Goldman's Clients Are Asking What Happens If Trump Loses And Dems Take The Senate

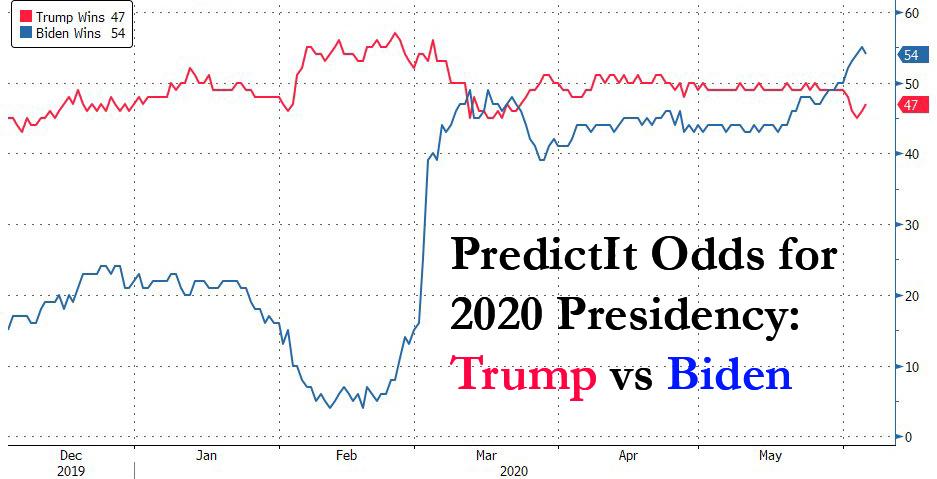

Over the past week, a significant change has taken place in the US political world and we are not talking about the unprecedented nationwide protests, riots and looting that have prompted comparisons to 1968, or the economic collapse resulting from the covid shutdowns. We are referring to the fact that after dominating the PredictIt online betting poll for who will win in 2020, for the first time ever, Donald Trump has relinquished first place with a material margin to his challenger, Joe Biden, who last night officially clinched the democratic nomination.

To be sure, this dramatic reversal has not been lost on either the president - who has unleashed an all out push to demonstrate that the US economy is recovering after Friday's surprisingly strong, some would say manufactured, jobs report to halt the downside momentum. It has also not been lost on Wall Street, because as Goldman's chief equity strategist David Kostin writes, with markets looking ahead to the post-pandemic recovery, investor conversations have increasingly focused on the political landscape where, as noted above, prediction markets now show roughly 50% likelihoods of Democrats winning the presidency and the Senate in November. This is notable because as Kostin explains, for many Goldman clients, the most important equity market implication is the potential for higher corporate tax rates.

Follows is an interesting admission from the Goldman strategist who writes that although the coronavirus has caused the sharpest decline in economic activity on record - this is largely affecting the poor and middle classes - while it is tax policy that represents a larger risk to earnings and consequently to equity prices, and by extension Goldman's predominantly wealthy clients. Furthermore, with the help of record policy support and inflecting data, investors have largely looked through the coronavirus as a temporary hit to total corporate earnings according to Kostin, although as we have shown before even the most optimistic forecasts don't show corporate earnings returning to pre-covid levels until the end of 2022 at the earliest, so it depends on one's definition of "temporary".

In contrast, a shift in government policy toward higher corporate taxes would reduce expectations for the entire long-term stream of profits.

To explain why investors are more concerned about tax policy than Covid, Kostin uses an interest analogy, namely that "every company in the world is in a joint venture." Taking this further, the JV partner is the government and its stake is represented by the effective corporate tax rate. In the case of S&P 500 constituents, companies had a 70% interest for many years that jumped above 80% following the passage of the Tax Cut and Jobs Act (“TCJA”) in December 2017.

From a valuation perspective, the NPV of the incremental future earnings reallocated by the reduced tax rate suddenly inured to the shareholders whereas it previously benefited the government. That is what happens when the JV split goes from 70/30 to 80/20.

But the split may change - and not to the benefit of shareholders - in 2021 depending on the outcome of the November election.

