High Dividend 50: AT&T Inc.

In this article, we will analyze the telecom behemoth AT&T Inc. (T).

Business Overview

AT&T is a leading telecommunications company, that provides a wide range of services, including wireless, broadband, and television. The company is made up of three operating segments.

First, AT&T Communications provides communications and entertainment services through mobile and broadband. The segment serves over 100 million U.S. customers and nearly 3 million business customers. In 2021, this segment generated $114.7 billion in revenue.

Second is WarnerMedia, the world’s leading producer of film and television programming. WarnerMedia creates and distributes feature films, television, gaming, and other content across the globe. Some brands include HBO, Warner Bros. and Xandr. In late December 2021, the company announced it would sell advertising marketplace Xandr to Microsoft. WarnerMedia generated $35.6 billion in 2021 revenue.

And lastly is the AT&T Latin America segment, which provides mobile service to consumers and businesses in Mexico. The Latin America segment generated $5.4 billion in revenue in 2021. However, to note, is that the company sold off the Vrio video operations in mid-November 2021, which was responsible for $2.7 billion of the $5.4 billion in that time period.

AT&T is a large-cap stock with a market capitalization above $160 billion. The company has generated steady profits and strong cash flow for many years.

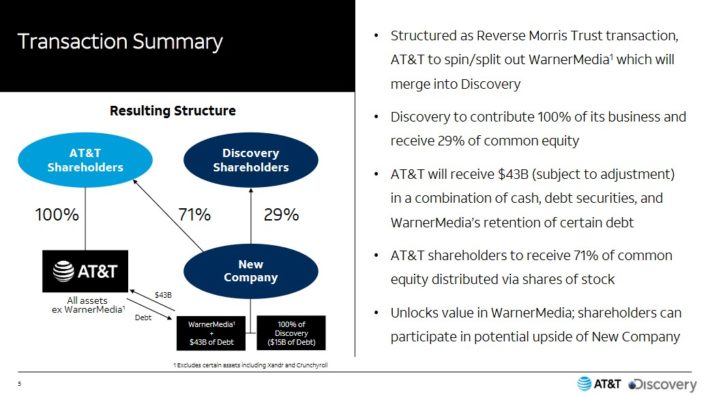

The company made a tremendous announcement on May 17th, 2021, with an agreement to combine WarnerMedia with Discovery, Inc. (DISCA) to create a new global entertainment company.

Source: Investor Presentation

Under the terms of the transaction, AT&T will receive $43 billion in a combination of cash, securities, and retention of debt. Additionally, AT&T shareholders receive stock representing 71% of the new company, with Discovery shareholders owning 29%.

The new media company will combine HBO Max and Discovery+ to compete in the direct-to-consumer business, bringing together names like HBO, Warner Bros., Discovery, CNN, HGTV, Food Network, TNT, TBS, and more.

On January 26th, 2022, AT&T reported Q4 and FY 2021 results for the period ending December 31st, 2021. For the quarter the company generated $41.0 billion in revenue, down -10.4% from $45.7 billion in Q4 2020, as a result of divested businesses and lower Business Wireline revenues. On an adjusted basis, earnings-per-share equaled $0.78 compared to $0.75 in the year-ago quarter.

For the year AT&T generated revenue of $168.9 billion, down -1.7%. Adjusted earnings-per-share equaled $3.40 compared to $3.18 in 2020. AT&T’s net debt-to-EBITDA ratio was 3.22x at the end of the year.

AT&T also provided a 2022 outlook. The company anticipates low single-digit consolidated revenue growth and $3.10 to $3.15 in adjusted EPS.

Growth Prospects

AT&T is a massive business, and as the law of large numbers dictates, the company grows very slowly.

The company took on loads of debt to fund acquisitions, such as DIRECT-TV in 2015 and Time Warner in 2018, in addition to other bolt-on acquisitions. Paying down this significant accumulated debt took its toll on the company and prevented it from investing as much as it otherwise would have been able to into its main business, telecommunications.

Source: Investor Presentation

AT&T expects to spend tremendously on capital investments in the next couple of years on its telecom business. In 2022 and 2023 each, the company anticipates capital investments of $24 billion. Starting in 2024, these investments should diminish, but still remain at about $20 billion.

