Here's What Traders Are Saying About Today's Freak Selloff

It came out of nowhere, and once it hit, it was fast and furious and eerily reminiscent of the liquidation-driven meltdowns observed in December 2018.

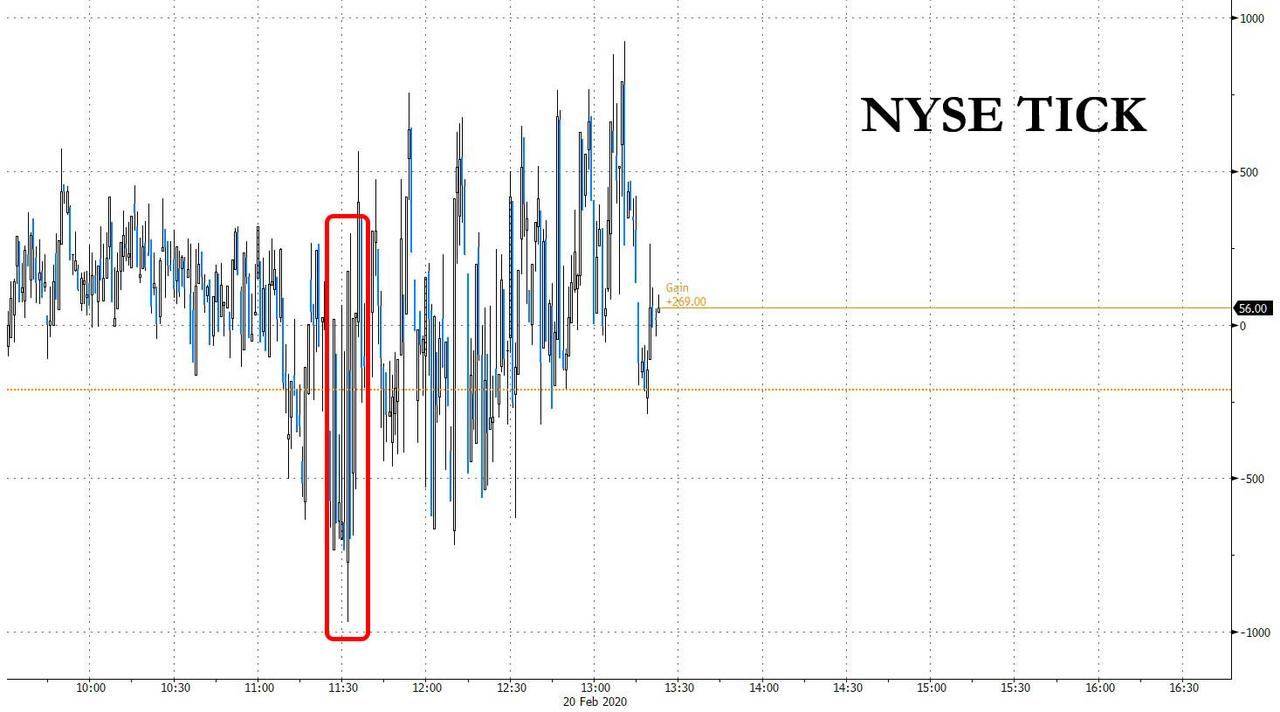

Today's freak selloff, which peaked just as Europe closed at 1130am ET (suggesting a European fund may have been behind the violent move), saw a surge in activity, focusing primarily on those momentum names that had soared in recent weeks on a flurry of call buying such as Tesla, Virgin Galactic, Plug Power, and the FAAMGs of course. And while it is still unclear what triggered the selling, we do know that once the avalanche started, it was straight down, as the NYSE Tick index dropped as low as -968 just as Europe closed, meaning almost 1000 more stocks traded on a downtick than an uptick...

(Click on image to enlarge)

