Green Thumb Industries Q1 Financial Results Remain Green

Green Thumb Industries Inc. (GTBIF), a constituent in the munKNEE Pure-Play MSO Pot Stock Index, reported its financial results today for the Q1 period ended March 31, 2021.

Q1 Highlights

(All results are presented in USD and compared to the previous quarter.)

- Revenue: increased 9.7% to $194.4M

- primarily driven by increased scale in the Consumer Packaged Goods and Retail businesses, especially in Illinois and Pennsylvania.

- Overall performance was driven by expanded distribution of Green Thumb’s branded products, 13 new store openings and increased traffic in the Company’s 56 open and operating retail stores.

- Gross Profit: increased 10.3% to $110.9M driven by increased scale in the Consumer Packaged Goods and Retail businesses

- As a % of Revenue: increased to 57.0% from 56.7%

- Net Income: declined 53.8% to $10.4M

- Net Profit/Share: declined to $0.05 from $0.11

- Adj. EBITDA: increased 9% to $71.4M

- As a % of Revenue: increased to 36.7% from 33.9%

- SG&A: increased 11.5% to $59.3M

- As a % of Revenue: declined to 30.5% from 33.9%

- Cash on hand: increased 229.2% to $275.9M

Q4 Operational Highlights

- Realized its 5th consecutive quarter of positive cash flow from operations, delivering $39.7 million.

- Raised $156M through direct public sales of approximately 4.7M shares in the Company’s U.S. initial public offering of securities.

- Entered the beverage category through a partnership with Cann, the leading cannabis-infused beverage brand.

- Grew comparable-store sales by 35% based on 40 stores that had been open for at least 12 months.

Management Commentary

Ben Kovler, Chairman, Founder, and CEO said:

- “...We are excited to expand our east coast footprint by signing an agreement to enter the Virginia cannabis market. This follows the recent sweep of adult-use legalization measures across Virginia, New York, and New Jersey where we see material untapped market potential.

- Our recent debt financing at industry-leading rates positions us to capitalize on the opportunities ahead. A strong balance sheet, supported by a low cost of capital, is key to staying ahead in this fast-paced new industry.

- As the green wave continues to gain momentum, it is more important than ever to maintain our focus on strong execution and high-value capital allocation.”

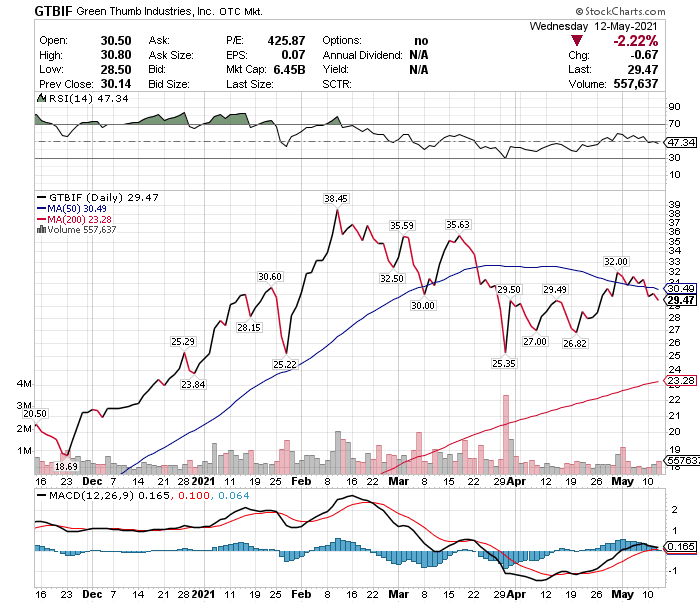

Stock Performance

Green Thumb is one of the 23 constituents in the munKNEE MSO Pot Stock Index and its stock price was +25.7% during Q1, is up +1.7% since then, and is +27.8% YTD as illustrated in the chart below:

If you found the above analysis of interest check out the other recent quarterly reports from Hexo, Columbia Care, Ayr Wellness, Aurora, Canopy, TerrAscend, Trulieve, Rubicon, Harvest Health, Valens, Cronos, Curaleaf, Tilray, and Organigram.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more