Here's The Reason Why Marchex's Owner Is Regularly Buying Stock

TM Editors Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

Call analytics company Marchex (MCHX) has been stuck in a price band between $2.45 and $5.50 and was quoting $3.42 as of Feb 14, 2020. The stock looks like a laggard on the charts and any trader or investor would not give it a second glance because there are loads of exciting stocks to chase in this age of volatility.

(Click on image to enlarge)

The performance is nothing to speak of (Q4 EPS at $0.01) and it does seem that the stock will have to learn to walk before it can run.

Why then is Marchex’s 10% Owner, EdenBrook Capital, buying Stock at regular intervals? What is brewing inside Marchex that we are not aware of?

(Click on image to enlarge)

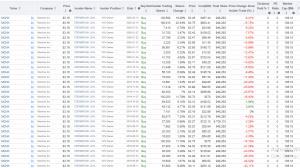

Edenbrook Capital is a small hedge fund that invests in small caps and its current portfolio value is $351 million. The only way to find out if Edenbrook was doing the right thing in buying MCHX was to check its track record, and I did just that.

Edenbrook Capital’s 2018 Track Record

In Jan and Feb 2018, Edenbrook Capital purchased 350,641 of Brightcove (BCOV) at prices between $6.44 and $7.32. This is how BCOV did:

(Click on image to enlarge)

BCOV touched a high of $13 by mid-2019 and that’s almost 100% gain in 18 months. It retraced quite a bit since its highs but is still above Edenbrook’s average purchase price.

Edenbrook also purchased 565,465 shares of Telaria (TLRA) in July- Aug 2018 at prices between $3.45 and $4.01. It picked up another 400K shares at $2.21 in Oct 2018. Here’s what happened to TLRA:

(Click on image to enlarge)

The stock’s at $11.81 as of Feb 14, 2020, and that’s a gain of more than 200% over the purchase cost.

This kind of sealed it for me. Edenbrook was a sharp and savvy small-cap stock picker.

The next thing was to check what’s going on with Marchex.

Key Notes from Marchex’s Q4 2019 Earnings Call

1. The management team at MCHX reckons that if it leverages the conversational data it has amassed while measuring inbound phone calls, it could open up a multibillion-dollar opportunity.

2. MCHX is investing in Artificial Intelligence (AI), which it figures is the future of call analytics. The company’s AI-powered solutions are expected to help businesses increase sales efficiency and customer satisfaction.

3. In Q$ 2019, MCHX acquired Sonar Technologies, an enterprise text and messaging sales system. The acquisition will help MCHX add text and messaging analytics to its existing business.

4. The company’s recruited John Roswec as its Chief Revenue Officer, and I think this is a very significant development. Before joining MCHX, John was the Executive VP of Criteo Brand Solutions for Criteo SA. John also successfully increased revenue at Aquantive, which was taken over by Microsoft.

The Verdict

MCHX may seem an unexciting stock as of now, but it has many drivers going for it. The biggest of them all is the regular purchase of its stock by Edenbrook Capital, its 10% owner. Edenbrook’s earlier small-cap purchases hit the bullseye and MCHX can work out too. Joh Roswec, the new sales chief, is another bullish factor.

Then there’s the acquisition, the investment in AI and the fact that the use of smartphones in B2C is increasing. Smartphones have turned into personal shopping assistants. If MCHX can develop a tool by converting the conversational data it has gathered into targeted actionable intelligence, it will hit the jackpot.

I’m bullish on the stock. Risk-takers in for the long-term can consider buying MCHX. Conservative investors who like to fish for 5-baggers can consider buying the stock in a SIP (Systematic Investment Plan).

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more