Goodyear Continues Sliding Ever Lower

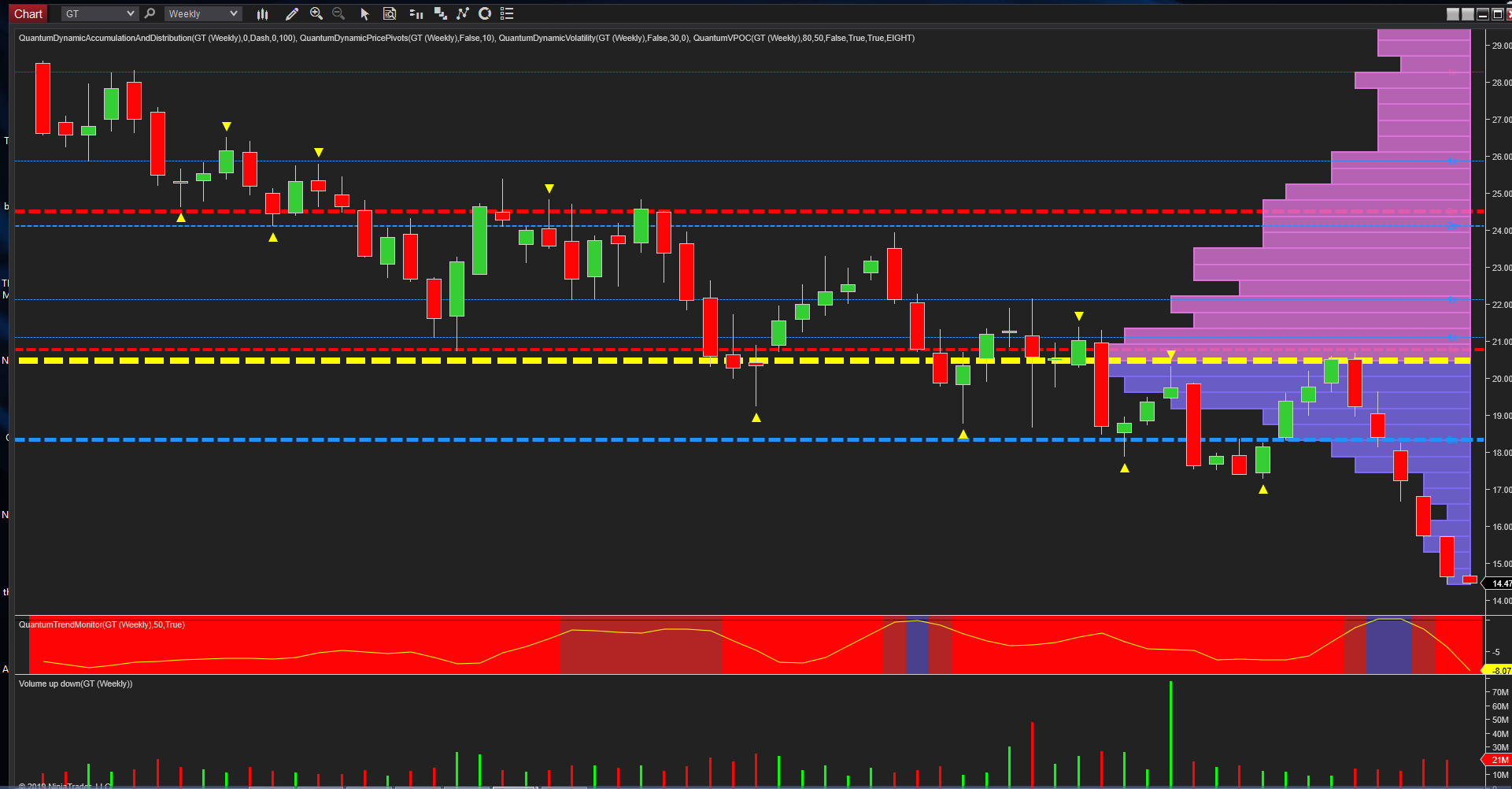

One stock I covered in recent weeks was Goodyear Tire & Rubber Company (GT), a particular favorite of mine years ago when it was in a strong congestion phase with mildly bullish momentum, and therefore a perfect candidate for writing covered calls. As I mentioned in my post of 7th May and entitled Goodyear tires on slicks, the key level at that time was around the $17 per share level, and to quote the final sentence of the post:

“Moreover, with a low volume node now waiting below, the trapdoor could open once the move through $17 is completed“.

And as we can see from the price action over the last few weeks, this has certainly been the case with the stock falling from the price back then of $17.67 to currently trade at $14.51, and despite the compression of the volume bars owing to the spike of early March, selling volumes continued to rise with falling prices on widespread candles thereby confirming two things. First, sellers remain in control so further downside momentum is likely to follow. Second, there is no evidence of buying by the market makers on the weekly chart which is now approaching a further low volume node in the $14.00 per share region. The monthly chart for the stock has some minor support in this area, but given the strength of selling now in evidence, we could see this stock move to single figures in the medium term, and much also depends on the EPS figure delivered at the next quarterly earnings cycle, which will hopefully improve on last quarter’s dire results.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more