Google Tumbles After Revenue, Profit Miss; Breaks Out YouTube, Cloud For First Time

After the stellar earnings reports from Apple, Microsoft and Amazon (let's ignore Facebook for now), investors were expecting nothing but great news from the world's biggest search engine, Google, aka Alphabet, despite reports earlier today that DOJ officials are meeting with state attorneys general reps tomorrow afternoon to discuss their antitrust investigations of Google.

Alas, it was not meant to be, and moments ago Alphabet reported Q4 earnings that while beating on the bottom line, missed on revenues, operating margin and operating profit, to wit:

- Q4 EPS of $15.35 beat Est. $12.50

- Q4 Total Revenue $46.08BN missed Exp. $46.94BN

- Q4 Revenue Ex-TAC $37.57B missed Est. $38.40B

- Q4 Oper Margin 20% missed Est. 24.7%

- Q4 Oper Income $9.27B missed Est. $9.79B

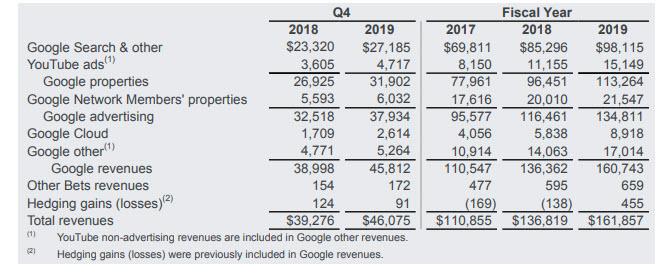

Also of note: for the first time ever, Google broke out its YouTUbe and Cloud revenue and reported it generated $15.15BN in YouTube revenue and another $8.92 billion in Cloud. As Bloomberg notes, "breaking out Cloud and YouTube revenue is monumental for Wall Street." YouTube revenue nearly doubled from 2017, where it was $8.15 billion, and while some investors had expected overall YouTube sales for 2019 to be as high as $20 billion, they will probably take $15BN.

Meanwhile, on the cloud side the business also more than doubled since 2017, from $4.1 billion to $8.9 for the full year 2019, which while solid still lags the market leader, Amazon Web Services, which reported $9.9BN in just Q4 revenue last week. That said, Google's cloud business grew 53% Y/Y, far above the 34% growth rate posted by AWS.

Visually:

(Click on image to enlarge)

(Click on image to enlarge)

Meanwhile, Alphabet's "other Bets" - from self-driving cars to its biotech units - continued to bleed cash, losing $2.03 billion during the quarter on $172 million in revenue.

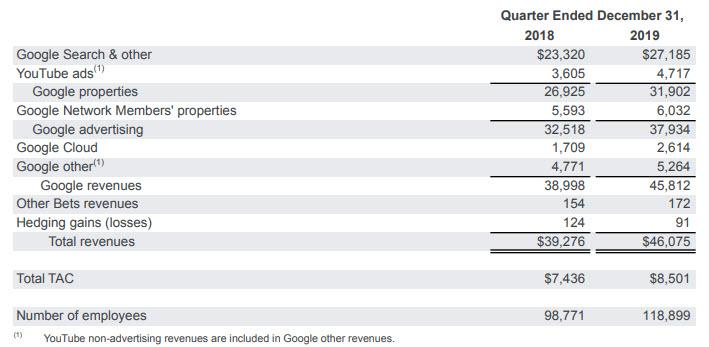

Despite the revenue miss, revenue growth was still a solid 18%, although with the stock soaring in the past year, it - like the rest of its FAAMG peers - was priced beyond perfection, and investors were not happy, especially as a result of the sharp jump in TAC or traffic acquisition costs, which rose by $1BN in Q4 compared to a year ago, suggesting that Google’s ads business is getting more costly. And, as shown below, Google has never paid more in comp: Alphabet now employs 118,899 people, up more than 20,000 from a year ago.

(Click on image to enlarge)

There was a silver lining on the cost side: overall CapEx fell year-on-year to $6.05 billion, with almost all of the spending going to Google, not the “Other Bets” companies like Waymo and Verily.

On net, while the business continues to post solid growth, concerns about rising costs, and a miss on the top-line and profit margins left a sour taste in investor's mouths, and as a result GOOGL stock, with its 27x forward PE...

(Click on image to enlarge)

...dropped sharply after hours, tumbling as much as 5%, before stabilizing slightly below 3% lower.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more