Goldman Upgrades Exxon To Buy For The First Time In Four Years As Cycle Begins To Turn

Just one day after Wells Fargo issued a rare upgrade on beaten-down energy giant Exxon, late on Tuesday Goldman did what it hasn't done since 2016, and it upgraded Exxon from Neutral to a Buy - just two months after it upgraded the major from a Sell - with a $52 price target given Exxon's "potential for capital/cost reductions, Guyana and Chemicals upside, improved free cash flow versus history, underweight positioning and our constructive view on crude."

As analyst, Neil Mehta explains, "we have been skewed more cautious on Exxon for multiple years given a history of weak returns, concerns around capital discipline, room for a clearer decarbonization strategy, a dividend policy that added leverage to the business and lackluster earnings execution." And while each of these concerns are still an issue that management will need to respond to, the rate of change is moving in the right direction, and with the stock trading at only 10.1x Goldman's 2022 P/E estimate (versus a 10-year history of 15x), the analyst believes "investors are able to acquire the stock at a reasonable valuation level." Furthermore, with XOM shares down 38% in 2020, the bank now sees "much of these risks as priced into the story and see low hanging fruit to make progress on each of these concerns."

Some more details behind the four key points underpinning Goldman's upgrade.

First, the company has meaningfully lowered its capital spending outlook from $30-$35 bn to $17-$19 bn in 2021 and $20-$25 bn in 2022-2025.

