success at Hilton without buying higher-priced Hilton stock.

I welcome your comments and questions and I wish you a wonderful holiday and good investing!

Disclosure: Do your due diligence! If we can help, you are welcome to contact me directly about a subscription to Investors Edge® or about our portfolio management service.