Goldman Plunges After Trading Revenue Miss

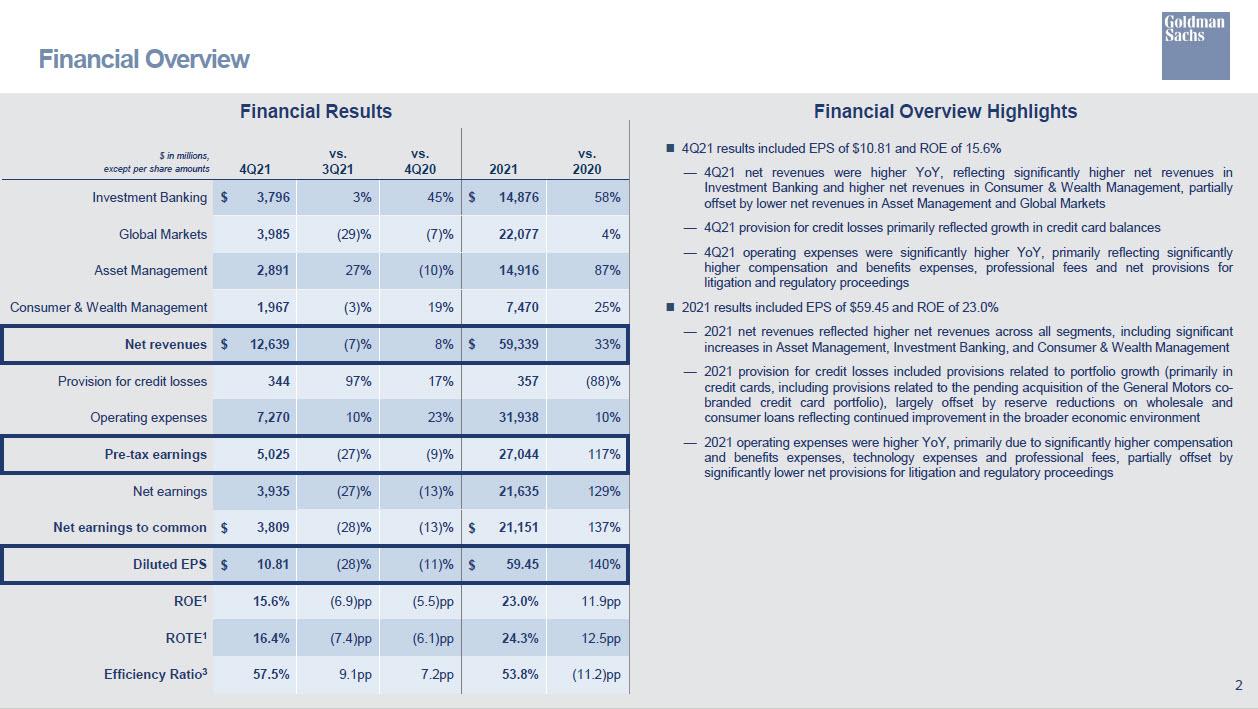

One trading day after JPM reported disappointing earnings and its stock suffered the biggest post-earnings drop in a decade, moments ago Goldman joined it in the penalty box with its shares tumbling as much as 3.1% in premarket trading Tuesday after reporting worse-than-expected fourth-quarter trading revenue, even if overall revenue beat (Q4 revenue $12.6BN, Exp. $12.08BN), with EPS of $10.81 also coming in below expectations of $11.76.

(Click on image to enlarge)

