Heavy Insider Buying Could Signal Big Rallies For These 3 Stocks

I look for many things before making an investment in a small biotech firm. I like to see “multiple shots on goal”, interesting technology, a solid balance sheet, and analyst support. On top of this, one correlation I have noticed over two decades investing in the biotech sector is the uncanny “coincidence” how many stocks that eventually stage huge rallies have insider buying or significant purchases from heavy hitters prior to their rise.

I am constantly on the lookout for this kind of buying as it can be a harbinger of finding the next biotech rocket such as Avanir Pharmaceuticals (NASDAQ: AVNR) or Eagle Pharmaceuticals (NASDAQ: EGRX), both of which have provided over 200% returns since inclusion into the Small Cap Gems portfolio.

My regular readers know, to properly mitigate risk and succeed in this sector, I use my “Shotgun Investing” philosophy. This strategy consists of taking small stakes in many promising stocks across a vast cross-section of these highly volatile areas. Using this strategy, I can diversify my portfolio effectively while also maximizing my exposure to the small cap rockets like Eagle and Avanir.

Regardless of how good an investor one is, there will be frequent blow ups in these sectors as developing and successfully bringing a drug to market is a complicated affair. To put in context, the FDA only approved 41 new drugs in 2014 and that was up significantly from recent years. However, done right the occasional five or ten bagger in this space will more than make up for any “strike outs”.

Here are a few small biotech stocks that have garnered considerable interest recently from notable investors as of late.

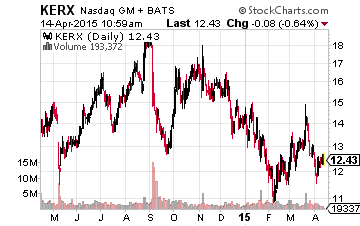

First up is Keryx Pharmaceuticals (NASDAQ: KERX), a company focused on developing therapies for patients with renal diseases. Secretive and multi-billionaire hedge fund manager Seth Klarman has been has building a huge position in this stock with a market capitalization just north of $1 billion. Klarman’s fund Baupost has amassed a position over $250 million in Keryx according to the latest 13F filings.

The company just started shipping Auryxia late in 2014. Auryxia is an absorbable-iron-based phosphate binder approved for the control of serum phosphate levels in patients with chronic kidney disease. This compound will be the company’s key growth driver in the years ahead. Some analysts were projecting $400 million of sales and $200 million in profit in FY2017 a few months ago for the company. Auryxia’s slow rollout has tempered that enthusiasm a bit but the consensus has Keryx racking up more than $150 million in sales in FY2016 up from just over $10 million in revenue in FY2014.

Coffers are flush since a $100 million secondary offering to begin 2015. This negates any need to raise additional funding in the foreseeable future. Keryx does not have the pipeline I usually like to see in the small biotech space. However, Auryxia could develop into a major drug. The compound could get approved in 2016 for an expanded group of kidney patients due to probable efficacy and safety data and should garner approval for current uses in the European Union later this year. The stock sells just north of $12.00 a share after a recent slide. Roth Capital, J.P. Morgan, Maxim Group, and Stifel Nicolaus have all reiterated “Buy” ratings on the stock over the past month or so. Their price targets for KERX range from $19.00 to $32.00 a share.

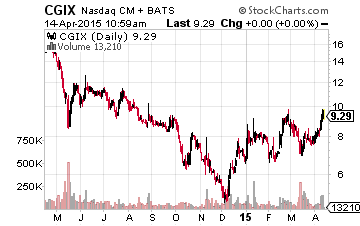

Next up is Cancer Genetics (CGIX) where under the radar investor John Pappajohn is involved in as a director. Mr. Pappajohn – not the pizza guy – has been a serial investor for decades and has used his wealth accumulated from these successful investments to seed and build myriad entrepreneurial centers at numerous college campuses across this great land.

Cancer Genetics is focused on developing and commercializing DNA-based tests and services to enhance and personalize the diagnosis, prognosis, and treatment of targeted cancers. Mr. Pappajohn and one other director have been frequent if small purchasers of this stock recently. Cancer Genetics has an approximate $100 million market capitalization of which over 20% consists of net cash on the balance sheet. The consensus has annual revenue going from just over $10 million in FY2014 to over $30 million in FY2016. The stock trades at just over $9.00 a share. Both Janney and Cantor Fitzgerald have initiated or reiterated Buy ratings on the stock over the past month. Both have $13.00 a share price targets on the shares.

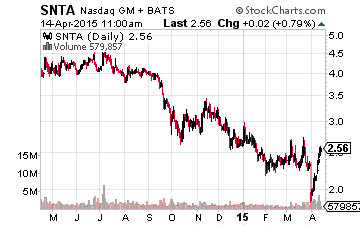

Finally, we have Synta Pharmaceuticals (NASDAQ: SNTA): one of the few small cap biotech picks that have not performed well in my “shotgun investing” portfolio over the past six months. I am somewhat encouraged to see billionaire investor Bruce Kovner buying some $12 million of a recent secondary offering of approximately $45 million. Also noteworthy is that two other directors also bought some $700,000 in new shares during the offering; this goes back to my comment earlier about insiders making purchases. The stock has a market capitalization of approximately $250 million, over 30% of which is represented by net cash on the balance sheet.

Synta is certainly not lacking for analyst support. The stock trades for $2.50 a share. The mean price target by the six analysts that cover the company is $8.75 a share currently. The company’s core product is “ganetespib,” which it is developing and testing as a treatment for non-small-cell lung cancer, breast cancer, and colorectal cancer. It has several trials ongoing and some important milestones later in the year. Hopefully positive results can boost the shares to previous levels and closer to analysts’ price targets.

Disclosure: Long SNTA

For more on how I find these winners and how you can too, more