Goldman Jumps On Blowout FICC Revenue Despite "Significant Decline" In I-Banking

One day after JPM reported disappointing earnings (coupled with a rather dismal economic outlook) and its stock plunged to one-year lows, moments ago Goldman Sachs bucked the trend, its stock jumping 1.6% after reporting better-than-expected first-quarter trading revenue, which led to a solid overall revenue beat (Q1 revenue $12.93BN, Exp. $11.73BN), with EPS of $10.76 also coming in well above expectations of $8.90, with the only red flag being the weakness observed previously at JPM, namely at the investment banking group, though even here the miss was modest, with revenue coming in at $2.13BN, vs est of $2.28BN.

(Click on image to enlarge)

Cutting to the chase, here are all the relevant details:

- Trading rev. $7.87 billion, estimate $5.84 billion

- FICC sales & trading revenue $4.72 billion, estimate $3.12 billion

- Equities sales & trading revenue $3.15 billion, estimate $2.73 billion

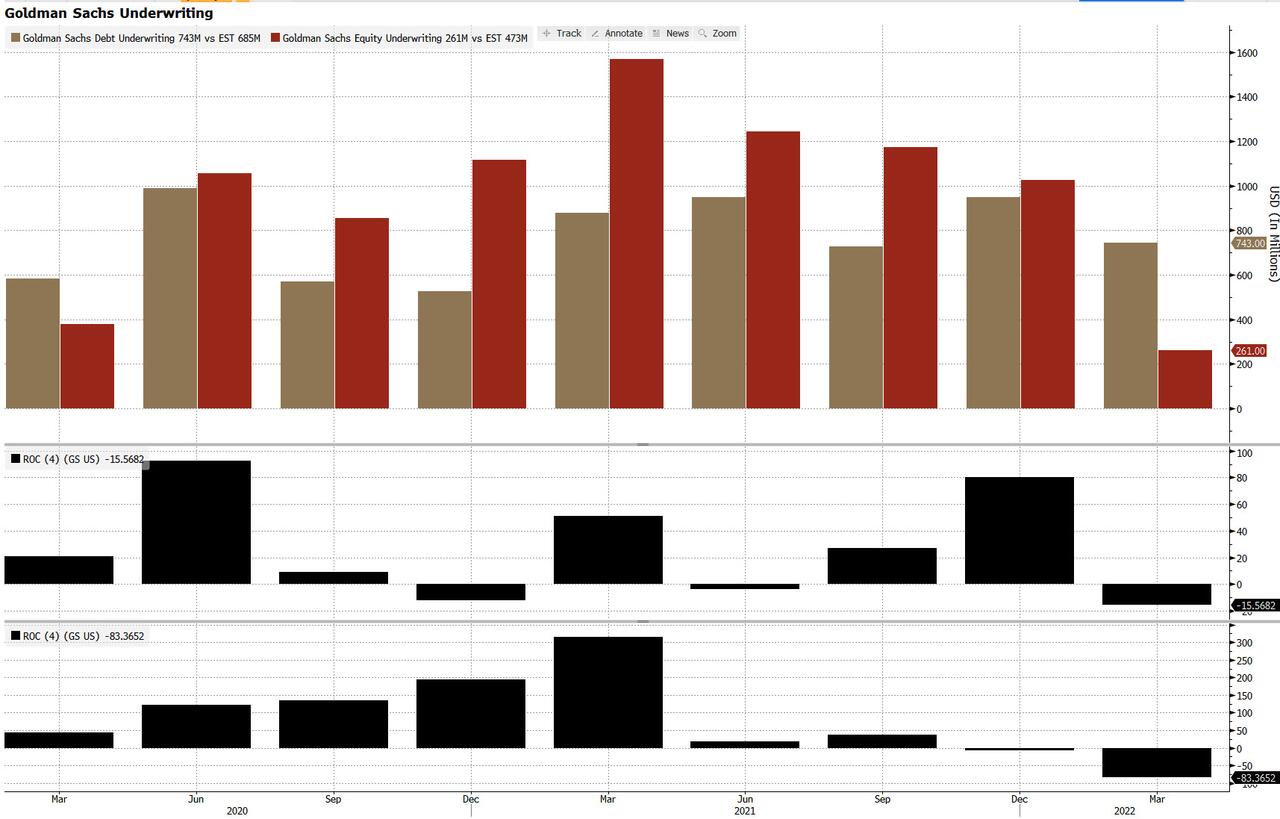

- Debt underwriting rev. $743 million, estimate $685.4 million

- Financial advisory revenue $1.13 billion, estimate $1.12 billion

but

- Investment banking revenue $2.13 billion, estimate $2.28 billion

And some more headline details:

- Net interest income $1.83 billion, estimate $1.81 billion

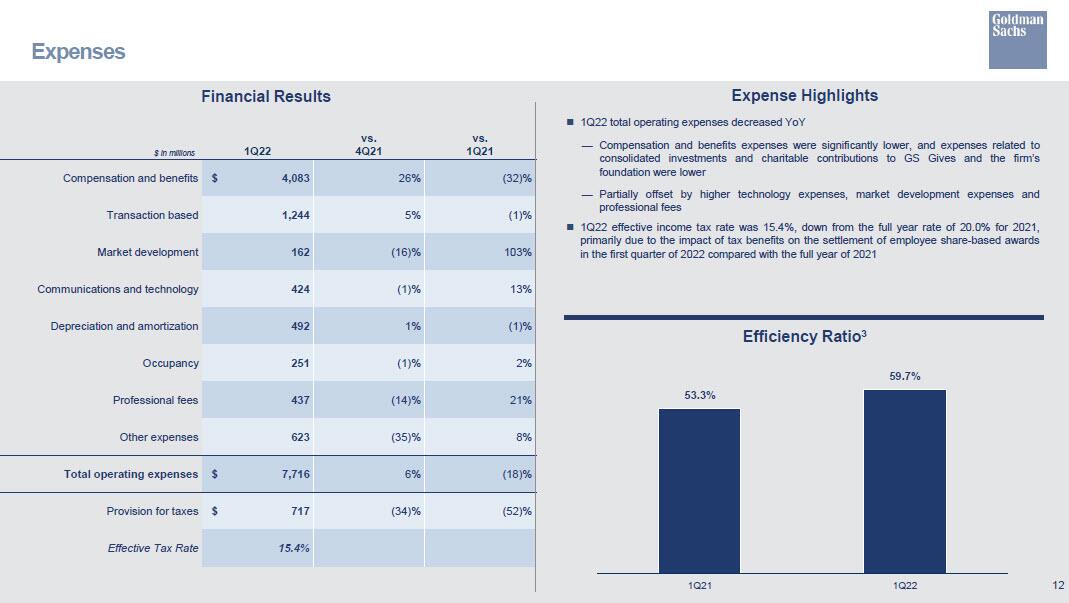

- Total operating expenses $7.72 billion, estimate $7.39 billion

- Compensation expenses $4.08 billion, estimate $3.97 billion

- Annualized ROE +15%, estimate +12.5%

- Standardized CET1 ratio 14.4%, estimate 14.2%

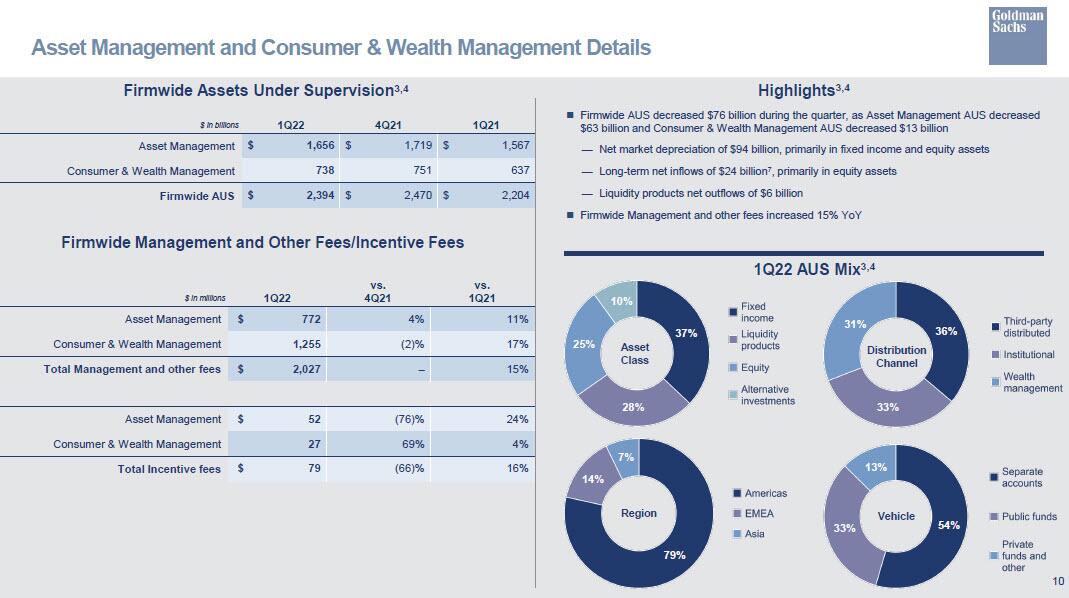

- Assets under management $2.39 trillion, estimate $2.23 trillion

“It was a turbulent quarter dominated by the devastating invasion of Ukraine,” DJ and CEO David Solomon said in a statement.

“Despite the environment, our results in the quarter show we continued to effectively support our clients and I am encouraged that our more resilient and diversified franchise can generate solid returns in uncertain markets.”

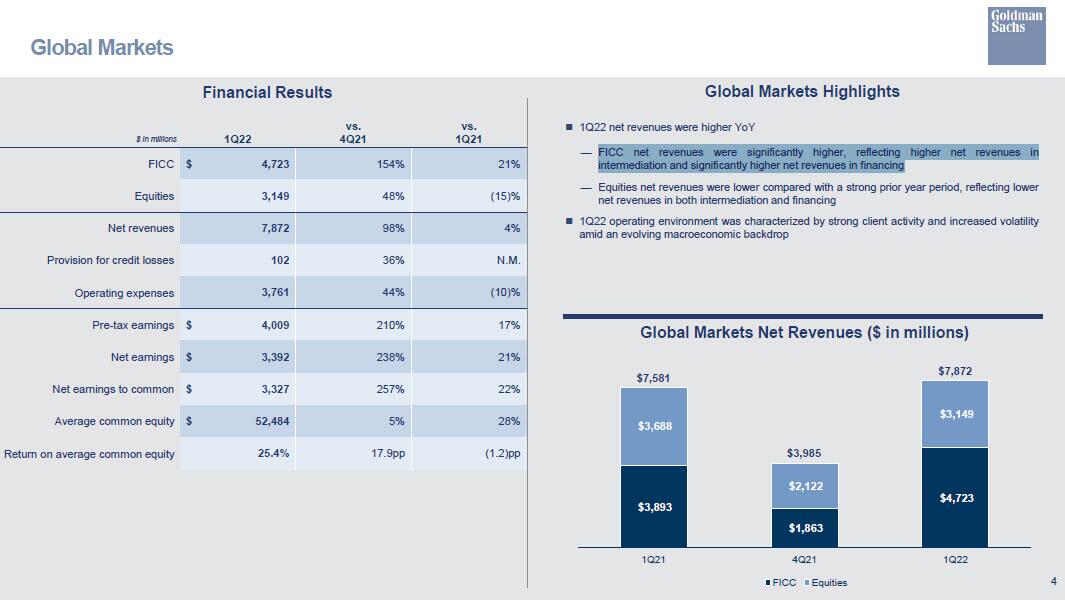

Going back to the bank's trading results, the big (and pleasant) surprise here was the bank’s whopping FICC sales and trading revenue of $4.72 billion, up 21% Y/Y, which blew out estimates of a 20% drop to $3.12 billion - and which was the largest FICC revenue in at least 5 years (the next largest was $4.235 billion in the extraordinary Q2 of 2020, after the flood of Federal Reserve support to fight the Covid pandemic) - with revenues "significantly higher, reflecting higher net revenues in intermediation and significantly higher net revenues in financing." Equity sales and trading revenue also beat expectations, coming in at $3.15 billion versus the $2.73 billion seen by analysts if 15% lower Y/Y, with Goldman explaining that revenues "reflected lower net revenues in both intermediation and financing." That said, according to Goldman, the Q1 2022 operating environment was "characterized by strong client activity and increased volatility amid an evolving macroeconomic backdrop." As a result, overall trading rev. of $7.87 billion, far above the $5.84 billion expected, and up 4% vs a year as the Ukraine-war linked volatility sparked a lucrative frenzy in capital markets.