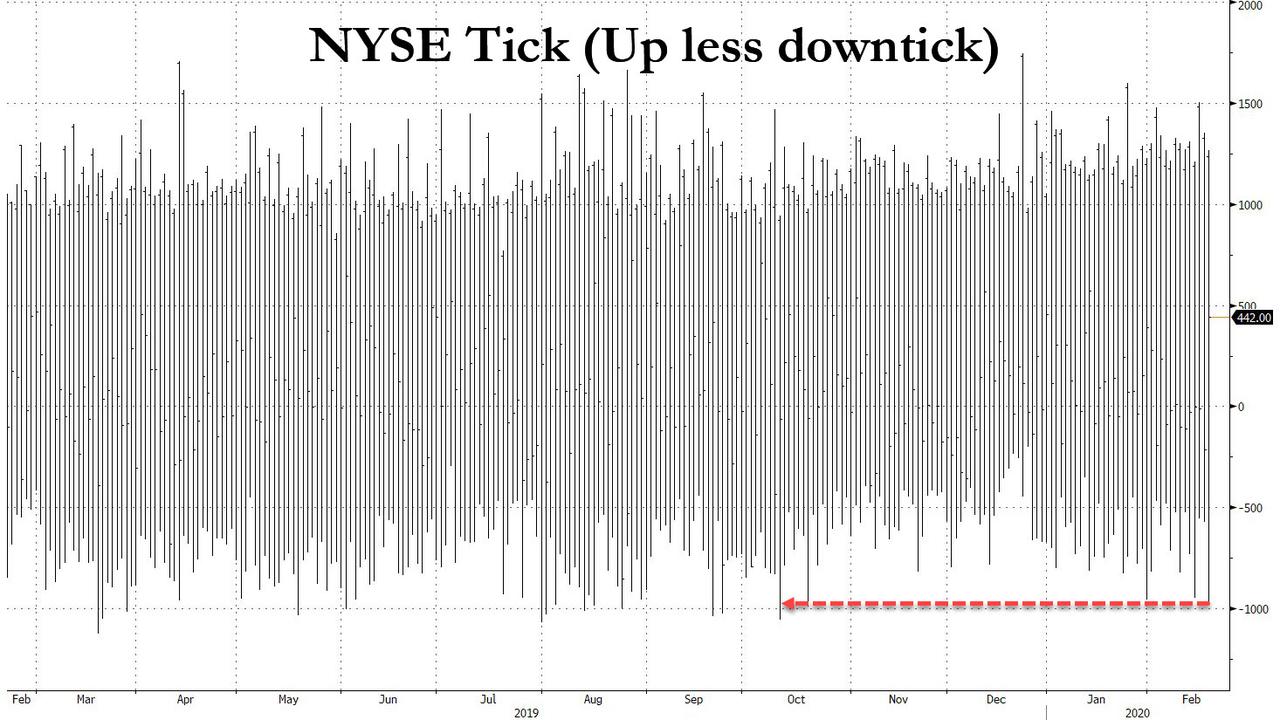

... amid the burst in market sell orders - according to Bloomberg there were 225,000 S&P 500 e-minis futures contracts changed hands from 11:30 a.m. to 11:40 a.m., more than double the volume in the previous 10 minutes - which dragged the TICK index to the lowest level since the early October selloff just before the Fed launched QE4 and pushed the S&P to session lows.

(Click on image to enlarge)

So with everyone speculating what caused the selling, and if it is a harbinger to a broader crash, whether in various bubbly factors or the overall market, here is a recap of what some traders are saying:

Thomas Thornton, founder of Hedge Fund Telemetry:

Stocks globally are trading heavy today and there doesn’t seem to be any new reason that we haven’t been living with for weeks and months. Could it be Bernie Sanders is looking more like the Democrat candidate with Mike Bloomberg’s lackluster debate performance last night? Coronavirus? Earnings? Higher USD? Again, all of this is nothing new. A Goldman Sachs analyst said market not factoring in coronavirus and lack of earnings growth and elevated market multiple. Hardly a revelation yet I agree. Back in March 2000, I remember when Abbie Joseph Cohen said something similar causing quite a pullback and ultimately a market top. There’s been a lot of evidence of excessive speculation within the options markets that I highlight below. I’ve been neutral on the S&P and Nasdaq for weeks allowing the speculation to cool off and perhaps that’s what is happening to today.

Max Gokhman, head of asset allocation for Pacific Life Fund Advisors:

“We opened up OK in the U.S. with claims in line with survey and Philly Fed ahead of expectations but on the flip side we had the first coronavirus fatalities in Japan and South Korea,” he said. “It’s more of an IT and health care down day. On the former I’d say it’s due to concerns about components. South Korea especially, but also Japan, are big parts of tech hardware supply chains. So far as health care may actually be due to how strong Bernie and Warren looked yesterday at the debates.”

Quincy Krosby, chief market strategist at Prudential Financial Inc.:

“It’s the cautionary tone from investment banks and analysts suggesting the market is too sanguine about the risk of coronavirus. When you see that underscored with gold climbing higher despite a stronger dollar and money coming into the Treasury market pushing the yield down -- that’s the market acting and suggesting there is more to go on the coronavirus,” she said. “The pullback isn’t dramatic, but it did gain some steam. I think it’s a combination of the analyst calls on it and the idea that the ramping up of manufacturing in China has begun but it’s slower than expected.”

Willie Delwiche, an investment strategist at Baird:

“The bullish case is that the viral impact would be contained -- there’s uncertainty about the impact but that it would be contained to an area in China. If you have evidence that it’s spreading elsewhere, if it’s going to Beijing or a spike in Korea, it’s small numbers but again it’s the uncertainty of how this unfolds that I think is -- given the move we’ve seen in equities, given how equities seem priced for perfection -- there can be a sell-first-ask-question-later if you get some bad news. That might be the type of thing that you get with headlines about whether it’s spreading or not.”

Peter Mallouk, president of Creative Planning:

“The coronavirus thing continues. It’s pretty clear that it’s disruptive in Asia and it’s going to disrupt production and manufacturing and pricing which then is going to impact, to some degree, the earnings of U.S. companies and global companies. You saw Apple say that. The market is starting to price that in. I mean, the market has been priced to perfection, large U.S. stocks have been priced to perfection for a long time. It doesn’t mean they can’t go higher but they’re pricing in a global economy that’s functioning where people are healthy and buying stuff and we’re not in a trade war and interest rates are low. They’re pricing in all of those things.”

Steve Sosnick, chief strategist at Interactive Brokers:

“That it’s happening the day before expiration probably exacerbated the pain for those who are short gamma. There are a lot of profits to be protected and stops are normally a great way to do that. Except for the fact that stops often trigger other stops and liquidity dries up when you need it. Interesting that the most speculative names -- Tesla, Virgin Galactic, Plug Power -- are among the hardest hit.”

Kevin Caron, portfolio manager for Washington Crossing:

“I would attribute today’s move to continued concerns about coronavirus. To the extent that this is still front and center in the news flow, until we see the rate begin to roll over and to the extent we see any expansion of the outbreak beyond Chinese borders, there’s going to be concern. After a year of subpar global growth, the positive outlook would be that we see growth firm up globally and turn around. When we came into the year, we saw some signs of that. Over the last several weeks, the coronavirus has become an outside shock to the outlook. This is obviously not something that helps to create global growth.”

Some quotes courtesy of Bloomberg

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more