GNC: Strategic Fit For Amazon Or Wal-Mart

Thesis: GNC (NYSE:GNC)

Analysis of current situation as an investment and as a trade. Buyout interest provides an interesting risk/reward for more speculative accounts. Why it makes strategic sense for Amazon (Nasdaq:AMZN) or Wal-Mart (WMT).

Overview:

GNC Holdings is a leading global specialty retailer of health and wellness products, including vitamins, minerals, and herbal supplement products, sports nutrition products and diet products. It has a multi-channel business model through company-owned retail stores, domestic and international franchise activities, and third party contract manufacturing.

The company now has 5M loyalty members of its My GNC Rewards Program.

Now that we see Amazon and Wal-Mart getting more aggressive in terms of external M&A, it makes more sense as a strategic asset to both companies.

Why M&A Strategy (And Your Retail Experience) Just Changed Forever -- Amazon Swallows Whole Foods

Good Fit: Amazon (AMZN) - General nutrition centers offers Amazon a good strategic fit for its current initiatives.

- Access to growing sector: health and wellness.

- Natural fit with Amazon's branded products, Amazon Basics.

- Fits well into a subscription model (Amazon's Subscribe and Save option for Prime Members).

- Stores an added benefit as Amazon is moving into physical stores in Amazon pop-up stores and grocery stores.

- Valuable Brand: 5M loyalty members of My GNC Rewards.

As will be discussed later, there are already a few potential buyers.

GNC Market Cap data by YCharts

Valuation:

Debt:

The debt is a major issue for the company. It presents a risk to the shareholders since the business has been slowing for some time. Slowing same-store sales and earnings amplify the risk for shareholders.

Industry Issues:

In addition to an extremely weak retail sector, the health and wellness space is incredibly competitive now. Competition (VSI) from drugstores (Nasdaq:WBA) and warehouse retailers like Wal-Mart (NYSE:WMT) and Costco (Nasdaq:COST) have hurt the industry.

Earnings:

Weak earnings but better than some had expected.

- Same-store sales decreased 3.9% in domestic company-owned stores (including GNC.com sales) in the first quarter of 2017.

- In domestic franchise locations, same-store sales decreased 4.6%.

- For the first quarter of 2017, the company reported net income of $23.9 million compared with $50.8 million in the prior year quarter.

- Adjusted EPS was $0.37 and $0.69 in the three months ended March 31, 2017 and 2016, respectively.

The deterioration of earnings is an issue. Obviously, the nutrition category is extremely competitive.

On the positive side, estimates have the company profitable in 2018 at $1.32 a share (Marketsmith).

Shrinking margin of safety:

Dividends and Share Repurchases:

GNC Holdings ((NYSE:GNC)) announces that it will suspend its dividend.

The company says the dividend suspension is part of a broader plan to use free cash to reduce debt. GNC intends to reallocate ~$55M of cash annually, primarily to reduce debt through the pay-down of its revolver.

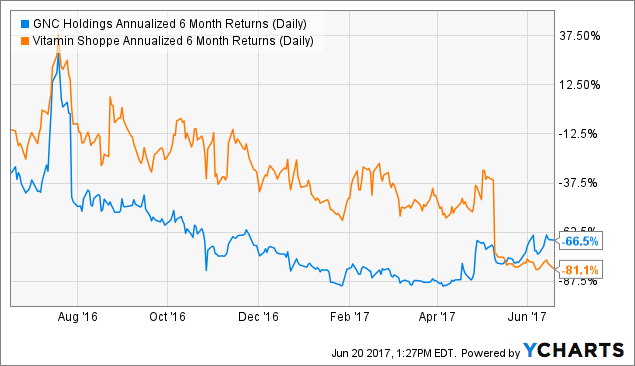

GNC Annualized 6 Month Returns (Daily) data by YCharts

No dividend:

The Board of Directors has approved management's recommendation to suspend the Company's quarterly dividend. The dividend suspension is part of a broader plan to utilize a greater portion of the Company's free cash to reduce debt. By suspending what has been a $0.20 per share quarterly dividend, the Company intends to reallocate approximately $55 million of cash annually, primarily to reduce debt through the pay-down of its revolver.

End of Buyback:

During 2016, the Company repurchased 7.9 million shares of the Company's stock for $229.2 million. No shares were repurchased by the Company under its share repurchase program in the fourth quarter of fiscal 2016. The remaining $197.8 million authorized under the current program is not expected to be utilized during fiscal 2017.

Potential Buyers:

The GNC brand is very valuable and has attracted numerous potential buyers. Possible suitors include: JD.com (Nasdaq:JD), KKR, Fosun Group, ZZ Capital.

Technical Overview:

Starting to form a base. Also, the huge short interest could create an opportunity to the upside.

As an investment:

Unfortunately, the shares do not have the requisite margin of safety due to the debt and lack of initiatives to benefit shareholders. A dividend and buyback would make the company much more attractive. The brand is attractive, but as an investment, GNC does not have the requisite margin of safety for investors.

As a Trade:

Strategy: Medium/High Risk

Buy/Write: Buy the stock and sell calls against it.

Buy the shares at $7.38 and sell the June 16 $10 calls for .20

Income: The premium will generate ~2.7% return for the 60 days if the shares stay flat. Ideally, one would continue to roll the calls and collect premium.

At $10: The return would be ~ 35% for the 2 months and more than 200% annually.

Buyout: Numerous parties are interested in GNC. In a buyout, this strategy might not provide as much upside as simply holding the stock. But the risk/reward of the buy-right is better in my opinion.

Conclusion:

While the stock is not attractive to value investors at this level, there are opportunities to profit in GNC. Debt is an issue, but the brand is valuable and would make a strategic fit with Amazon.

Disclaimer: Options involve risk. Ideas are for Educational purposes only.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next ...

more

I really enjoyed your work and miss seeing it here. Planning on publishing anything new?