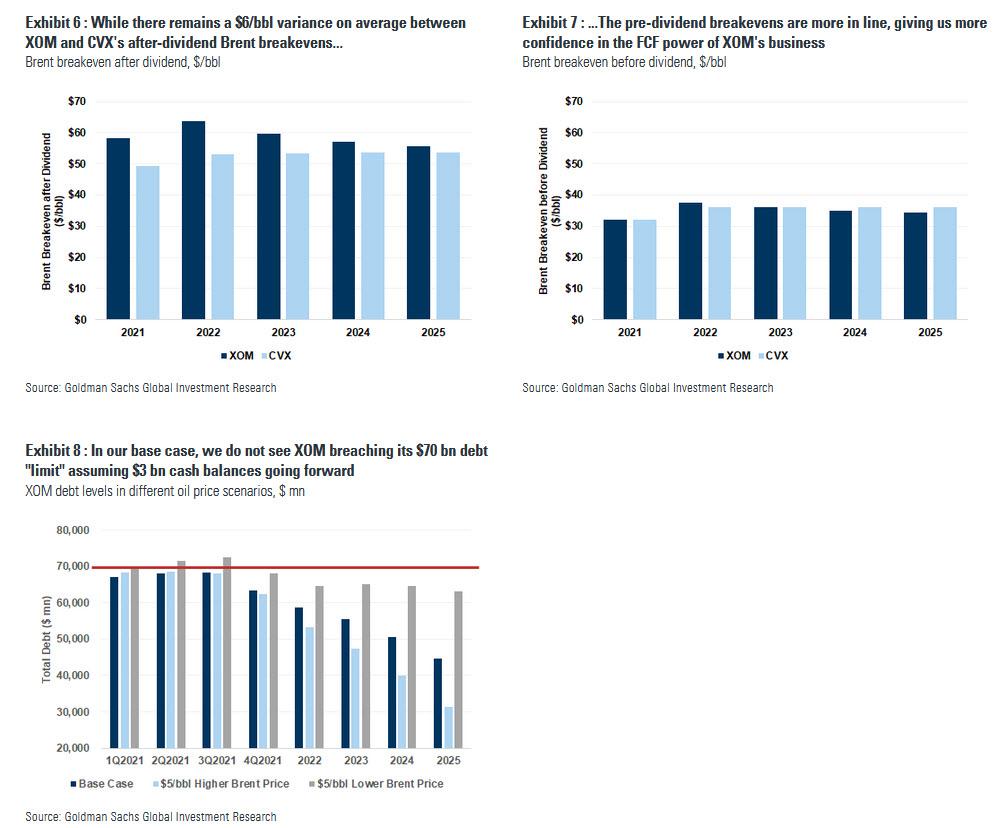

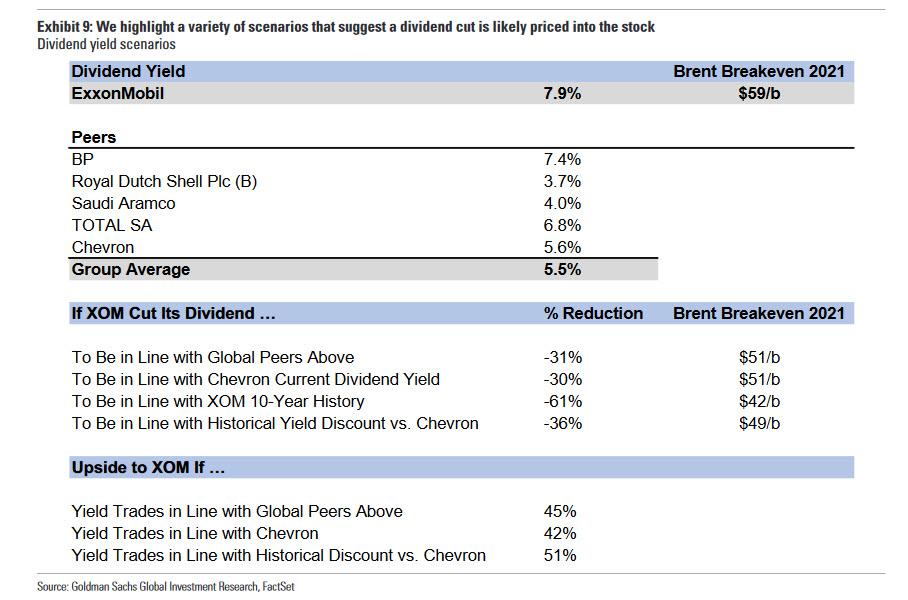

Second, while not our base case, we no longer see a potential dividend cut as a negative catalyst given the leverage guard rails the company has put around it. We continue to believe a variable dividend strategy has potential to be well-received by the market.

Third, we see value in the company's growth assets including in Guyana and Chemicals.

Fourth, we see more attractive valuation following underperformance, with XOM now trading at an EV/DACF discount to Buy-rated CVX versus its historical premium.

Of these, perhaps the most important point is the impact of a potential dividend cut. Here are the details on that:

We continue to view the merits of a variable dividend strategy positively and believe that XOM could benefit from such a strategy. In our view, a variable dividend strategy could enable the company to reduce the need for increasing debt at the bottom of the cycle and drive outsized capital returns to shareholders in better pricing environments. We also believe it would allow the company to balance cash returns to shareholders with investment in attractive projects that could contribute to long-term value and returns generation for the company. We do not currently base a case on a dividend reduction or implementation of a variable dividend model.

Goldman's conclusion:

We revise our 12-month price target to $52 from $42 in this note. We update our methodology to now include a P/E component to our equal weighted EV/DACF and FCF yield valuation. We apply a 15x P/E multiple (in line with XOM's 10-year historical average) to normalized EPS (defined as an average of 2021-2025, consistent with the time frame for our normalized FCF yield component). We also update our EV/DACF multiple from 7.5x to 8.0x to be more in line with the multiple we use on CVX and now assume a normalized Brent price of $59/bbl in our valuation (from $55.50 previously). For illustrative purposes, we construct an upside case using the 10-year average multiples of 15x P/E and 9.75x EV/DACF, as well as 15-year average FCF yield of 5%, which drives an incremental $10/share of value or a $62/share implied valuation, all else equal.

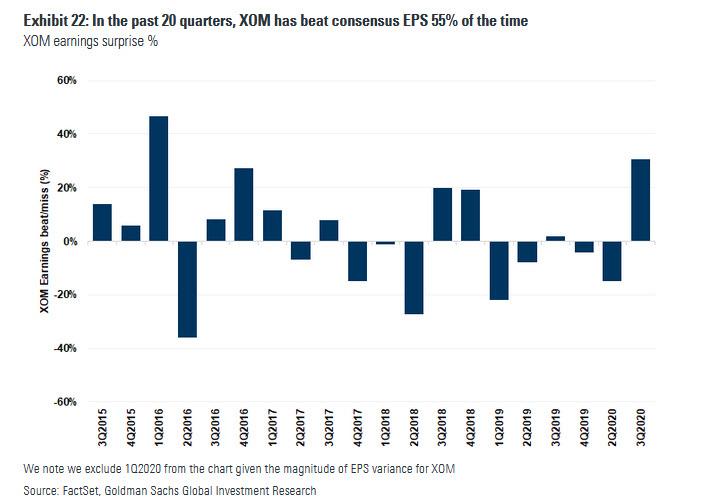

We note that historically Exxon has been one of the poorest earnings executors in the S&P500. However, as we look forward, we actually see potential for consistent upward consensus revisions. Over the past twenty quarters, XOM has only beaten EPS estimates 55% of the time. However, we are well above consensus for 2021, 2022 and 2023 EPS, with our EPS of $2.70/$4.18/$3.82 on average 36% above consensus of $1.57/$3.14/$3.72.

And the risks:

Capital spending surprises to the upside as commodity prices recover. We currently forecast XOM headline capital spending at $22 bn on average in 2022-2025, within the company's guidance range of $20-$25 bn. Our model assumes an average Brent price of $61/bbl over that period, which we recognize is above the current forward curve. To the extent XOM does not remain committed to the lower capital spending outlook as commodity prices recover, we would see higher FCF breakevens, which could impact our positive view on the stock.

Chemicals business remains weak. We expect the company's investments in performance products projects in the Chemicals business to drive improved returns in the coming years. We see potential for multiple expansion in chemicals as the macro environment and integrated HDPE margins improve relative to 2019 and early 2020 levels. That said, to the extent the margin environment for chemicals deteriorates or the projects do not realize the returns we underwrite, we would see downside risk to our estimates.

Production growth metrics surprise to the downside. While some production growth for XOM has likely been pushed out given the near-term capital spending cuts, we still expect investment in the Permian and Guyana to drive production growth going forward. To the extent the company faces execution or other issues that prevent the production growth from materializing, we would see downside risk to our earnings forecasts.

Commodity prices are weaker than we expect. We have an above consensus view on oil prices going forward, with a $55/$65/$60 per barrel Brent price view in 2021/2022/2023. If oil prices persist at something closer to the forward curve, which is at ~$49/bbl, our earnings and cash flow forecasts would see downside risk.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more