(Click on image to enlarge)

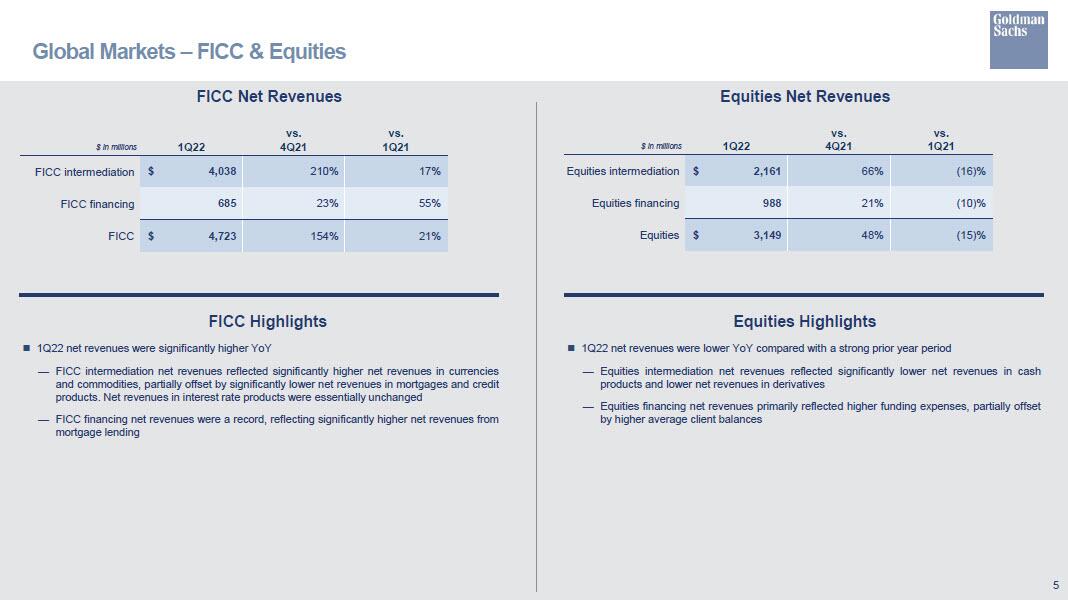

Some more details on global markets and the bank's whopper of a FICC quarter, where it appears that while the bulk of revenue came from commodities, FICC financing also benefited from mortgage lending.

(Click on image to enlarge)

