Guardant Health: Strong Momentum And Enormous Opportunities

Guardant Health (GH) is a high growth business with enormous potential and truly disruptive technologies. A position in Guardant Health carries significant risks in terms of both the business and the stock price. However, the long term upside potential may well be worth the risk.

Strong Growth And Abundant Potential

Guardant is a pioneer in liquid biopsies that detect cancer signals in the blood by analyzing fragments of DNA. Over the long term, the company is working on technologies for the detection of cancer at early stages, which could be a game-changer for patients. Early detection of cancer can significantly improve the effectiveness of treatments, potentially saving countless lives.

The company's Guardant360 platform detects genomic biomarkers in the blood in order to help doctors to find the most effective treatments for patients, and Guardant also provides the technology for other companies to develop and test different kinds of drugs.

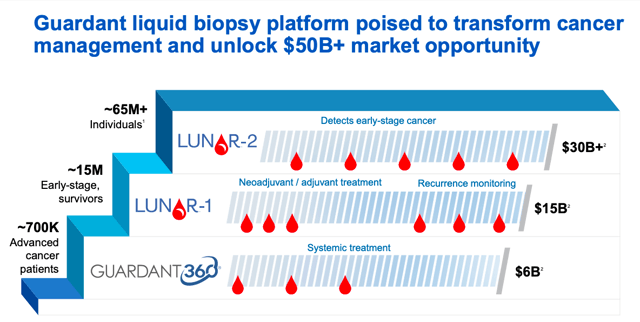

Management estimates that the size of the addressable market opportunity could be worth as much as $50 billion in the U.S. alone. Guardant is expected to make $277.78 million in revenue during 2020, so the company is barely getting started in terms of capitalizing on its long term growth opportunities.

Source: Guardant

The company is growing at an impressive speed. Management said during the most recent conference call that the business was starting to feel the impact of COVID-19 during the second half of March and into April, but the numbers for the first quarter of 2020 were still clearly strong.

Revenue reached $67.5 million during the period, an 84% increase versus the same quarter in the prior year. The increase was driven by significant increases in both testing volume and average selling price for ASP per test. Total precision oncology testing revenue for the first quarter was $60.2 million up 109% versus the same quarter in the prior year.

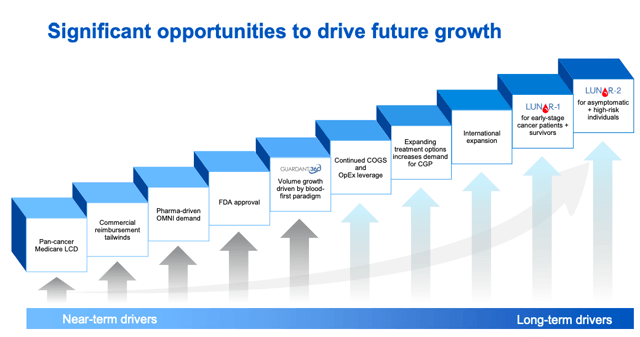

Source: Guardant

Precision oncology revenue from clinical tests in the first quarter totaled $38 million up 122%, and first-quarter clinical precision oncology volume totaled 15,257 tests, up 60%. Due to the COVID-19 pandemic, test volume was adversely in March, resulting in no growth from the prior quarter volume of 15,270 tests.

According to management, average daily clinical U.S. sample volume declined steadily across the last three weeks of March, bottoming approximately 30% below the average level in the first 10 weeks of Q1 2020. Clinical U.S. sample volume steadied at this level in the first three weeks of Q2, then picked up approximately 10% across the next two weeks of the second quarter.

Treatments for cancer patients cannot be postponed for too long, so it makes sense to expect the impact from the pandemic to be rather moderate for Genomic Health.

Gross profit margin in the first quarter of 2020 was 70%, a significant increase versus 63% during the first quarter of 2019. This increase was driven higher ASP with a contribution also from production and cost efficiencies. The company has a healthy balance sheet, ending the quarter with $758 million in cash and marketable securities.

Risk, Reward, And Timing Considerations

Guardant Health is a risky investment proposition, no doubt about that. The company will remain in aggressive investment mode over the years to come, and the path toward potential profitability could be rocky and hard to predict. Gardant is not the right bet for investors looking for companies that generate consistent and predictable cash flows.

Valuation is also quite demanding, as the stock is trading at a price to sales ratio around 32.7 times revenue. Guardant has enormous opportunities for growth, and the company could grow into its valuation if things go out well over time. Nevertheless, valuation is still a major risk factor to consider when assessing a position in Guardant Health, because at these prices the stock is clearly vulnerable to any disappointments.

Competitive risk is always relevant in such a dynamic industry, and Guardant faces competition from players such as Foundation Medicine, which is owned by Roche (OTCQX:RHHBF). Guardant will need to stay on top of its game and continue dynamically investing in research and development over the long term in order to protect its markets from the competition.