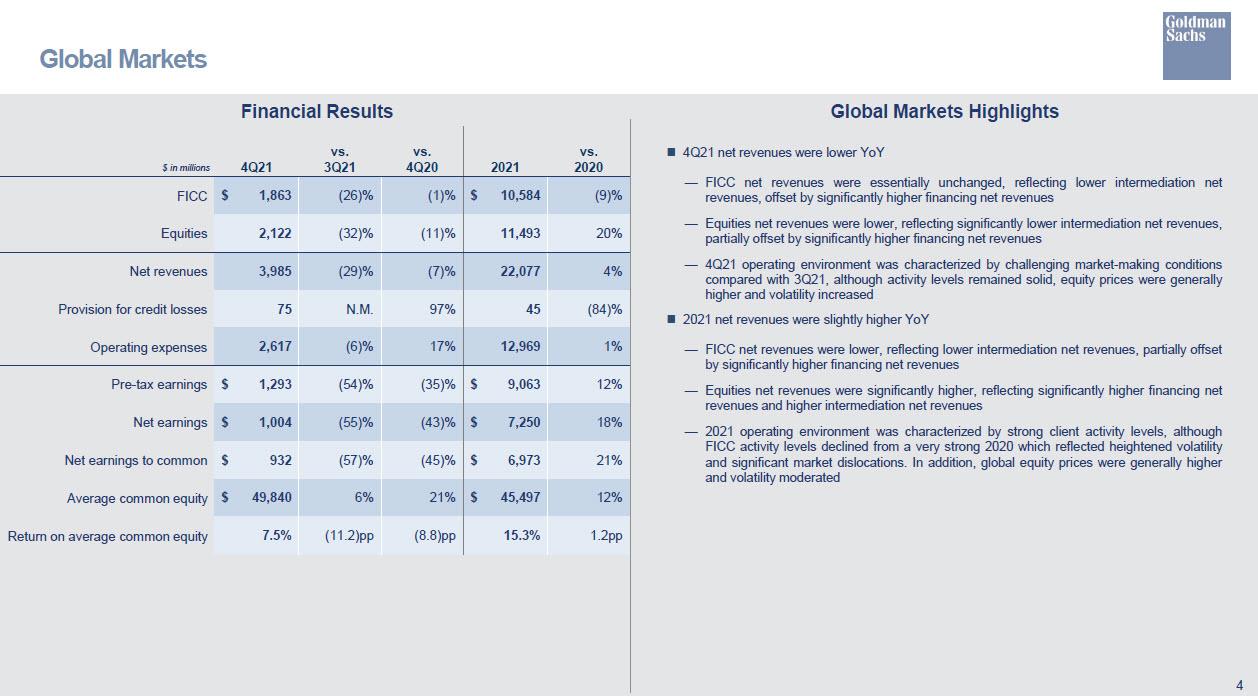

While the bank’s FICC sales and trading revenue of $1.86 billion were higher than the average analyst forecast of $1.80, equity sales and trading revenue missed expectations, coming in at $2.12 billion versus the $2.47 billion seen by analysts, resulting in a miss in overall trading rev. of $3.99 billion, which came in below the estimated $4.27 billion. According to Goldman, the reason for the miss is that "Equities net revenues were lower, reflecting significantly lower intermediation net revenues, partially offset by significantly higher financing net revenues." Furthermore, the "4Q 21 operating environment was characterized by challenging market-making conditions compared with 3Q 21, although activity levels remained solid, equity prices were generally higher and volatility increased."

(Click on image to enlarge)

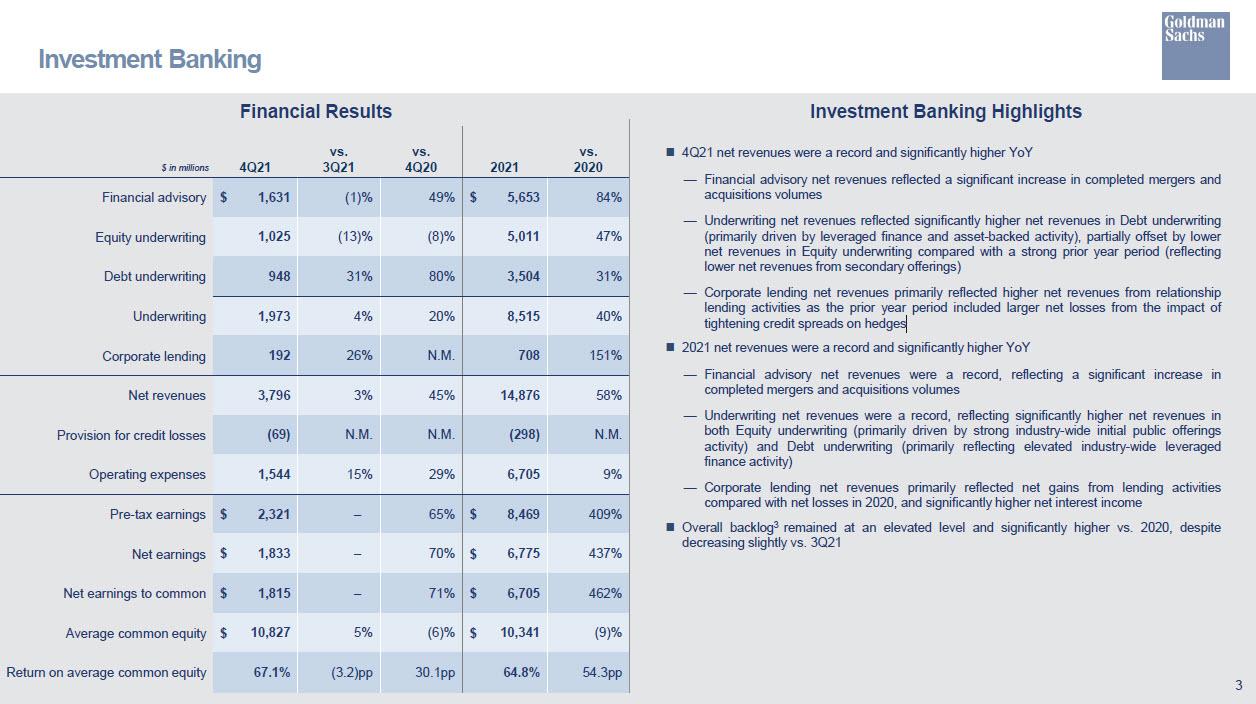

On the other hand, and similar to JPM, investment banking revenue of $3.60 billion came in well above expectations of $3.07 billion.

(Click on image to enlarge)

And perhaps more concerning is that just like JPMorgan, Goldman's compensation expenses came in red hot, at $3.25 billion, well above the estimated $2.89 billion.

“This is a disappointing quarter due to the big jump in expenses and the softness in equities,” writes Vital Knowledge founder Adam Crisafulli. “It also looks like their portfolio of equity investments was hurt by turbulent capital markets in Q4,” he added.

The stock is sharply lower premarket on the disappointing earnings.

(Click on image to enlarge)

The full Goldman investor presentation can be found here.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more