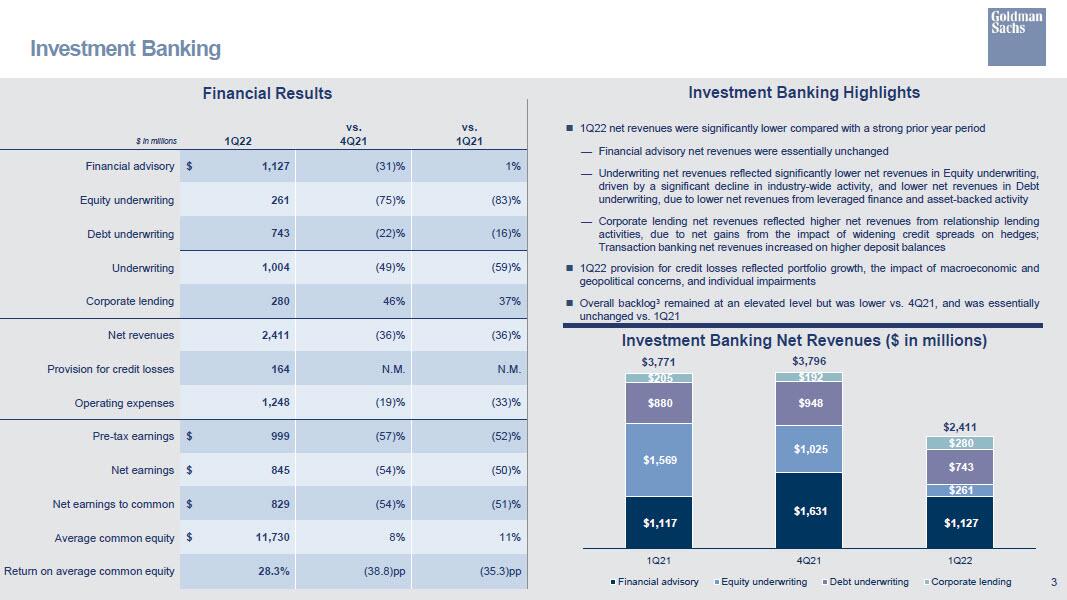

It wasn't all great news, however, and just like JPM, Goldman reported a reversal of the trend observed in Q4 (when trading was weak and banking was strong) with weakness in IBanking, as revenue here came in at $2.13 billion, below expectations of $2.28 billion.

(Click on image to enlarge)

Some more details:

- Net revenues in Investment Banking were $2.41 billion for the first quarter of 2022, 36% lower compared with both a strong first quarter of 2021 and the fourth quarter of 2021. The decrease compared with the first quarter of 2021 reflected significantly lower net revenues in Underwriting.

- The decrease in Underwriting was due to significantly lower net revenues in Equity underwriting, reflecting a significant decline in industry-wide activity, and lower net revenues in Debt underwriting, due to lower net revenues from leveraged finance and asset-backed activity. Corporate lending net revenues were higher, primarily due to higher net revenues from relationship lending activities, reflecting net gains from the impact of widening credit spreads on hedges. Net revenues in Financial advisory were essentially unchanged. The firm’s backlog decreased compared with the end of 2021 and was essentially unchanged compared with the first quarter of 2021.

(Click on image to enlarge)

While not nearly as balance sheet intensive as other money center banks, Goldman reported a Net Interest Income of 1.827BN for Q1, a significant increase from $1.482BN in Q1 2021. Total loans rose from $158BN in Q4 to $166BN in Q1 (and from $121BN a year ago). According to the bank, total loans increased by $8 billion, up 5% QoQ, primarily reflecting growth in commercial real estate and in credit cards (primarily related to the acquisition of the General Motors co-branded credit card portfolio).

(Click on image to enlarge)

Curiously, and very similar to JPM, Goldman said it is taking a $561 million provision for credit losses in the first quarter, compared with a net benefit of $70 million in the first quarter of 2021 and net provisions of $344 million in the fourth quarter of 2021. Provisions reflected "portfolio growth (primarily in credit cards), the impact of macroeconomic and geopolitical concerns, and individual impairments on wholesale loans."

That said, while the bank did end up boosting provisions, net charge-offs were just $154 million, which is a sign that they’re not bolstering reserves because things are fully worsening and are likely more preventative at this point.

It was a mixed picture for Goldman’s asset management (i.e. prop). While asset management net revenue dropped 88%, consumer and wealth revenue rose 21% to a record $2.1 billion. In asset management, the bank is blaming geopolitical tensions and saying clients’ equity investments took some big mark-to-market losses.

Here's what the bank said:

Net revenues in Asset Management were $546 million for the first quarter of 2022, 88% lower than the first quarter of 2021 and 81% lower than the fourth quarter of 2021, primarily reflecting net losses in Equity investments and significantly lower net revenues in Lending and debt investments.

Broad macroeconomic and geopolitical concerns led to volatility in global equity prices and wider credit spreads. As a result, net losses in Equity investments reflected significant mark-to-market net losses from investments in public equities and significantly lower net gains from investments in private equities compared with a strong prior year period. The decrease in Lending and debt investments net revenues primarily reflected net losses from investments. Management and other fees were higher, reflecting the impact of higher average assets under supervision.

And visually:

(Click on image to enlarge)

Also notable is that last year's record pay is finally fading, and bonuses are coming down: Goldman said operating expenses dropped 18% in the first quarter, to $7.72 billion.

(Click on image to enlarge)

The bottom line: the size of Goldman's FICC trading revenue beat was so big and powerful, that it allowed investors to ignore the company's weakness in Ibanking, and helped push its stock sharply higher in the premarket, bucking the trend set previously by JPMorgan.

(Click on image to enlarge)

Full Goldman earnings presentation (pdf link).

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more