Here it is also worth recalling that one of the main reasons for the market's outperformance during the Trump administration is that declining tax rates have been arguably the biggest contributor to S&P 500 profit growth. Consider this:

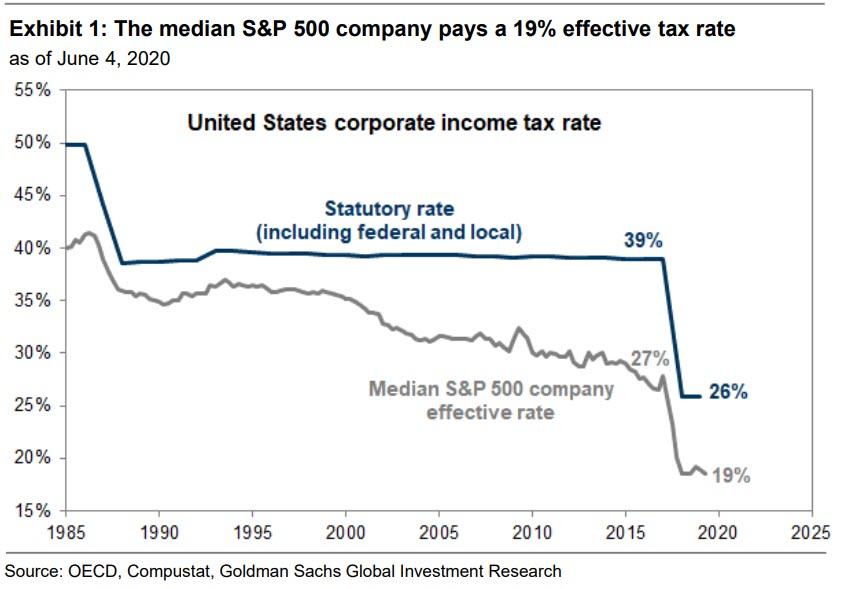

The TCJA effected anumber of changes in the corporate tax code, including reducing the federal statutory rate on domestic income from 35% to 21% (from 39% to 26% including state and local taxes). In practice, this reduced the effective corporate tax rate paid by the median S&P 500 company by 8 percentage points, from 27% to 19%, and boosted S&P 500 EPS in 2018 by 10%.

Overall, since 1990, declining effective tax rates have accounted for 200 bp of the 400 bp increase in net profit margins and 24% of total S&P 500 earnings growth, according to Goldman calculations.

Not that this was a secret of course, and in fact in much of the world corporate taxes were far lower than in the US, which for years had an uncompetitive corporate tax regime compared with most other countries. In 2017, the 39% statutory tax rate for US firms was the highest among OECD countries, which otherwise had an average statutory rate of 24%. Several years ago, Goldman - correctly - predicted that this disparity could not exist indefinitely, and as a result in 2013, the bank created two baskets of US stocks based on their effective corporate tax rates:

"Our belief was that legislation would be enacted to level the playing field. From an investment strategy perspective, the intuition was that firms with the highest effective tax rates would benefit the most from tax reform and that the resulting upward EPS revision would translate into relative share price outperformance. In the two months around the passage of the tax reform in late 2017, our 50-stock, sector-neutral High Tax basket outperformed our Low Tax basket by 910 bp (16.5% vs. 7.4%) and the S&P 500 by 580 bp as those firms experienced the strongest upward EPS revisions."

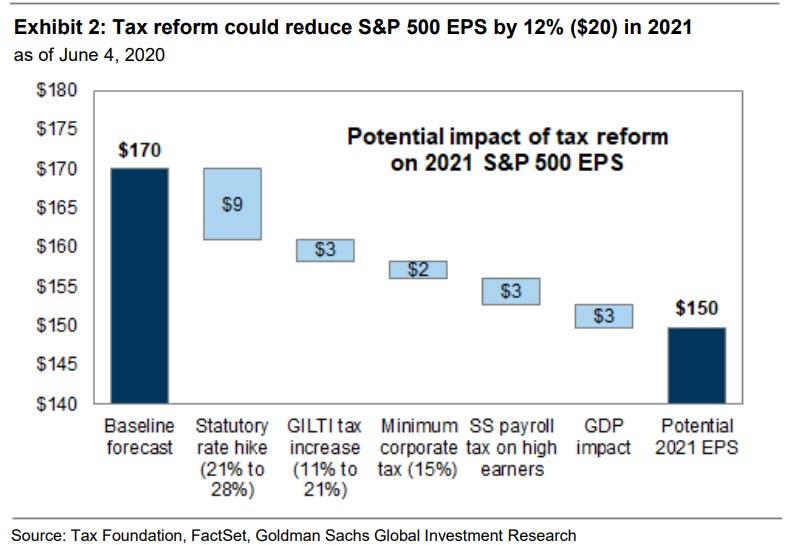

The problem for shareholders is that if Trump wins, much, if not all, of this would be reversed, as Joe Biden has proposed partially reversing the 2017 TCJA. In fact, according to the Tax Foundation the former Vice President’s plan would raise the statutory federal tax rate on domestic income from 21% to 28%, reversing half of the cut from 35% to 21% instituted by the TCJA.

In addition, the plan would double the GILTI tax rate on certain foreign income, impose a minimum tax rate of 15%, and add an additional payroll tax on high earners.

