Home Depot Rises On Q1 Earnings & Sales Beat, Upbeat View

The Home Depot, Inc. (HD - Free Report) has posted first-quarter fiscal 2022 results, wherein earnings and sales beat the Zacks Consensus Estimate and improved year over year. The company gained from the continued strong demand for home-improvement projects, robust housing market trends, and ongoing investments. It has reported robust average ticket growth amid the inflationary cost environment, boosting the top line.

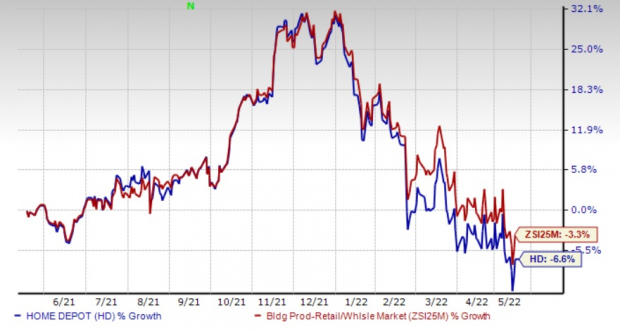

Shares of the leading home improvement retailer rose 3.7% in the pre-market session, following the strong results and raising the fiscal 2022 view. The Zacks Rank #3 (Hold) stock has lost 6.6% in the past year compared with the industry's decline of 3.3%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Home Depot's earnings of $4.09 per share improved 6% from $3.86 registered in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate of $3.66.

Net sales advanced 3.8% to $38,908 million from $37,500 million in the year-ago quarter and significantly beat the Zacks Consensus Estimate of $34,492 million. This marked the company’s highest first-quarter sales in its history. Sales benefited from the continued robust demand for home-improvement projects.

The company’s overall comparable sales (comps) grew 2.2%, with a 1.7% improvement in the United States. In the reported quarter, comps were aided by an 11.4% rise in average ticket, driven by high-value purchases by home builders. This was partly offset by an 8.2% decline in customer transactions. Sales per square foot improved 2.7% in the reported quarter.

The Home Depot, Inc. Price, Consensus, and EPS Surprise

(Click on image to enlarge)

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

In dollar terms, the gross profit increased 3.2% to $13,145 million from $12,742 million in the year-ago quarter, primarily driven by robust sales growth. This was partly offset by a 4.1% increase in the cost of goods sold. Meanwhile, the gross profit margin contracted 20 basis points (bps) to 33.8% from 34% in the year-ago quarter.

The operating income increased 2.6% to $5,929 million, while the operating margin contracted 20 bps to 15.2%. The operating margin benefited from top-line growth, offset by a gross margin contraction, as well as higher SG&A and other operating expenses.

Balance Sheet and Cash Flow

Home Depot ended first-quarter fiscal 2022 with cash and cash equivalents of $2,844 million, long-term debt (excluding current maturities) of $39,158 million, and shareholders' deficit of $1,709 million. In the first-quarter of fiscal 2022, the company generated $3,789 million of net cash from operations.

In first-quarter fiscal 2022, it paid out cash dividends of $1,962 million and repurchased shares worth $2,308 million.

Fiscal 2022 View

Following a strong start to the year, Home Depot raised its guidance for fiscal 2022. HD anticipates sales and comps growth of 3% in fiscal 2022 compared with the slightly positive growth mentioned earlier. The operating margin is estimated to be 15.4%. Earlier, the company expected the operating margin to be flat with the fiscal 2021 reported level. Net interest expenses are expected to be $1.6 billion compared with the $1.5 billion stated earlier. It continues to expect an effective tax rate of 24.6%. The company estimates earnings per share growth in the mid-single digits for fiscal 2022 versus the low-single-digit growth stated earlier.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more