Green Thumb Industries Inc.'s Q1 Results Show Improved Revenue, Profit, Income And EBITDA Growth

Below are Green Thumb Industries Inc.'s (CSE:GTII; OTCQX:GTBIF) financial and operational results for its first quarter of fiscal 2020 ended March 31, 2020.

Green Thumb Founder & CEO, Ben Kovlersaid, “We achieved a major milestone in Q1 by breaking $100 million in revenue along with substantial EBITDA growth...[both of which] helped contribute to our positive free cash flow from operations."

Key Financial Highlights (All amounts are expressed in U.S. dollars unless otherwise noted, and are compared to the results achieved in Q4 of 2019.)

- Total Revenue: increased 35% to $102.6M

- Gross Profit: increased 30.5% to$53.0 million

- Gross Margin: 51.6% of revenue

- Net Income (Loss): loss reduced by 70% to ($4.2M)

- Profit (Loss)/Share: loss reduced by 71% to ($0.02)

- Adj. EBITDA: increased 85% to $25.5M

- SG&A Expenses: slightly reduced to 44.3% of revenue ($45.4M) from 61.6% of revenue ($46.7M) in Q4.

Key Operational Highlights

- Sold 2 facilities to (and leaseback from) IIPR which provided the company with $57.2M in non-dilutive capital.

- Increased product distribution into 42 retail locations in California, Colorado, Connecticut, Florida, Illinois, Maryland, Massachusetts, New Jersey, Nevada and Pennsylvania to support the execution of the Company’s plan to distribute brands at scale.

- Grew branded product sales by approximately 21% gross (13% net) quarter-over-quarter, driven primarily by expanded product distribution in what is now over 700 retail stores.

- Expanding the company's capacity according to plan in Illinois,Pennsylvania, New Jersey and Ohio with the latter two state facilities on track to contribute revenue in the third quarter 2020.

- Launched sales of the Rythm brand’s line of flower products in Maryland.

- Resumed sales of the brand’s vape products in Massachusetts following the lifting of the state’s ban on vape sales in the prior quarter.

- Launched 2 new products in Maryland under The Feel Collection and Big Dog brands.

- Launched a capsule product extension in Florida as part of the Dr. Solomon’s brand.

- Increased growth in comparable sales (stores opened at least 12 months) in excess of 75% on a base of 14 stores with sequential quarter-over-quarter comparable sales up 24% off a base of 33 stores.

- Increased retail revenue sequentially by 45% quarter-over-quarter, primarily driven by new store openings and growth generated from increased transaction activity in the Company’s retail stores.

- Opened three new retail stores: two ‘adult-use only’ stores in Illinois bringing total stores in the state to seven and one store in Pennsylvania bringing total open stores in the state to ten.

- Accelerated the buildout of its omnichannel infrastructure, including e-commerce, customer service, delivery, and curbside pickup, to better serve patients and customers during the COVID-19 pandemic.

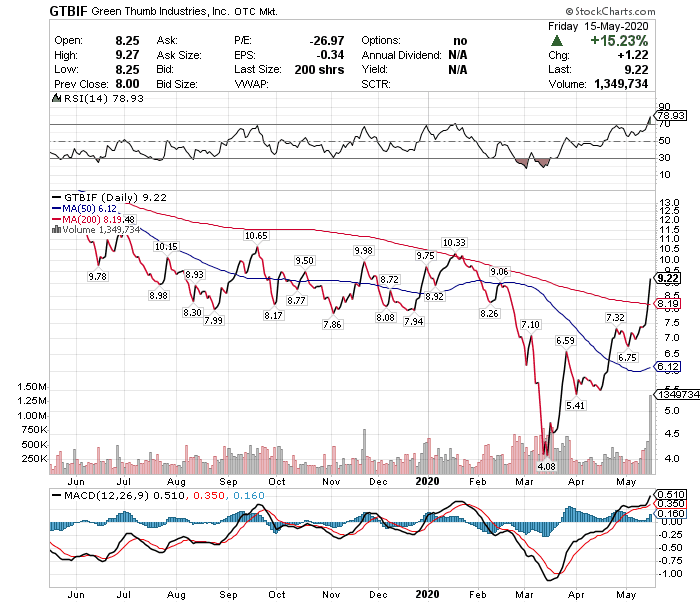

Stock Performance

Disclosure:

Editors' Note: This article discusses one or more penny stocks and/or microcaps. Such stocks are easily manipulated; do your own careful due diligence.