Goldman: We Are Entering The Best Two-Week Seasonal Period Of The Year For Stocks

Bank of America warned that "it's all downhill from here" when its CIO Michael Hartnett looked at the second half of the year and warned that as the US moves from inflation to stagflation and from QE to QT, the "combo of rising Rates, Regulation, Redistribution (3Rs) & peak Positioning, Policy, Profits (3Ps)" assures low/negative returns in the second half (see here). In short, the party is over.

Well, Goldman disagrees, and in an a note from the tactical flow desk the bank has listed several reasons why the party is just getting started.

Putting the immediate past in context, Goldman writes that "the S&P 500 has seen 33 new all-time highs this year or 1 new ATH for every 3.73x trading days. Going back to 1928, only 1995 would annualize at a faster pace, 1 ATH per 3.27x trading days. And 53 new S&P 500 all-time highs since March 2020."

But more to the point, unlike BofA which believes the stellar H1 will be followed by a stagflationary H2, Goldman thinks equities will come out of the gates strong in July, and then slow down at the end of month after options expiry: "Positioning is un-stretched as we rally higher, we think investors will have FOMO to start the month."

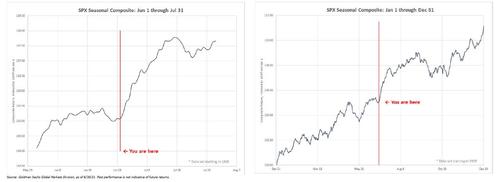

Claiming that a "strong 1H, typically means strong 2H", Goldman seeks to ease some of its more nervous clients and notes that we are now entering the best two-week seasonal period of the year. Specifically the high point of this seasonal chart since 1928, is July 1st to July 16th.

Don't believe in technical mumbo-jumbo? Here are the rest of Goldman's tactical reasons why traders should be long stocks right now.

- 401K Quarterly Money flows – July money flows are the biggest in Q3 as advisors rebalance investor client portfolios.+15bps of AUM of new money comes into the market in July, +$30B worth of inflows on ~$21 Trillion of assets. RIA’s are on the hook for running too low equity exposure and “waiting for a dip to buy”.

- Sentiment and Positioning – GS Research Sentiment Indicator declined week over week and sentiment is very un-stretched. Heading into last week, GS SI was the lowest level in 55 weeks. This is also consistent with GS PB team, HF fundamental L/S Gross Leverage ranks in the 31st percentile.

- S&P Index Gamma – Until recently, dealer long gamma(~$5.5B) is at two-year highs but a significant portion of this gamma has just rolled off This means that the market can move more freely to the upside (or downside) after Wednesday's close. This has prevented a material break out higher as dealers would need to sell futures into a rally. If there is a chase to the upside from here, its potential for spot up and vol up with dealers less long gamma.

- Buybacks – the blackout window ends on 7/23/21 and opens 7/26/21 (~40% of companies will be in the open window). However the de-facto start to the open window is following JPM earnings/big bank reports on 7/13/21. Corporates remain the largest source of demand for 2H and bank demand may pick up mid-July (when overall money flows slow).

- 1H 2021 fund flows scoreboard – YTD, Money Markets +$116B inflows + Global Bonds +$276B inflows vs. Global Equities +$575 inflows.... or said another way, the $3 Trillion wedge only declined by --$183B ytd. The cash position and bond position is still too high for advisors to send on their quarterly statement given the record ATH stock run.

- Flow of funds winner of 1H – Households own 38% of the US equity market, the largest owner of the equity has become the largest trader. Tracking Friday weekly call options really just became a thing in 2021. Three out of the top 15 call option volume days on record, going back to 1992 (7200 observations) happened since Memorial Day 2021.

Finally, here is a snapshot of how Goldman's bubble baskets are doing: GS Yolo +83% YTD, most short +53%, Bitcoin equities +39%, Retail Favorites +23%, High Vol +22%.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more