These changes would be complemented by a variety of changes to the personal tax code, including an increase in the tax rate applied to capital gains and dividends for the highest income individuals, as well as potential changes in non-tax regulatory policy that could also affect corporate earnings and equity valuations.

Long story short, if Biden's tax proposals are enacted, this tax reform would reduce Goldman's S&P 500 earnings estimate for 2021 by roughly $20 per share, from $170 to $150.

As Kostin explains, according to a a rule of thumb, every percentage point change in the effective corporate tax rate should change S&P 500 earnings by 1.2% or $2 per share.

And while the Biden plan would only reverse half of the TCJA cut to the statutory domestic tax rate, along with the other proposals Goldman estimates it would lift the S&P 500 effective tax rate to 26%. Combined with a drag on US GDP of a similar magnitude to the boost that Goldman's economists estimate the TCJA created in 2018, this would reduce the bank's 2021 EPS estimate by roughly 12%, although it is unclear yet if Kostin will do a bifurcated S&P price forecast as he did ahead of the midterm elections, giving one target in case Trump retains the presidency and another in case of a Democratic sweep.

What are the implications for stocks?

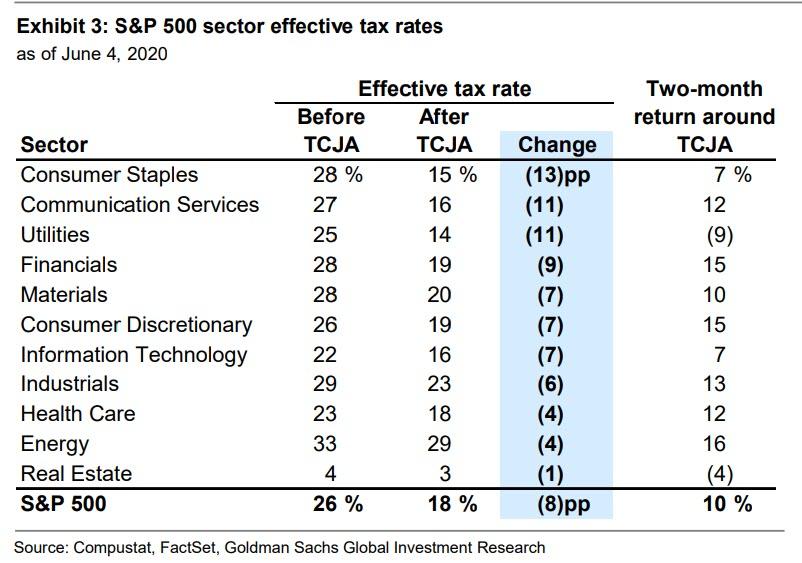

At the sector level, domestic-facing cyclicals generally experienced the largest earnings boost and strongest outperformance resulting from the passage of the TCJA. Financials, Consumer Discretionary, and Comm Services experienced the largest absolute and beta-adjusted returns in the two months around the TCJA passage as earnings expectations surged. Energy and Industrials also outperformed but fared worse on a beta-adjusted basis and benefited from a rise in crude oil prices. At the other end of the distribution, Utilities and Real Estate firms declined as investors rotated to firms with more EPS exposure to tax cuts. Info Tech, which tends to pay low tax rates, also lagged. However, the GILTI and minimum tax provisions could cause some Tech firms to lag again if the Biden plan is enacted.

