Hidden Value In These Stocks When Rates Move Up

Some savvy investors in Fannie Mae (FNMA) and Freddie Mac (FMCC) know a little secret that hasn't got much attention. That little secret is the hidden value of guarantee fees. While the companies have been forced to send all of their profits to the U.S. Treasury over the past few years, this little gem stays hidden off the balance sheet due to some fuzzy accounting.

There's nothing funny going on here. They're actually accounting for these guarantee fees just as GAAP accounting recommends (probably). The accountants don't want them to recognize an asset for the guarantee fees. For some reason, these little gems stay hidden even though they have BILLIONS of dollars in potential value. While it may be difficult to calculate the full value of Fannie Mae and Freddie Mac's guarantee fees, a quick comparison to mortgage servicing rights gets us a lot closer to an accurate accounting.

What is a guarantee fee?

Like any insurance company, Fannie and Freddie charge a premium for their service of ensuring each mortgage-backed security (MBS). The guarantee fee is simply a small sliver of each mortgage payment which is collected and retained by the GSE's and used to offset any potential losses. Since 2014, guarantee fees have been about 58 basis points (bp).

Most insurance companies earnings are retained and kept set aside for future losses. With Fannie and Freddie they have not been allowed to do this. Regardless, the guarantee fees keep coming in every year and if Treasury and FHFA decide to change the rules, they could actually begin to retain these fees.

To further understand guarantee fees you must also understand other types of similar arrangements. One type of similar arrangement is called a mortgage servicing right (MSR). Like the guaranteed fees, the mortgage servicing right is a sliver of each mortgage payment which is set aside to cover expenses. In this case the mortgage servicing right covers the expenses associated with servicing the mortgage as a financial company. So, if you send your payment to Bank of America, for instance, Bank of America gets to keep a sliver of each mortgage payment as a servicing fee. They show the servicing fee on their income statement each period. When a borrower pays off a mortgage, they stop sending mortgage payments and the fees also stop coming in. So, there is some uncertainty with these payments.

Mortgage servicing fees typically run about 25 to 50 basis points per period. So, in general, the servicing fees are about half of the amount of a guarantee fee.

Even with the uncertainty associated with collecting future payments, under GAAP accounting, most companies actually show the value of these mortgage servicing rights on their balance sheet. And if the value of the mortgage servicing right changes, due to market fluctuations, they must actually show a profit or loss from the value of that will be servicing right in the income statement. So these assets are fully on the books, both on the income statement and on the balance sheet.

You might have already come to the realization that guarantee fees and mortgage servicing rights are very similar. The likelihood of a borrower refinancing should be factored into the value of the MSR just in the same way that you could factor in that value into a guarantee fee asset. So looking at these assets in a similar way, we could probably figure out some type of value for a guarantee fee.

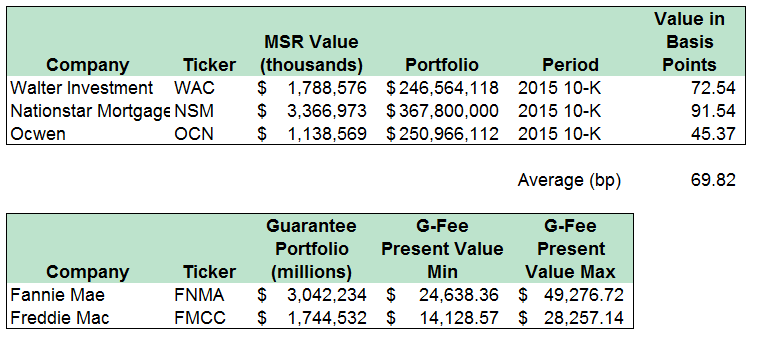

Let us start by looking at the value of mortgage servicing rights at some well-known financial services companies. For this analysis, we look at the total value of the mortgage servicing right as a percentage of the total asset value of the mortgages that are being service it serviced. We will use three of the largest non-bank mortgage servicers in the United States, Ocwen (OCN), Nationstar (NSM), and Walter (WAC).

As you can see, mortgage servicing rights typically run about 70 basis points of the total value of the assets being serviced. This is during an especially difficult period of low interest rates. Low interest rates cause a high number of mortgage prepayments, lowering the value of the mortgage servicing right. Now let's take this one step further, Fannie Mae and Freddie Mac have a total portfolios of $3 and $1.7 trillion dollars. Using the estimated value of MSRs as a percentage of the portfolio, with an understanding that guarantee fees run about 58 basis points and mortgage servicing fees are about 25 to 50 basis points, we can quickly create a value. In a quick analysis, we can see that the value of the guarantee fee assets may be between $38 billion to $78 billion. This guarantee fee asset is intangible and off of the books. The current accounting does not bring these assets into the financials.

Readers should be aware that these are very quick estimates. There are numerous differences between guarantee fees and mortgage servicing rights. Additionally, the portfolios of the three non-banks used in the analysis differ from the portfolios of the government sponsored entities. A full GAAP analysis of the assets would need to include a discount rate as well. So, do your own due diligence.

One final note, as interest rates begin to move up, the value of mortgage servicing rights and guarantee fees will also go up. This is due to a lower number of mortgage prepayments in the form of refinance transactions. Expect all of the non-banks mentioned in this analysis to show higher profits in conjunction with higher interest rates.

Disclosure: Long Impac Mortgage (IMH), Fannie Mae (FNMA), and Freddie Mac (FMCC), primarily in the form of preferred stock shares.