Growlife: What It Needs To Get Higher

Growlife has declined by 88.7% (as of the writing of this article) since its peak on March 17, 2014.

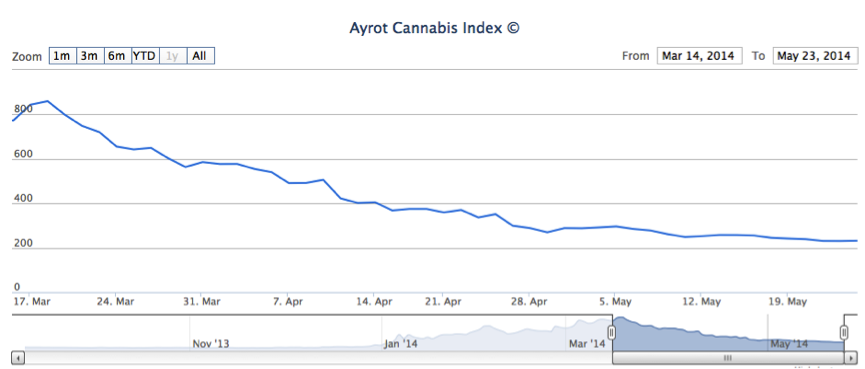

The decline has in part been due to a reduced retail interest in the cannabis industry, which has caused overall cannabis companies' share prices, as measured by the Ayrot Cannabis Index to fall by 72.5% since mid-March 2014.

[The company has other troubles, see this and this. ~ Talk Market editors]

The Ayrot Cannabis Index is an index that consists of 19 equally weighted stocks that are all related to the cannabis industry in some way. The 19 stocks are CannaVest Corporation (OTCQB:CANV), Cannabis Sativa, Inc. (OTCQB:CBDS), Cannabis Science, Inc. (OTCQB:CBIS), ENDEXX Corporation (OTCPK:EDXC), Fusion Pharm, Inc. (OTCPK:FSPM), GreenGro Technologies, Inc. (OTCPK:GRNH), GW Pharmaceuticals (GWPH), Hemp, Inc. (OTCPK:HEMP), mCig, Inc. (OTCQB:MCIG), Medbox, Inc. (OTCQB:MDBX), Medical Marijuana, Inc. (OTCPK:MJNA), Nuvilex, Inc. (OTCQB:NVLX), Growlife Inc., Vape Holdings, Inc. (OTCQB:VAPE), Plandai Biotechnology, Inc. (OTCQB:PLPL), Puget Technologies Inc (OTCQB:PUGE), Medical Cannabis Payment Solutions (OTCPK:REFG), Terra Tech Corp. (OTCQB:TRTC) and Aventura Equities, Inc. (OTC:AVNE).

As Growlife is still in the early stages of the financing cycle and therefore operates with negative free cash flow, the company’s ability to raise capital remains crucial for its future success. Without money, its creditors can force the company into bankruptcy.

How much liquidity does Growlife need?

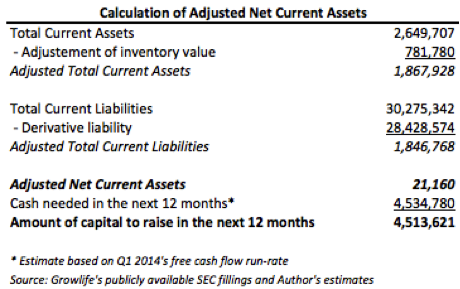

The company has been operating with negative free cash flow for the last couple of quarters. The run-rate based on the company’s last reported quarter, which was the first quarter of 2014 is negative free cash flow of approximately $4.53 million per year.

The company’s net current assets excluding the company’s derivative liability, as of March 31, 2014, was $802,939. The derivative liability is excluded due to the fact that it is a non-cash liability.

If we adjust the net current assets conservatively by halving the value of the inventory( in a fire sale the inventory’s would have to be reduced), the company’s adjusted net current assets is $21,159.5. The following table shows how the adjustments has been made and the amount of capital that the company needs to raise in the 12 months after March 31, 2014:

The company needs to raise approximately $4.5 million in the 12 months following March 31, 2014.

Beware: This is a penny stock. Penny stocks are notoriously at the mercy of pump and dump trading patterns. ~ Talk Market Editors