GTY Technology - Stock Of The Day

Summary

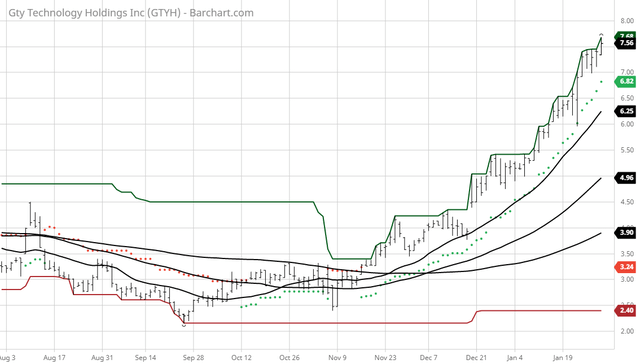

- 100% technical buy signals.

- 15 new highs and up 55.03% in the last month.

- 64.07+ Weighted Alpha.

The Barchart Chart of the Day belongs to the cloud-based software solutions company GTY Technology (Nasdaq: GTYH). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 11/17 the stock gained 131.60%.

GTY Technology Holdings Inc. operates as a software as a service company that offers a cloud-based suite of solutions for the public sector, in North America. The company develops software technologies for the procurement and vendor or supplier sourcing industry in government, public sector, and various highly-regulated commercial vertical markets; content, digital services, and integrated payments via a software-as-a-service platform for government agencies and utility companies. It also develops cloud-based grants management and cost allocation software for the state, local, and tribal governments; builds software to streamline municipal permissions and licenses; offers budgeting software, performance management, and transparency and data visualization solutions; and provides public sector budgeting software and consulting services. GTY Technology Holdings Inc. was founded in 2016 and is headquartered in Las Vegas, Nevada.

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- 64.07+ Weighted Alpha

- 27.32% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 15 new highs and up 55.03% in the last month

- Relative Strength Index 87.04%

- Technical support level 7.19

- Recently traded at 7.52 with a 50 day moving average of 4.96

Fundamental factors:

- Market Cap $411 million

- Revenue expected to grow 20.80% this year and another 22.60% next year

- Earnings estimated to increase 38.50% next year

- Wall Street analysts issued 1 strong buy and 1 buy recommendation on the stock

- 330 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more