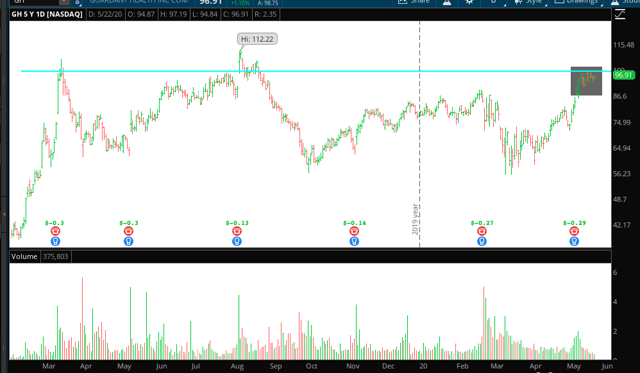

The timing for a position in Guardant Health is actually quite interesting. The stock is showing impressive momentum lately, and it is testing the important area of $100 per share. This area has worked as resistance on prior occasions both in March and in August of 2019.

Source: TOS

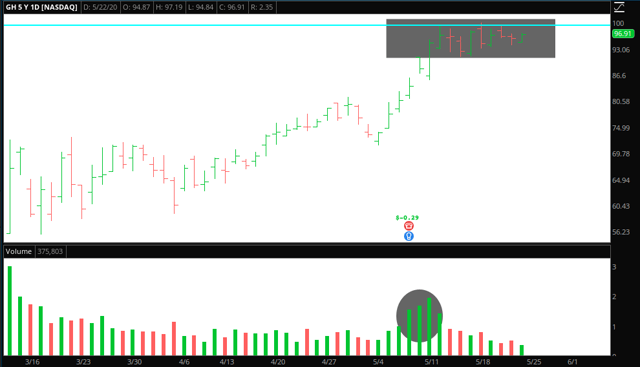

Zooming in into a shorter timeframe, we can see that Guardant stock has surged on very strong volume, and now it is tightly consolidating in a small range with very low volume. This price action looks quite solid, and a break above $100 per share could open the door to explosive returns in the near term.

Source: TOS

Not only is the stock price being driven by vigorous momentum, but Guardant Health is also firing on all cylinders in terms of fundamental momentum. This is a crucial consideration to keep in mind when analyzing valuation levels.

The current price of the stock is incorporating a particular set of expectations about the future of a company. If the company can perform consistently better than expected, this will drive increased expectations about future performance, and the stock price will tend to rise in order to reflect increasing growth expectations for the company.

Guardant has delivered revenue numbers above market expectations in every quarter since being a public company. The company had its IPO in October of 2018, so the track record is not particularly long, but it is in fact flawless in this sense.

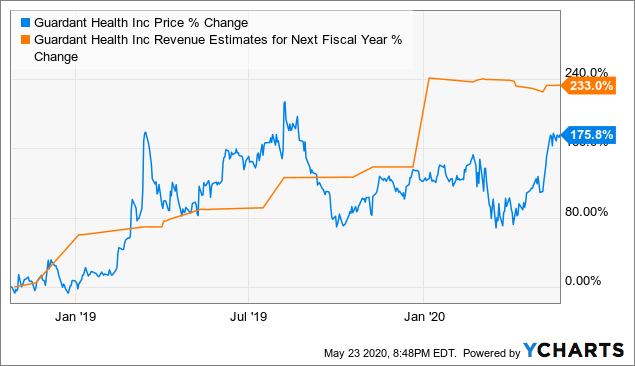

The chart below shows how revenue estimates for Guardant have significantly increased over time, as the analysts following the stock adjust their expectations for the company higher. If we compare the stock price with the evolution of sales estimates, revenue projections have increased more than the stock price in recent months.

Data by Ycharts

There are a lot of things that need to go well in order for Guardant Health to capitalize on its long term growth opportunities. Investors in the company need to be willing to tolerate significant risks and uncertainties going forward. However, management is proving that it can actually deliver, and the company has enormous potential for growth in the years ahead.

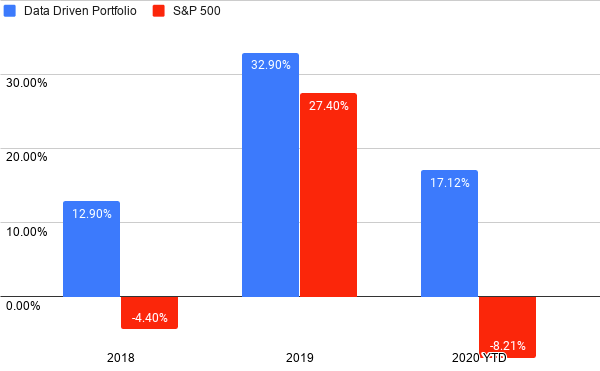

Performance as of May 24, 2020

Disclosure: Editors' Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.

I/we have no ...

more