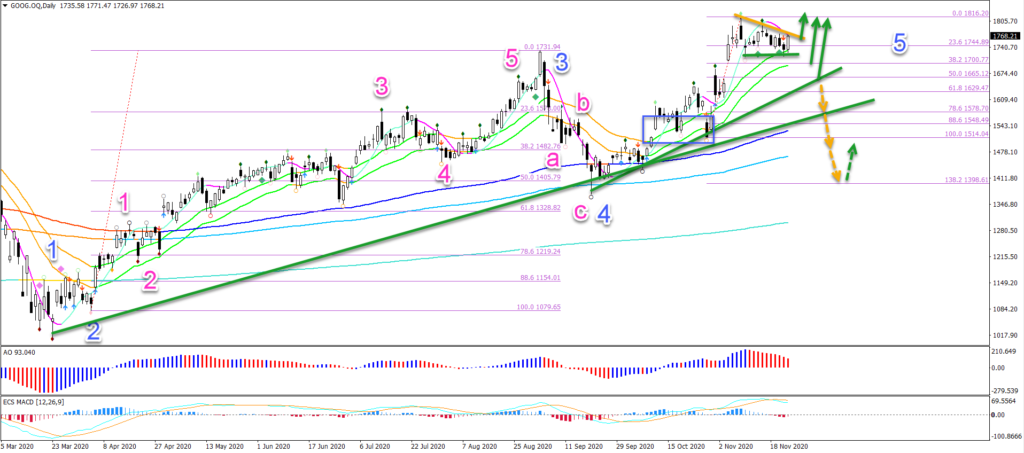

Google Bull Flag Pattern Aims At $1,900 Target Zone

Google (GOOG) made a bullish breakout, pullback, and continuation above the 21 ema zone (blue box). Now price action is sailing above the previous top. Can the uptrend continue higher?

Photo by Mitchell Luo on Unsplash

Price Charts and Technical Analysis

(Click on image to enlarge)

Yes, the current bull flag chart pattern suggests that more upside is likely. In fact, even a retracement is likely to find buyers at the 38.2% or 50% Fibonacci support levels.

But price action does not need to retrace. Google could also break the flag and make an immediate bullish swing higher.

The main target zone of both Fibs is located at the -27.2% Fibonacci target around $1,900 – $1,905.A break above the Fractal at $1800 should confirm it.

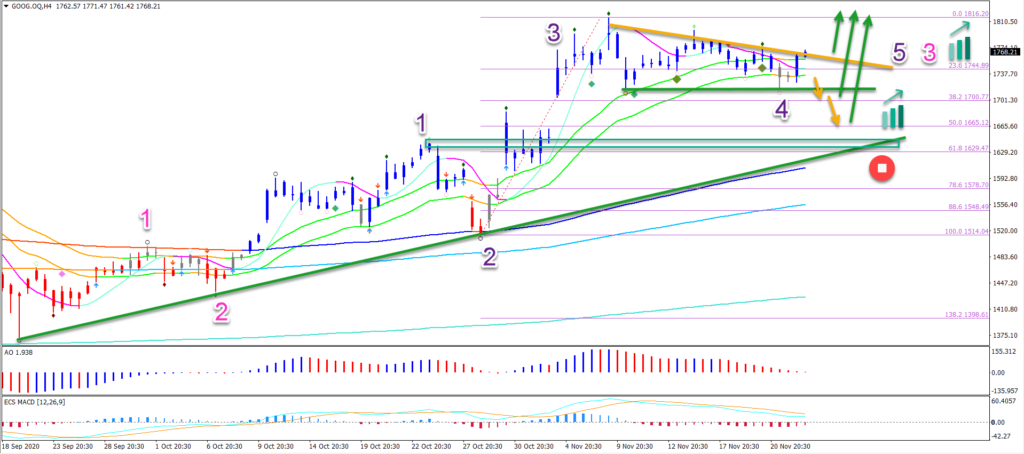

On the 4 hour chart, we can see an internal 5 wave pattern (purple) within wave 3 (pink). This indicates that more wave 345 breakout, pullback and continuations are expected.

A break below the 50% Fibonacci and top of wave 1 (green box) does invalidate (red circle) the current wave pattern.

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more