Home Run #32: Google

Perhaps this is getting a little boring for you, dear readers?

But, wow! Two new home runs in consecutive blog posts! And this after I thought it would be a while before I report on another home run!

Today, one of the growth stocks I own exploded higher after an earnings beat and so becomes DivGro's 32nd home run stock. Because the stock doesn't pay dividends, it means the stock price doubled up on my average cost basis. I first invested in this stock in June 2017 and added shares in 2018 and 2019. With annualized returns of 33%, there's nothing to complain about concerning this stock's performance!

Can you guess which growth stock I'm talking about?

DivGro's Home Runs

Here is a list of DivGro's home runs with updated total returns (and annualized total returns):

- Home run #1: General Dynamics (GD) — up 32% (15% annualized)

- Home run #2: Nippon Telegraph & Telephone (NTT) — closed for 125% gain (37% annualized)

- Home run #3: Digital Realty Trust (DLR) — closed for 102% gain (44% annualized)

- Home run #4: Altria Group (MO) — up 7% (2% annualized)

- Home run #5: Reynolds American (RAI) — closed for 180% gain (53% annualized)

- Home run #6: Main Street Capital (MAIN) — up 81% (20% annualized)

- Home run #7: Microsoft (MSFT) — up 436% (84% annualized)

- Home run #8: UnitedHealth Group (UNH) — up 104% (29% annualized)

- Home run #9: Northrop Grumman (NOC) — closed for 132% gain (46% annualized)

- Home run #10: McDonald's (MCD) — up 50% (23% annualized)

- Home run #11: AbbView (ABBV) — up 94% (20% annualized)

- Home run #12: Lockheed Martin (LMT) — up 30% (14% annualized)

- Home run #13: Raytheon Technologies (RTX) — up 41% (49% annualized)

- Home run #14: Netflix (NFLX) — up 170% (59% annualized)

- Home run #15: Intel (INTC) — up 191% (27% annualized)

- Home run #16: Valero Energy (VLO) — up 13% (3% annualized)

- Home run #17: Aflac (AFL) — up 113% (21% annualized)

- Home run #18: Apple (AAPL) — up 430% (84% annualized)

- Home run #19: Xcel Energy (XEL) — up 27% (19% annualized)

- Home run #20: Amazon.com (AMZN) — up 169% (58% annualized)

- Home run #21: Salesforce.com (CRM) — up 70% (31% annualized)

- Home run #22: Procter & Gamble (PG) — up 88% (13% annualized)

- Home run #23: Taiwan Semiconductor Manufacturing (TSM) — up 196% (68% annualized)

- Home run #24: Pinterest, Inc (PINS) — up 168% (372% annualized)

- Home run #25: Air Products and Chemicals, Inc (APD) — up 80% (37% annualized)

- Home run #26: QUALCOMM Incorporated (QCOM) — up 144% (84% annualized)

- Home run #27: Cummins Inc (CMI) — up 100% (25% annualized)

- Home run #28: NextEra Energy (NEE) — up 111% (42% annualized)

- Home run #29: BlackRock, Inc (BLK) — up 91% (44% annualized)

- Home run #30: T. Rowe Price Group, Inc (TROW) — up 96% (30% annualized)

- Home run #31: Texas Instruments Incorporated (TXN) — up 96% (30% annualized)

Once a position reaches home run status, it retains that status even if the stock price drops and the total returns dip below the 100% mark. Also, if I buy additional shares of a home run stock at a higher cost basis, the calculated total returns could also drop below 100%.

I've reopened positions in NOC and DLR, both of which achieved home run status before I closed my original positions. Repeat positions like NOC and DLR will have to earn home run status again... they don't get a free ride!

Below is a snapshot of DivGro's existing home run stocks, sorted by annualized returns (>1 year):

Twenty-eight of my existing positions are home run stocks. The Information Technology stocks MSFT, AAPL, TSM, and INTC top the list based on annualized returns. I'm also happy that some of my growth stocks, PINS, NFLX, and AMZN are near the top of the list as well.

Home Run #32

My 32nd home run stock is Alphabet Inc (GOOG), a company that provides online performance and brand advertising services in the United States and internationally.

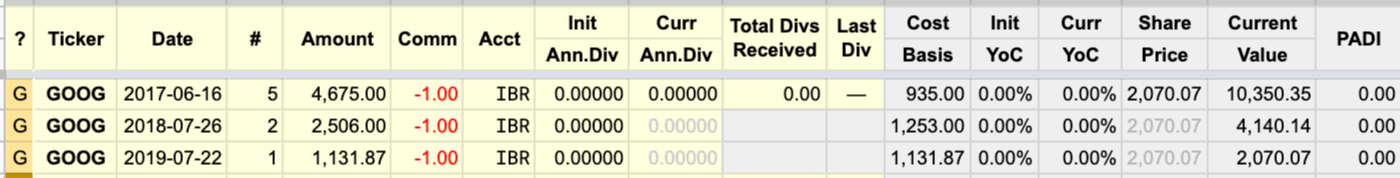

I first opened a position in GOOG on 16 June 2017, paying $935 per share for five shares. Since then, I've added three more shares on two other occasions. GOOG is a growth stock that does not pay dividends. I call GOOG and the few other growth stocks in my portfolio that don't pay dividends, my future dividend growth stocks.

Below is a summary of my GOOG transactions showing the cost basis of each transaction:

Here is a price chart of GOOG indicating my trades:

Source: Trading View

I'm happy with the timing of my buys and with GOOG's overall performance. My GOOG position shows annualized returns of 33%!

Home Run Contenders

There are two stocks in my portfolio with total returns above 80%:

- Lowe's Companies, Inc (LOW) -- total returns of 90%

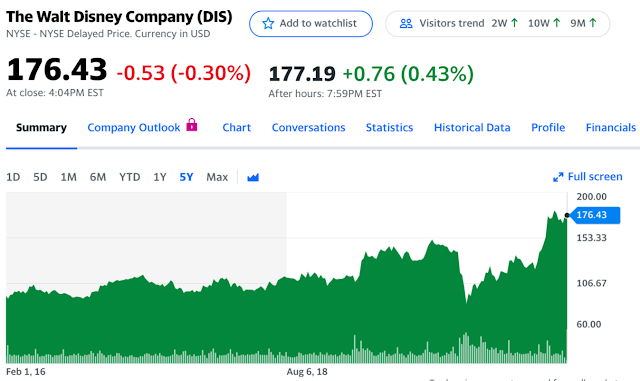

- The Walt Disney Company (DIS) -- total returns of 87%

|

|

Source: Yahoo! Finance

It is not obvious to see which of these stocks has the momentum advantage, but LOW has a slight lead over DIS. We'll see which one achieves home run status first!

Concluding Remarks

With returns exceeding my initial investment, GOOG is the latest home run stock in my DivGro portfolio. I'm looking forward to seeing which stock becomes my 33rd home run!

Disclaimer: I'm not an investment professional or a licensed financial advisor. This article represents my personal views and decisions, which may not be appropriate for other investors. ...

more