The new AT&T will be a simpler and more focused company and have a goal of becoming America’s best broadband provider. This title would be appointed based on its network with fiber at its foundation. Through its fiber expansion plans the company expects to add 3.5 million to 4 million customer locations each year. It’s business customer locations should double to 5 million.

The company will strengthen the balance sheet by reducing its net debt with its free cash flow after dividends. AT&T believes they can reduce the net debt to adjusted EBITDA ratio to 2.5x by the end of 2023. After having separated its media business, AT&T’s renewed focus on telecom will benefit from the fact that they no longer need to invest in wireless network infrastructure and media assets at the same time.

For 2022 and 2023, the company is anticipating low single-digit revenue growth, as they adjust to the new makeup of the company. Growth will come from an increase in wireless service revenues and broadband revenue. Additionally, in 2022 and 2023, AT&T should see another $2.5 billion in cumulative cost savings, which in effect will fuel growth in adjusted EBITDA.

Also, existing shareholders will receive 71% of the new media company, which could benefit their investment portfolios. At the time, there is no indication that this new media company will pay dividends.

Competitive Advantages & Recession Performance

AT&T has a competitive advantage with its entrenched position in various important industries. The company also operates a recession-resistant business. AT&T enjoys steady demand, as most consumers require their broadband and wireless service, even during recessions.

AT&T’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $2.76

- 2008 earnings-per-share: $2.16

- 2009 earnings-per-share: $2.12

- 2010 earnings-per-share: $2.29

AT&T experienced some earnings decline during the Great Recession, but the company remained highly profitable. This allowed it to continue growing its dividend throughout the time period and beyond. AT&T eclipsed its pre-recession earnings level, but it took until 2016. Still, the company paid a dividend that was well covered throughout the last decade.

In the COVID-19 pandemic year of 2020, the business held up quite well. While many businesses faced tremendous challenges due to the pandemic, AT&T generated strong cash flow and had a payout ratio below 70%.

Dividend Analysis

Following the Time Warner acquisition, AT&T& faced difficulties in growing its dividend meaningfully. After 36 years of consecutive dividend increases, AT&T kept its dividend steady and lost its Dividend Aristocrats status in 2021. One could consider that AT&T is utilizing the spinoff as a way to reduce its dividend payment to shareholders. In turn, this will afford the company the funds for its massive capital investment plans.

At the time of this writing and according to the company’s latest dividend paid on February 1st, 2022, the annual dividend was $2.08. With its current share price, AT&T is yielding 9.0% based on this dividend. Based on the company’s forecasted adjusted EPS of $3.10, the company would be paying out 67% of 2022 earnings as dividends. However, the situation will be changing quite soon.

AT&T announced on February 1st, 2022 that it will reduce its dividend from $2.08/share to $1.11/share along with the spinoff. By spinning off its media assets, the company will be faced with a significant drop in revenue and cash flow.

The updated dividend of $1.11/share equals a current dividend yield of 4.8%. This is significantly lower than what shareholders would have otherwise earned in dividends, as we calculated above would be 9.0%.

With the lower anticipated payout, the new AT&T may return to increasing the dividends once its new structure has been digested. And 4.8% is still a respectable and high yield. Not to mention, this updated dividend represents only 40% of projected free cash flow of the new AT&T.

Final Thoughts

AT&T should benefit from its renewed focus on its main telecom business, as it spins off its media assets and reduces its dividend. Its slimmed-down business and improved efficiency should allow it to improve the balance sheet and continue to make massive capital investments in its expansion.

This new business structure comes with a reduced dividend, which income investors may shy away from. AT&T had paid a safe and high yield for many years, and a large portion of the shareholder base likely owned shares for this reason.

The company’s new anticipated 4.8% yield is still fairly high in this low-rate environment though. Also, the new media company spin-off could add to shareholders returns in the long run, but it is fairly speculative. The combined media assets are strong.

AT&T’s new dividend is predicted to be safe at only 40% of projected free cash flow. However, this spin-off cost the company its Dividend Aristocrats status. Following the digestion of the new business structure, AT&T may reinstate its annual dividend increases.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more