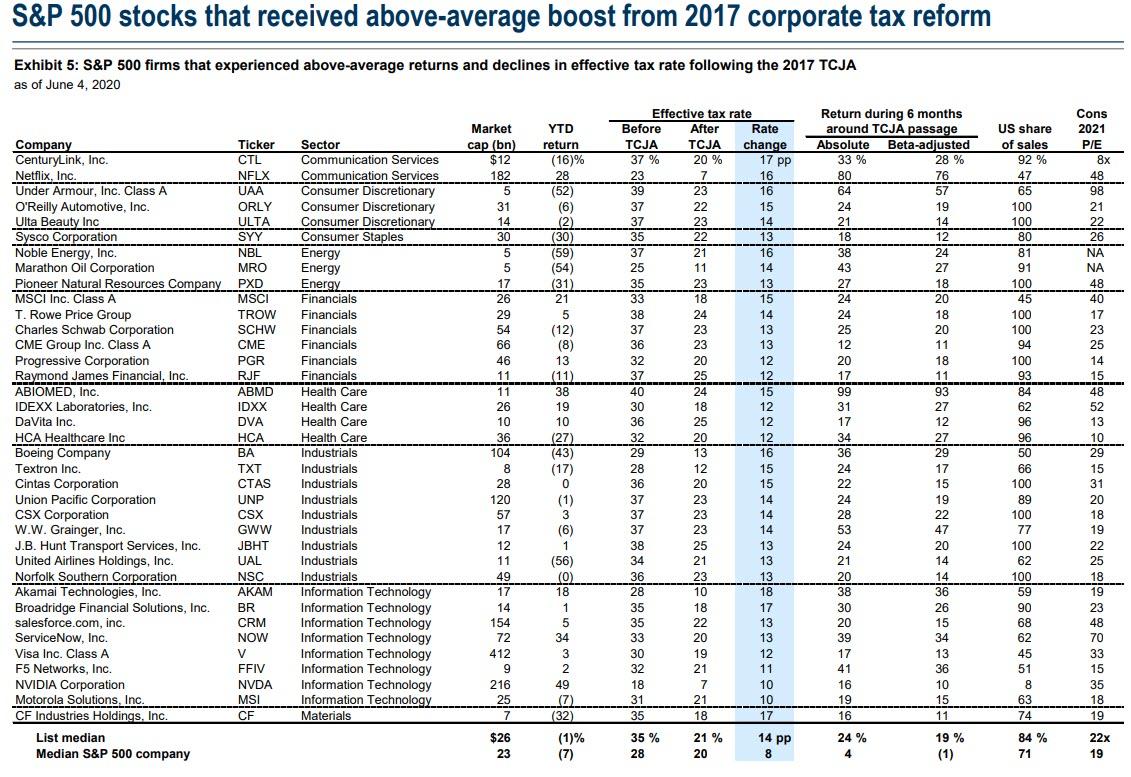

At the stock level, the firms that had the highest effective tax rates benefited most from the TCJA, and many of these companies would be particularly vulnerable to a rate hike. The next chart highlights a list of 37 stocks that experienced large reductions in tax rates relative to sector peers and outperformed following the TCJA passage.

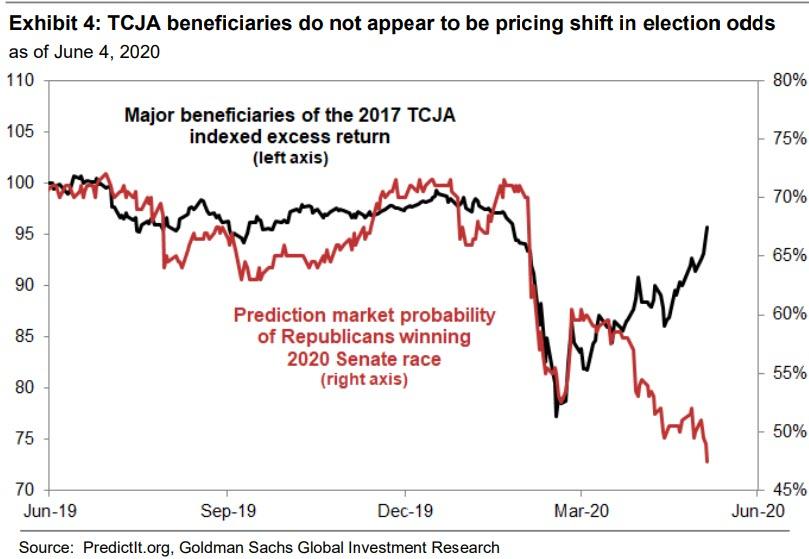

These stocks lagged in March as prediction market odds of Democratic Senate victory jumped, but they have recently outperformed despite a continued shift in prediction market-implied odds. Ultimately, the precise impact of tax reform on individual stocks will depend on the details of any legislation.

But before investors dump their exposure to all stocks that stand to see their tax rates jump, Kostin caveats that extreme uncertainty helps explain why the performance of tax-sensitive stocks has not fully reflected the tightening election race; and after all it's not that first time that polls showed Trump behind his challenger only for a shock outcome to emerge. Furthermore, in late 2017, Goldman reminds us that "high tax stocks outperformed sharply only once the TCJA legislation reached its final stages of Congressional ratification, despite months of negotiation and drafting beforehand." Fast forward to today, when Goldman's clients and investors in general not only face uncertainty regarding the specifics of potential tax reform, but also five more months of market volatility before the resolution of a close political race that could eliminate the likelihood of tax reform altogether.

[The original article was written by Dan Popescu (GoldBroker.com) and is presented here by the editorial team of more

This election, like the last presidential election, shows more than ever that one more choice is needed, which would be "NONE of the ABOVE." Certainly the humiliation would be severe, but perhaps the benefit of showing that alternative policies are needed would be worth it. Presently, while controls tend to favor the rich getting richer, the rest see an erosion of freedoms and a lack of concern about their well being in general.

Agreed, but how likely will that be?