Gold Royalty Companies Report A Solid First Quarter On Higher Metal Prices

A month is all it took to wipe out a decade of jobs growth.

U.S. employers cut an unprecedented 20.5 million jobs in April, the most in history, while the unemployment rate rocketed up to 14.7 percent. As of last week, a head-spinning 33.5 million Americans, or one out of every five workers in the U.S. labor force, have lost their jobs as a result of coronavirus lockdown measures.

With so many people out of work as we head into the second quarter, the next earnings season for S&P 500 companies is undoubtedly going to be one for the history books. FactSet reports that Wall Street analysts have already cut their second-quarter earnings estimates by 28.4 percent, the largest such decline on record.

Meanwhile, we’re seeing corporations file for bankruptcy protection at an accelerated clip. As of May 7, an estimated 78 public and private firms with liabilities greater than $50 million have declared bankruptcy so far in 2020, including iconic brands J.Crew and Neiman Marcus. This puts businesses on track to meet and even surpass the 271 bankruptcies that occurred in 2009.

Negative Rates in the U.S.?

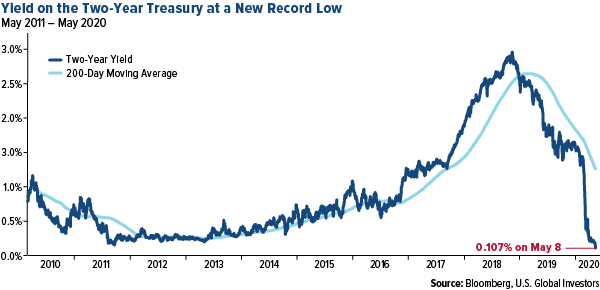

Against this backdrop, yields on the two-year and five-year Treasury fell to fresh record lows on Friday as the fed funds futures market continues to price in negative interest rates by early 2021.

(Click on image to enlarge)

If you recall, Alan Greenspan himself, former Federal Reserve chairman, said it was “only a matter of time” before negative rates spread to the U.S. That was back in September.

Greenspan’s prediction may well come true sooner than even he expected. With the two-year Treasury yield dipping to an anemic 10 basis points, the next test is 0 percent (or less!).

And remember, this is the nominal yield. Adjusted for inflation, it’s already turned negative.

Record Inflows Into Gold-Backed ETFs

To be clear, I’m not advocating for or in favor of negative U.S. rates. As others have pointed out, subzero rates don’t guarantee economic recovery. They don’t appear to have helped the Japanese or European economies in any way. Instead, they only seem to punish people with savings accounts, forcing them to spend their money or else see their balances slowly melt away.

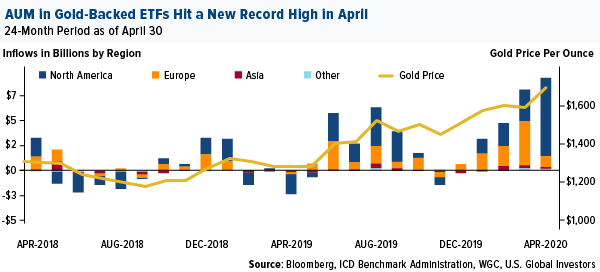

I believe this is a huge contributor to why we’re seeing higher gold prices right now. The yellow metal has surged above $1,700 an ounce, or 34 percent above its per-ounce price a year ago.

Yes, gold doesn’t pay dividends or interest, but then neither do Treasury bonds right now. And with S&P 500 companies losing revenue, an estimated $37 billion in dividends could be cut or suspended this year. Royal Dutch Shell recently cut its dividend for the first time since World War II. Last week, Disney became the latest blue-chip to suspend its dividend, despite the runaway success of its new streaming platform, Disney+.

Meanwhile, gold royalty company Franco-Nevada raised its quarterly dividend 4 percent, from $0.25 per share to $0.26 per share, marking the 13th annual consecutive dividend increase.

Rising investor appetite for gold is reflected in the fact that assets under management (AUM) in global gold-backed ETFs reached a new record high in April, according to the World Gold Council (WGC) data. AUM stood at $184 billion as of April 30, with holdings also hitting a new all-time high of 3,355 metric tons. Assets in such ETFs grew in 11 of the 12 previous months, adding 80 percent to total AUM.

(Click on image to enlarge)

Although demand for gold jewelry has been negatively impacted by the COVID-19 crisis, “history suggests that the likely strength of investment demand may offset this weakness,” the WGC writes in its April report.

Gold Royalty Companies Report $400 Million in Free Cash Flow

For more than a couple of months now, I’ve said that gold mining companies will have a strong first (and second) quarter thanks to higher metal prices. Stock prices, as you know, are largely driven by revenues and free cash flow (FCF).

FCF is what companies have in the bank after paying operating costs, taxes, and other expenses. The higher the cash flow, the better the company can expand its business and reward shareholders.

We like gold royalty companies here at U.S. Global Investors, and in the first quarter of 2020, the “big three” royalty names—Wheaton Precious Metals WPM, Franco-Nevada FNV, and Royal Gold RGLD—collectively generated a remarkable $402 million in positive free cash flow.

(Click on image to enlarge)

Looking ahead, Raymond James analysts project Franco-Nevada delivering earnings per share (EPS) of $1.91, up from $1.82 in 2019. If Bank of America is right and the price of gold rises to $3,000 an ounce in the next 18 months, Franco’s EPS could be as much as $2.29, according to Raymond James.

As for Royal Gold, Raymond James rates the company as Outperform, seeing EPS of $2.90 this year, up from $1.48 last year. The company’s “high-margin metal sales” can be expanded with “minimal” general and administrative costs, analysts Brian MacArthur and Chris Law write, adding that Royal Gold has a “high-quality, diversified asset base in lower-risk jurisdictions, as well as a flexible balance sheet to support future investments and a growing dividend.”

Disclaimer:

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. A basis point, or bp, is a common unit of measure ...

more