Hard To Argue With Bulls Here

From my seat, the state of the market depends largely on the time frame lens one is viewing the market through. Looking at the action from a shorter-term perspective, volatility remains high due likely to the uncertainty over the fate of additional stimulus and the election. Shorter-term, the market appears to want more stimulus and an uncontested election. On that note, it will be interesting to see if the elevated volatility levels can recede once the election is out of the way.

From a longer-term perspective, things are in pretty good shape. The economy is growing - albeit at a significantly slower pace than pre-COVID. Rates are exceptionally low. The Fed is in a very friendly mode. Inflation is low. The calendar has historically favored stocks for the next several months. And corporate earnings are moving in the right direction again. The only fly in the ointment is the extremely high valuation levels. As I've opined in the past, this condition isn't out of the ordinary when the economy emerges from a recession. Yet at the same time, there can be no denying that valuations are higher than normal this time around. All in all, my stance hasn't changed, and I believe the bulls continue to deserve the benefit of any doubt here.

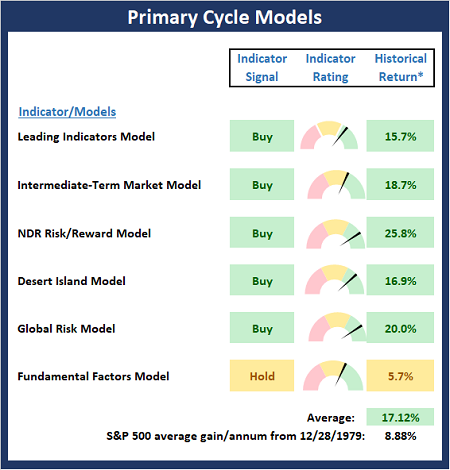

The Big-Picture Market Models

There are no signal changes on the Primary Cycle board this week. However, I think it is worth noting that the historical returns have improved a fair amount (17.1% vs. 11.8%) over that past two weeks as the readings on the Leading Indicators, Intermediate-Term Market, Risk/Reward, and Global Risk models have all increased since the last report. Given the state of the Primary Cycle board, it would be very hard for me not to side with the bull camp at this time.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

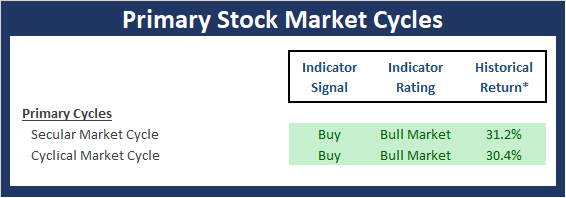

Checking On The "Primary" Cycles

While I don't often make portfolio adjustments based on the long-term trends in the stock market (aka the "primary cycles"), I have found over the years that checking in on state of the cycles and the weekly/monthly charts helps to keep the big-picture in perspective.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The Secular Market Cycle

Definition: A secular bull market is a period in which stock prices rise at an above-average rate for an extended period (think 5 years or longer) and suffer only relatively short intervening declines. A secular bear market is an extended period of flat or declining stock prices. Secular bull or bear markets typically consist of multiple cyclical bull and bear markets. Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 - Monthly

(Click on image to enlarge)

The Cyclical Market Cycle

Definition: A cyclical bull market requires a 30% rise in the DJIA after 50 calendar days or a 13% rise after 155 calendar days. Reversals of 30% in the Value Line Geometric Index since 1965 also qualify. A cyclical bear market requires a 30% drop in the DJIA after 50 calendar days or a 13% decline after 145 calendar days. Reversals of 30% in the Value Line Geometric Index also qualify. Below is a weekly chart of the S&P 500 illustrating the current cycle, which we estimate began on March 24, 2020.

S&P 500 - Weekly

(Click on image to enlarge)

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more